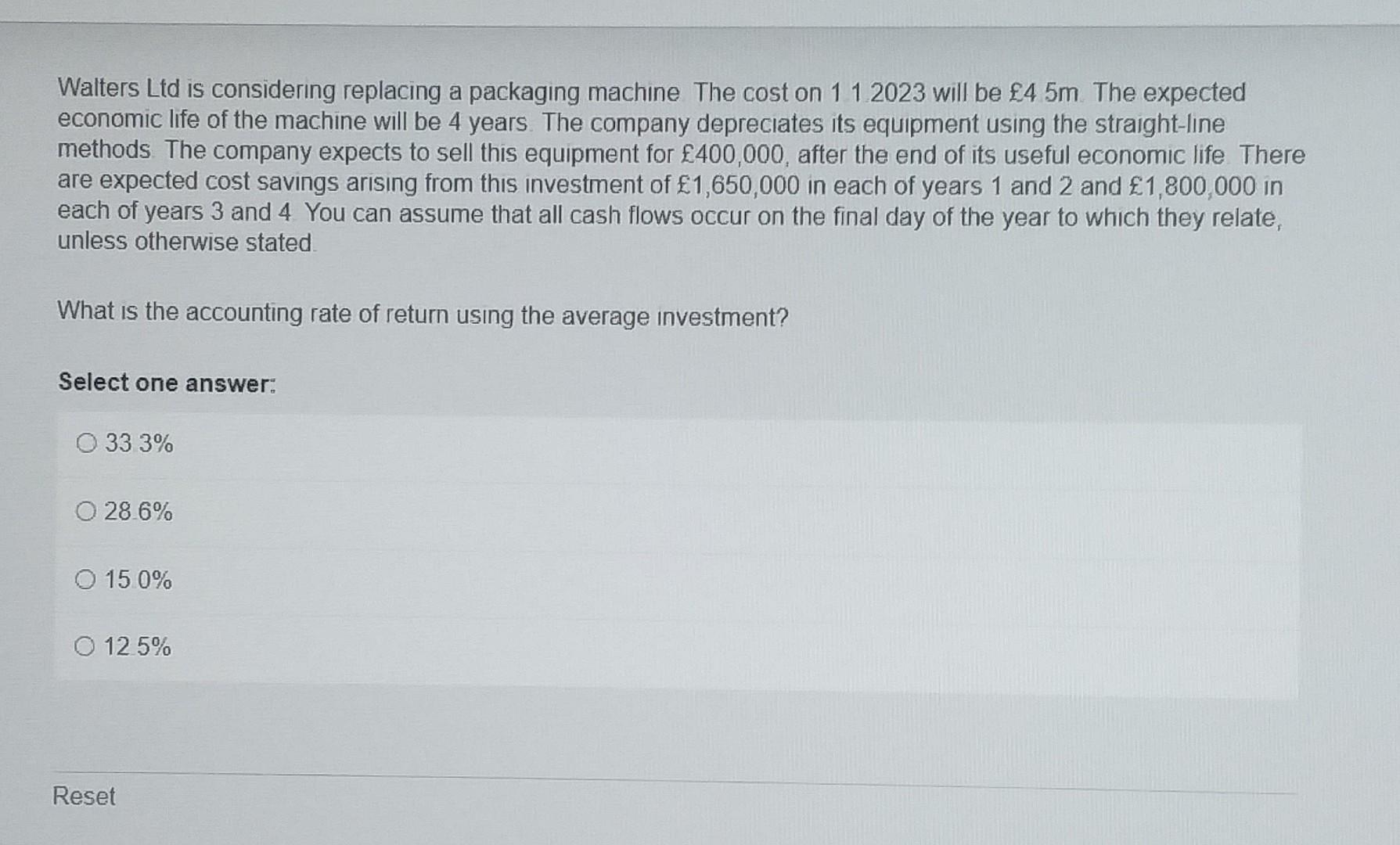

Question: Walters Ltd is considering replacing a packaging machine The cost on 112023 will be 45m The expected economic life of the machine will be 4

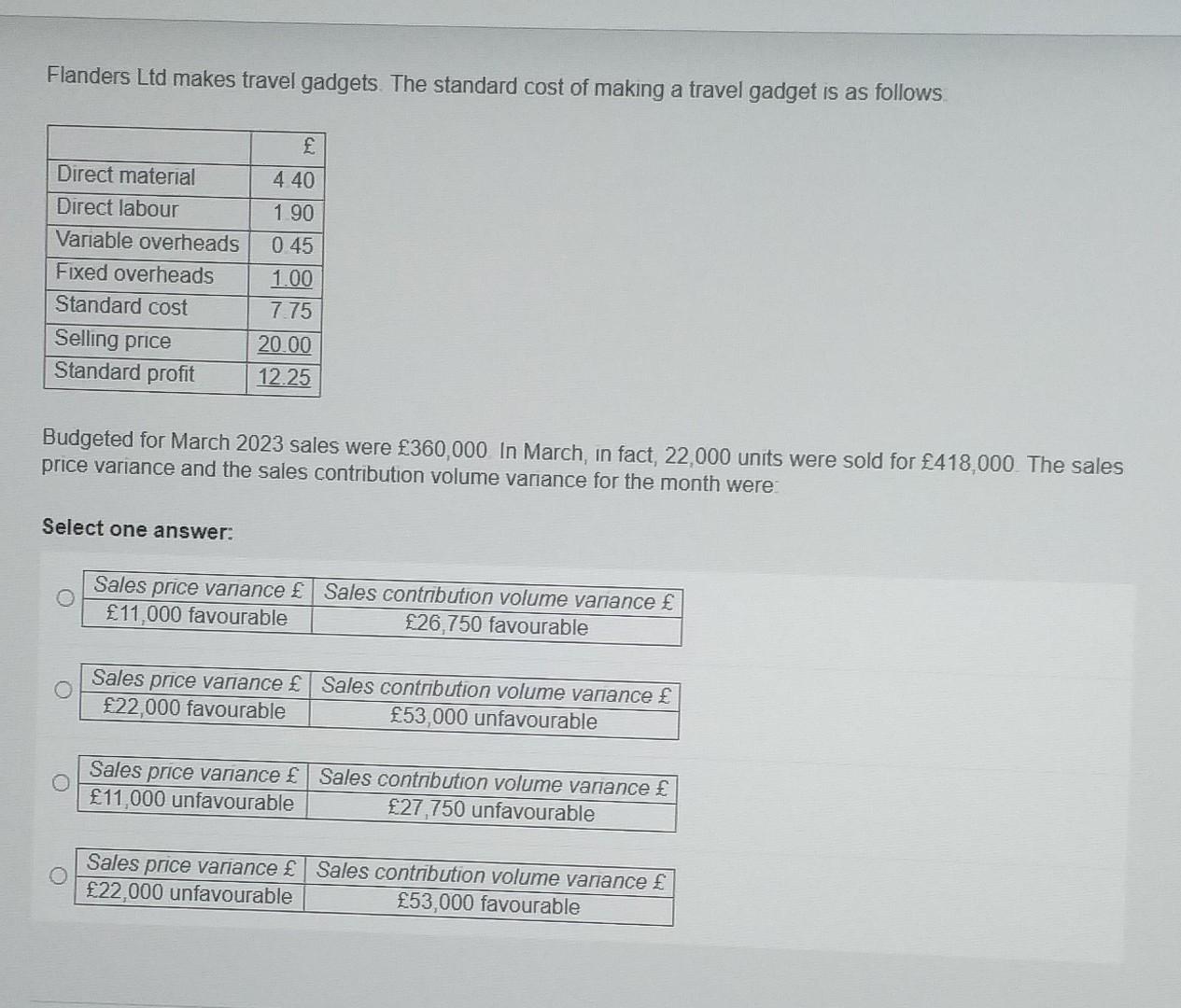

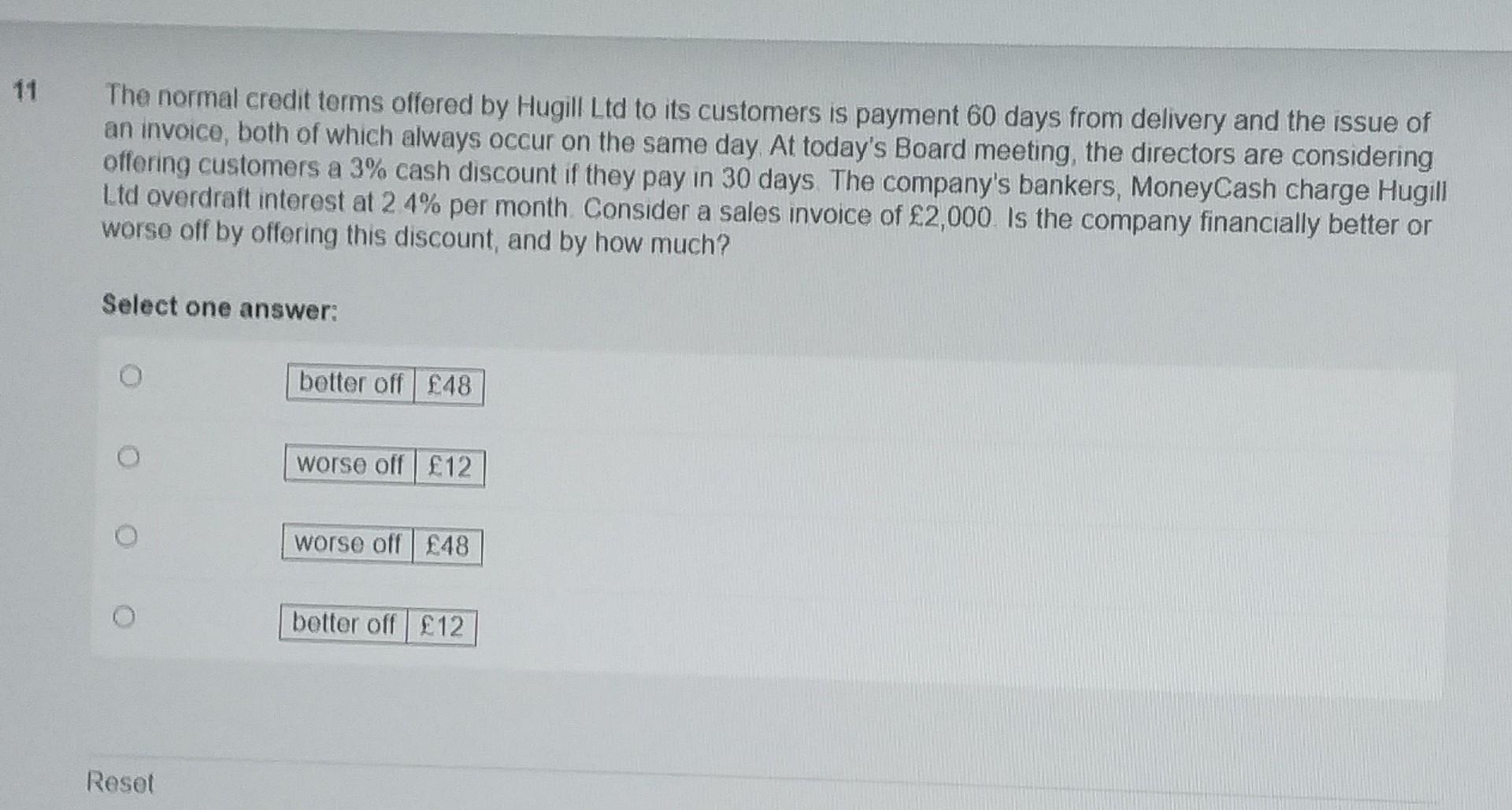

Walters Ltd is considering replacing a packaging machine The cost on 112023 will be 45m The expected economic life of the machine will be 4 years. The company depreciates its equipment using the straight-line methods. The company expects to sell this equipment for 400,000, after the end of its useful economic life There are expected cost savings arising from this investment of 1,650,000 in each of years 1 and 2 and 1,800,000 in each of years 3 and 4 You can assume that all cash flows occur on the final day of the year to which they relate, unless otherwise stated What is the accounting rate of return using the average investment? Select one answer: 333% 286% 150% 125% Flanders Ltd makes travel gadgets. The standard cost of making a travel gadget is as follows Budgeted for March 2023 sales were 360,000 In March, in fact, 22,000 units were sold for 418,000. The sales price variance and the sales contribution volume variance for the month were: Select one answer: The normal credit terms offered by Hugill Ltd to its customers is payment 60 days from delivery and the issue of an invoice, both of which always occur on the same day At today's Board meeting, the directors are considering offering customers a 3% cash discount if they pay in 30 days. The company's bankers, MoneyCash charge Hugill Ltd overdraft interest at 24% per month. Consider a sales invoice of 2,000 is the company financially better or worse off by offering this discount, and by how much? Select one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts