Question: want to calculate,the conversion price, conversion ratio, the conversion value ,The total number of shares that will be issued if the bonds were fully converted.

want to calculate,the conversion price, conversion ratio, the conversion value ,The total number of shares that will be issued if the bonds were fully converted. , the total number of shares that will be issued after 40% conversion .

Please faster , help me guys . Thank you i will give thumbs up.

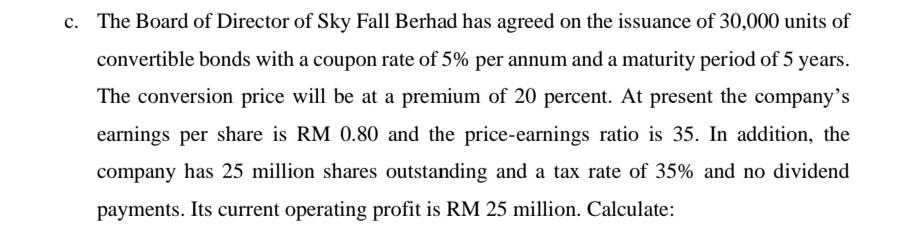

c. The Board of Director of Sky Fall Berhad has agreed on the issuance of 30,000 units of convertible bonds with a coupon rate of 5% per annum and a maturity period of 5 years. The conversion price will be at a premium of 20 percent. At present the company's earnings per share is RM 0.80 and the price-earnings ratio is 35. In addition, the company has 25 million shares outstanding and a tax rate of 35% and no dividend payments. Its current operating profit is RM 25 million. Calculate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts