Question: Warf Computers was founded 15 years ago by Nick Warf, a computer programmer. The small initial investment to start the company was made by Nick

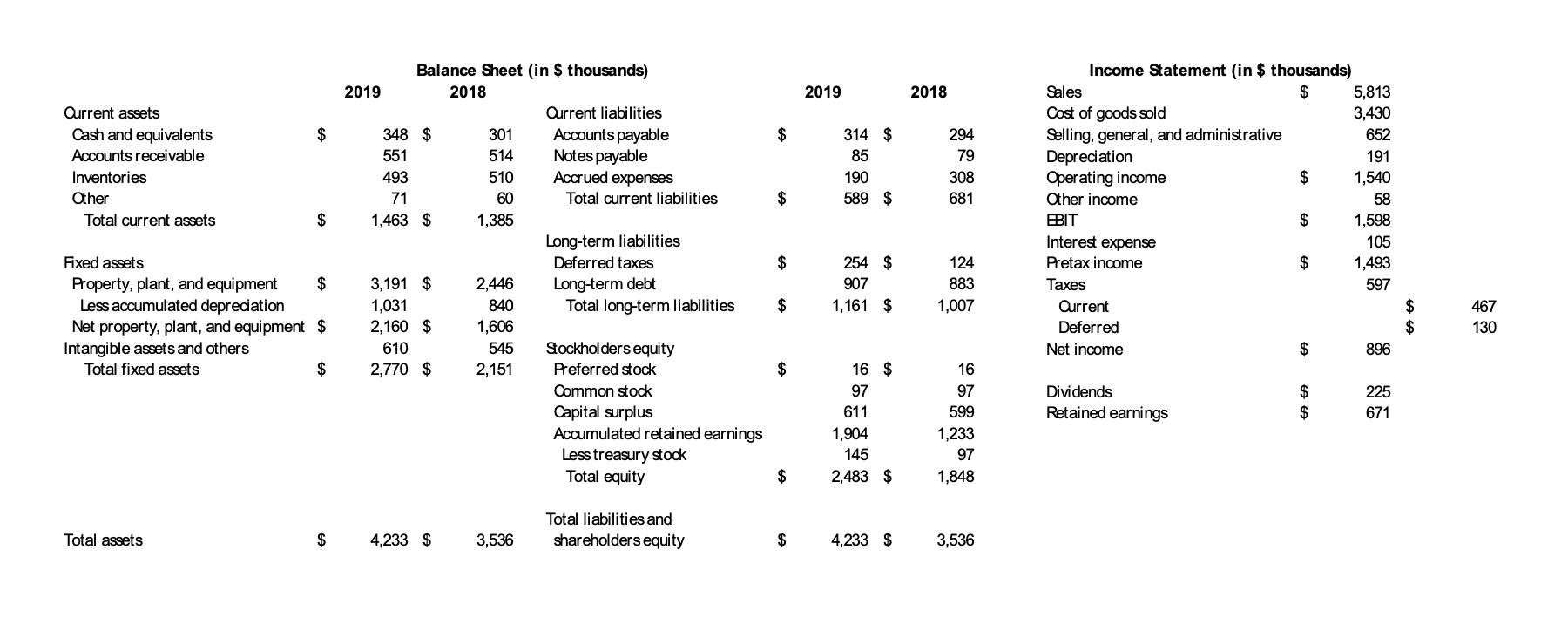

Warf Computers was founded 15 years ago by Nick Warf, a computer programmer. The small initial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed by the company in the from of both equity and short- and long-term debt. Recently the company has been developing applications that use artificial intelligence algorithms to applications like voice and visual recognition. To continue growth, the firm will require significant outside investment.

Nick has made the decision to seek this outside financing in the form of new equity investments and bank loans. New investors and the banks will require a detailed financial analysis. On behalf of these investors, you have been asked to analyze the cash flow of the firm for its most recent year.

Nick has also provided the following information:

During the year, the company raised $175,000 in new long-term debt and retired $151,000 in long-term debt.

The company sold $12,000 in new stock and repurchased $48,000 in stock.

The company purchased $1,140,000 in fixed assets and sold $330,000 in fixed assets.

Questions to answer:

Questions to answer:

Provide the Cash Flow Statement

What is the Operating Cash Flow (OCF) from assets? Operating Cash Flow is calculated using the cash-based items in the Income Statement. Interest expense (a financing cost) should not be included.

What is the Change in Net Working Capital? Net Working Capital is defined as total current assets less total current liabilities

What is the firms Net Capital Expenditures? Net Capital Expenditure is defined as acquisition of fixed assets less sales of fixed assets

Cash Flows to Investors

What is the Net Cash Flow to Bondholders? Net Cash Flow to Bondholders is defined as debt repayment plus interest expenses less issuance of new debt

What is the Net Cash Flow to Stockholders? Net Cash Flow to Stockholders is defined as repurchase of shares plus dividends less issuance of new shares

2019 2018 $ $ Current assets Cash and equivalents Accounts receivable Inventories Other Total current assets 314 $ 85 190 589 $ 294 79 308 681 1,540 $ Income Statement in $ thousands) Sales $ 5,813 Cost of goods sold 3,430 Selling, general, and administrative 652 Depreciation 191 Operating income $ Other income 58 BIT $ 1,598 Interest expense 105 Pretax income $ 1,493 Taxes 597 Qurrent Deferred Net income $ 896 $ $ Balance Sheet (in $ thousands) 2019 2018 Ourrent liabilities 348 $ 301 Accounts payable 551 514 Notes payable 493 510 Accrued expenses 71 60 Total current liabilities 1,463 $ 1,385 Long-term liabilities Deferred taxes 3,191 $ 2,446 Long-term debt 1,031 840 Total long-term liabilities 2,160 $ 1,606 610 545 Stockholders equity 2,770 $ 2,151 Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity 254 $ 907 1,161 $ 124 883 1,007 Fixed assets Property, plant, and equipment $ Less accumulated depreciation Net property, plant, and equipment $ Intangible assets and others Total fixed assets $ $ $ $ 467 130 $ 225 Dividends Retained earnings $ $ 671 16 $ 97 611 1,904 145 2,483 $ 16 97 599 1,233 97 1,848 $ Total liabilities and shareholders equity Total assets $ 4,233 $ 3,536 $ 4,233 $ 3,536 2019 2018 $ $ Current assets Cash and equivalents Accounts receivable Inventories Other Total current assets 314 $ 85 190 589 $ 294 79 308 681 1,540 $ Income Statement in $ thousands) Sales $ 5,813 Cost of goods sold 3,430 Selling, general, and administrative 652 Depreciation 191 Operating income $ Other income 58 BIT $ 1,598 Interest expense 105 Pretax income $ 1,493 Taxes 597 Qurrent Deferred Net income $ 896 $ $ Balance Sheet (in $ thousands) 2019 2018 Ourrent liabilities 348 $ 301 Accounts payable 551 514 Notes payable 493 510 Accrued expenses 71 60 Total current liabilities 1,463 $ 1,385 Long-term liabilities Deferred taxes 3,191 $ 2,446 Long-term debt 1,031 840 Total long-term liabilities 2,160 $ 1,606 610 545 Stockholders equity 2,770 $ 2,151 Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity 254 $ 907 1,161 $ 124 883 1,007 Fixed assets Property, plant, and equipment $ Less accumulated depreciation Net property, plant, and equipment $ Intangible assets and others Total fixed assets $ $ $ $ 467 130 $ 225 Dividends Retained earnings $ $ 671 16 $ 97 611 1,904 145 2,483 $ 16 97 599 1,233 97 1,848 $ Total liabilities and shareholders equity Total assets $ 4,233 $ 3,536 $ 4,233 $ 3,536

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts