Question: Warning The data required for the following question is new each term and can be downloaded from the Course Resources website under Projects available through

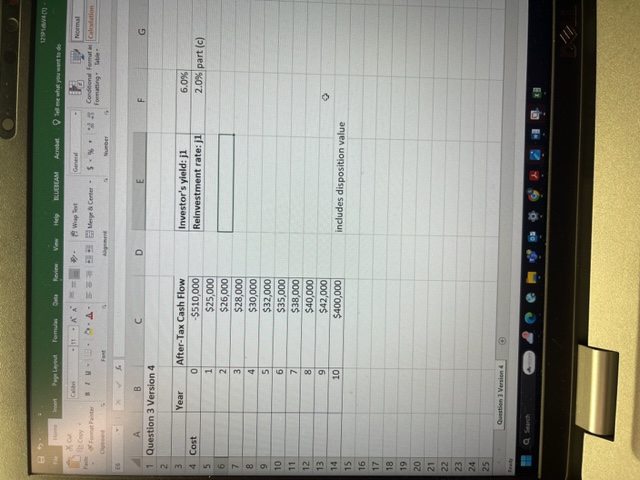

Warning The data required for the following question is new each term and can be downloaded from the Course Resources website under Projects available through Online Readings. Any use of data from prior terms will result in a grade of zero for this question. This is particularly important for students who have transferred from prior terms. ENSURE THAT YOU ARE USING CURRENT DATA. 3. JR has recently witnessed his friend Beth's success with her real estate investments, and he would like to pursue an investment of his own. JR has discovered an investment property that will provide him with a series of year-end annual cash flows based on a specific investment today. Download the file called "Project 1 " under the Projects link available through Online Readings on the course resources website. This document contains the details of the potential investment opportunity. After reviewing the details, answer the following questions: (a) Calculate the net present value of this investment. (5 marks) (b) Calculate the internal rate of return (IRR) with no explicit reinvestment considered. (2 marks) (c) Calculate the IRR and NPV assuming the stated reinvestment rate. Explain why the result is different than part (b). (7 marks) (d) If the reinvestment rate is higher than the IRR with no explicit reinvestment, what would happen to the IRR and NPV? Explain and support with numerical examples. (7 marks) (e) Based on all the investment measures calculated, should the investor proceed? Explain with reference to each of the measures calculated. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts