Question: Was given the answer, but I'd like to know how they got it! Thanks in advance. 26. In 2014 , James Company had $1,000,000 of

Was given the answer, but I'd like to know how they got it! Thanks in advance.

Was given the answer, but I'd like to know how they got it! Thanks in advance.

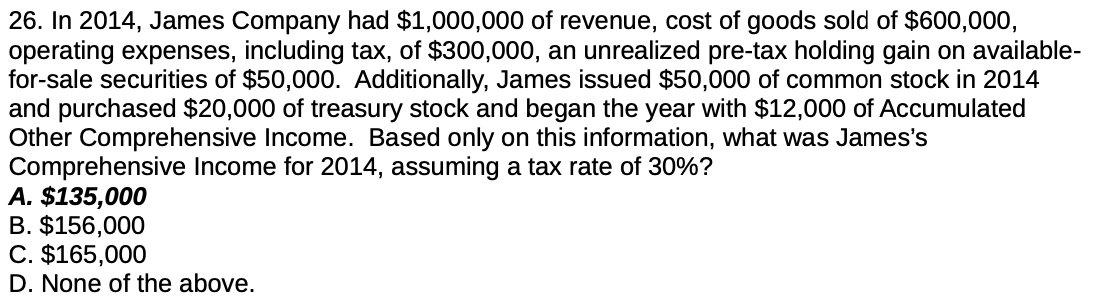

26. In 2014 , James Company had $1,000,000 of revenue, cost of goods sold of $600,000, operating expenses, including tax, of $300,000, an unrealized pre-tax holding gain on availablefor-sale securities of $50,000. Additionally, James issued $50,000 of common stock in 2014 and purchased $20,000 of treasury stock and began the year with $12,000 of Accumulated Other Comprehensive Income. Based only on this information, what was James's Comprehensive Income for 2014 , assuming a tax rate of 30% ? A. $135,000 B. $156,000 C. $165,000 D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts