Question: Was having difficulty with this practice problem set. Could you please help? Will be sure to leave a review! Thank you so much! (a) (6

Was having difficulty with this practice problem set. Could you please help? Will be sure to leave a review! Thank you so much!

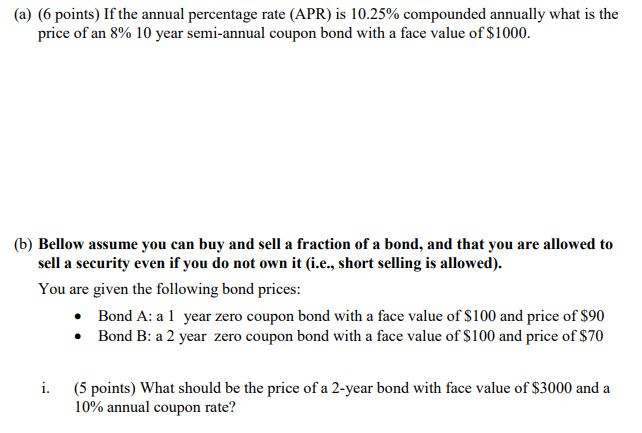

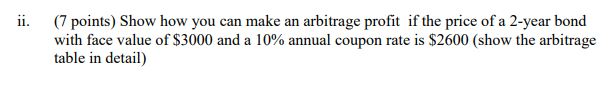

(a) (6 points) If the annual percentage rate (APR) is 10.25% compounded annually what is the price of an 8% 10 year semi-annual coupon bond with a face value of $1000. (b) Bellow assume you can buy and sell a fraction of a bond, and that you are allowed to sell a security even if you do not own it (i.e., short selling is allowed). You are given the following bond prices: Bond A: a 1 year zero coupon bond with a face value of $100 and price of $90 Bond B: a 2 year zero coupon bond with a face value of $100 and price of $70 i. (5 points) What should be the price of a 2-year bond with face value of $3000 and a 10% annual coupon rate? ii. (7 points) Show how you can make an arbitrage profit if the price of a 2-year bond with face value of $3000 and a 10% annual coupon rate is $2600 (show the arbitrage table in detail)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts