Question: Was there an offer? AAfter the borrower defaulted on a $ 1 6 . 8 million note, Principal Life Insurance Co . ( Principal )

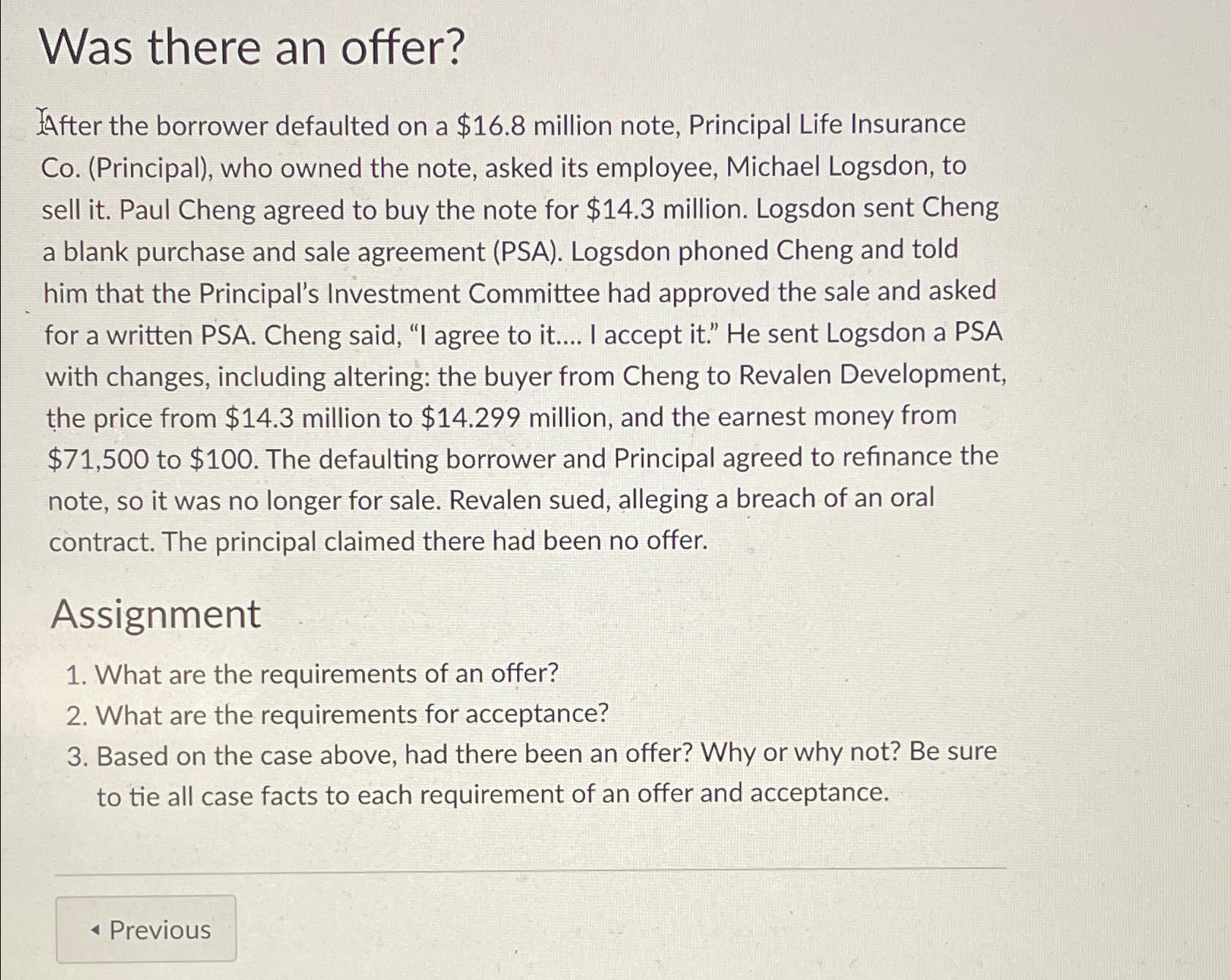

Was there an offer?

AAfter the borrower defaulted on a $ million note, Principal Life Insurance CoPrincipal who owned the note, asked its employee, Michael Logsdon, to sell it Paul Cheng agreed to buy the note for $ million. Logsdon sent Cheng a blank purchase and sale agreement PSA Logsdon phoned Cheng and told him that the Principal's Investment Committee had approved the sale and asked for a written PSA. Cheng said, "I agree to it I accept it He sent Logsdon a PSA with changes, including altering: the buyer from Cheng to Revalen Development, the price from $ million to $ million, and the earnest money from $ to $ The defaulting borrower and Principal agreed to refinance the note, so it was no longer for sale. Revalen sued, alleging a breach of an oral contract. The principal claimed there had been no offer.

Assignment

What are the requirements of an offer?

What are the requirements for acceptance?

Based on the case above, had there been an offer? Why or why not? Be sure to tie all case facts to each requirement of an offer and acceptance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock