Question: | |Washington Mining began operations by issuing common stock for $84,500. The company 2 paid $76,050 cash in advance for a one-year contract to lease

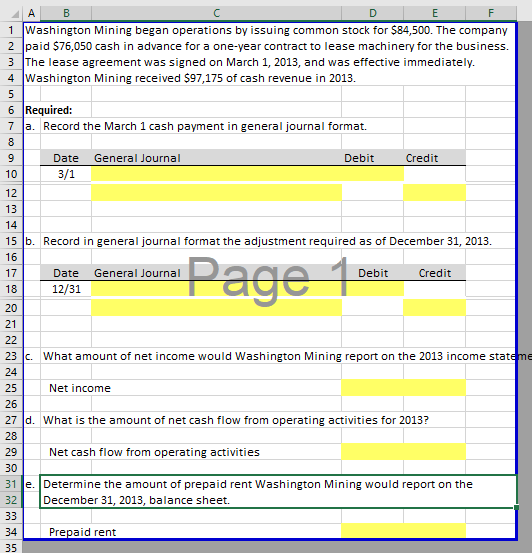

| |Washington Mining began operations by issuing common stock for $84,500. The company 2 paid $76,050 cash in advance for a one-year contract to lease machinery for the business. 3 The lease agreement was signed on March 1, 2013, and was effective immediately. 4 Washington Mining received $97,175 of cash revenue in 2013 6 Required: 7 a. Record the March 1 cash payment in general journal format. Date General Journal Debit Credit 10 12 13 15 b. Record in general journal format the adjustment required as of December 31, 2013. 16 Debit Date General Journal 12/31 Credit 18 20 21 23 C. What amount of net income would Washington Mining report on the 2013 income stateme 24 25 26 27 d. What is the amount of net cash flow from operating activities for 2013? 28 29 30 31 e. Determine the amount of prepaid rent Washington Mining would report on the 32 December 31, 2013, balance sheet. Net income Net cash flow from operating activities Prepaid rent 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts