Question: Watch the lecture video on the Chapter 1 - Common Tax Forms Taxpayers Receive for Preparing Their Tax Returns, then answer the following questions: a

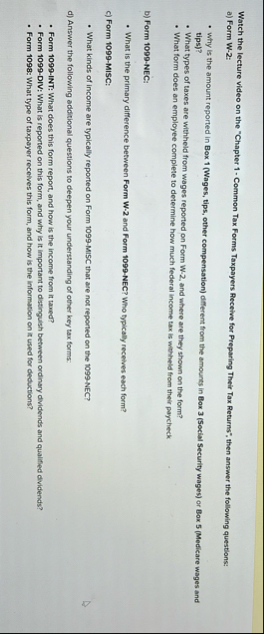

Watch the lecture video on the "Chapter Common Tax Forms Taxpayers Receive for Preparing Their Tax Returns", then answer the following questions:

a Form W:

Why is the amount reported in Box Wages tips, other compensation different from the amounts in Box Social Security wages or Box Medicare wages and tips

What types of taxes are withheld from wages reported on Form W and where are they shown on the form?

What form does an employee complete to determine how much federal income tax is wheneld from their paycheck

b Form NEC:

What is the primary difference between Form W and Form NEC? Who typically receives each form?

c Form MISC:

What kinds of income are typically reported on Form MISC that are not reported on the NEC?

d Answer the following additional questions to deepen your understanding of other key tax forms:

Form INT: What does this form report, and how is the income from it taxed?

Form DIV: What is reported on this form, and why is it important to distingulsh between ordinary dividends and qualified dividends?

Form : What type of taxpayer receives this form, and how is the information on it used for deductions?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock