Question: Waterways Continuing Problem-8 (Part Level Submission) When Waterways management met to review the year-end financial statements, the room was filled with excitement. Sales had been

|

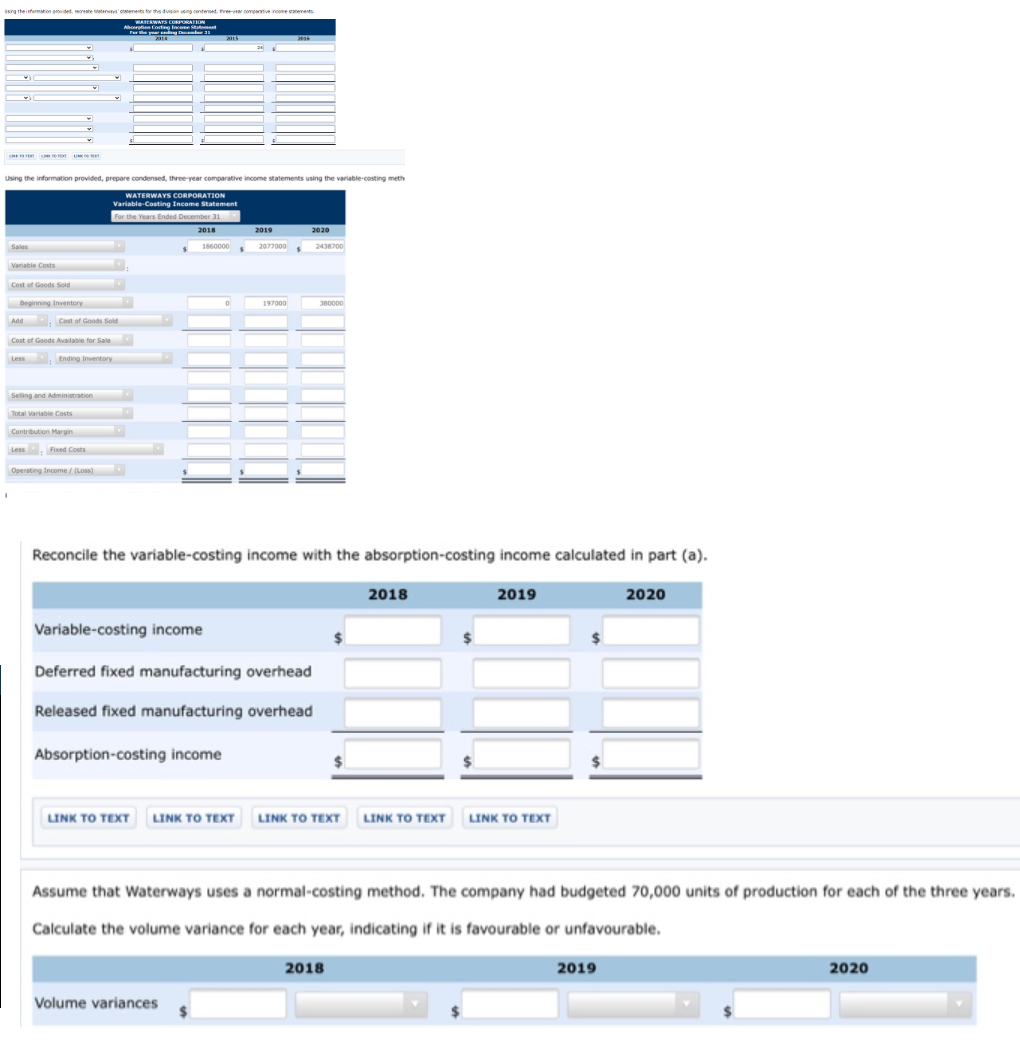

the formation Festes for this incredere comecents FAIRWATS CORPORATION Alberto Cortinget 2010 TO FORUM Using the information provided, prepare condensed, three-year comparative Income statements using the variable-costing meth , - WATERWAYS CORPORATION Variable-Casting Income Statement For the Years Ended December 31 2018 2019 2020 Sales 1560000 2077000 2438700 Variable costs Cost of Goods Sold 0 197000 380000 Beginning Inventory Add Cost of Good Sold Cost of Goods Available for Sale Less Ending Inventory Selling and Administration Total Variable costs Contribution Margin Less Feed Costs Operating Income / (Loss) 1 . Reconcile the variable-costing income with the absorption-costing income calculated in part (a). 2018 2019 2020 Variable-costing income Deferred fixed manufacturing overhead Released fixed manufacturing overhead Absorption-costing income LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT Assume that Waterways uses a normal-costing method. The company had budgeted 70,000 units of production for each of the three years. Calculate the volume variance for each year, indicating if it is favourable or unfavourable. 2018 2019 2020 Volume variances the formation Festes for this incredere comecents FAIRWATS CORPORATION Alberto Cortinget 2010 TO FORUM Using the information provided, prepare condensed, three-year comparative Income statements using the variable-costing meth , - WATERWAYS CORPORATION Variable-Casting Income Statement For the Years Ended December 31 2018 2019 2020 Sales 1560000 2077000 2438700 Variable costs Cost of Goods Sold 0 197000 380000 Beginning Inventory Add Cost of Good Sold Cost of Goods Available for Sale Less Ending Inventory Selling and Administration Total Variable costs Contribution Margin Less Feed Costs Operating Income / (Loss) 1 . Reconcile the variable-costing income with the absorption-costing income calculated in part (a). 2018 2019 2020 Variable-costing income Deferred fixed manufacturing overhead Released fixed manufacturing overhead Absorption-costing income LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT Assume that Waterways uses a normal-costing method. The company had budgeted 70,000 units of production for each of the three years. Calculate the volume variance for each year, indicating if it is favourable or unfavourable. 2018 2019 2020 Volume variances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts