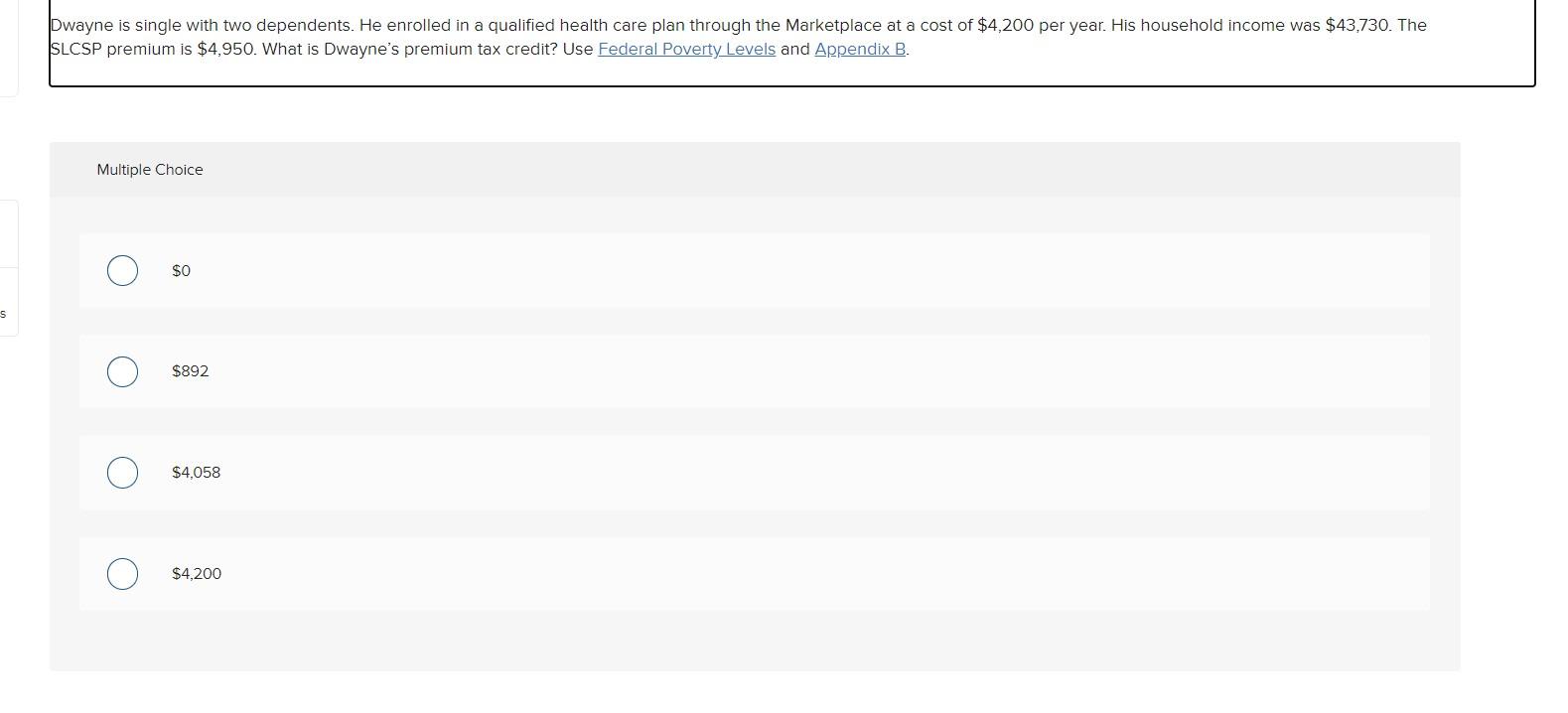

Question: wayne is single with two dependents. He enrolled in a qualified health care plan through the Marketplace at a cost of $4,200 per year. His

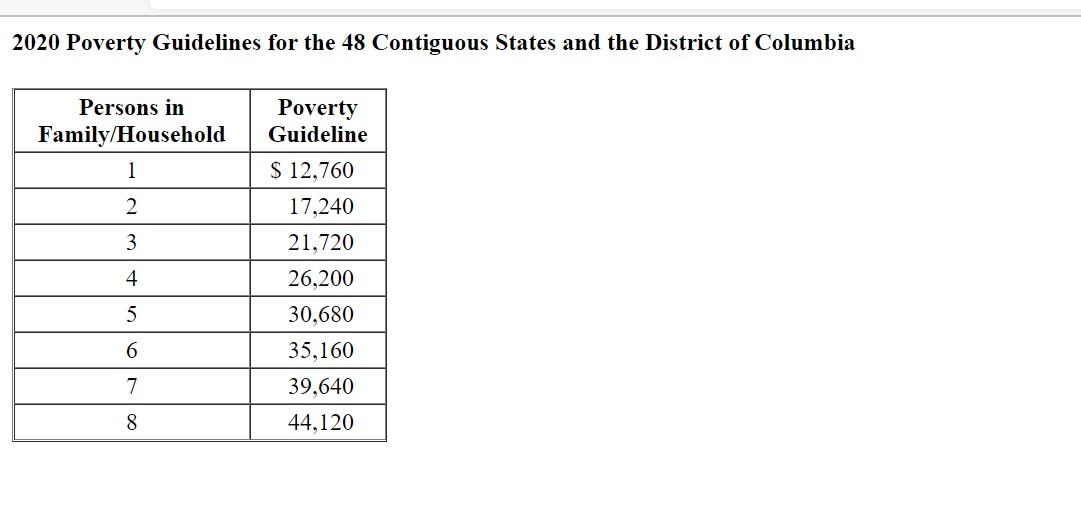

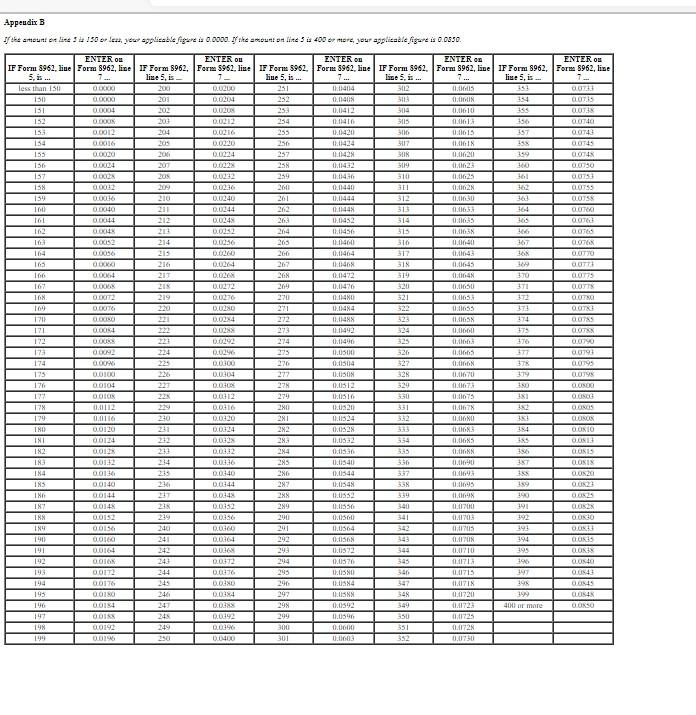

wayne is single with two dependents. He enrolled in a qualified health care plan through the Marketplace at a cost of $4,200 per year. His household income was $43,730. The CSP premium is $4,950. What is Dwayne's premium tax credit? Use Federal Poverty Levels and Appendix B. Multiple Choice $0 $892 $4,058 $4,200 2020 Poverty Guidelines for the 48 Contiguous States and the District of Columbia Appeudix 3 wayne is single with two dependents. He enrolled in a qualified health care plan through the Marketplace at a cost of $4,200 per year. His household income was $43,730. The CSP premium is $4,950. What is Dwayne's premium tax credit? Use Federal Poverty Levels and Appendix B. Multiple Choice $0 $892 $4,058 $4,200 2020 Poverty Guidelines for the 48 Contiguous States and the District of Columbia Appeudix 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts