Question: Wayne Yu: 34422866 Computer Services Centre (CSC): 3442-6488 - e-learning Team: 3442-6727 - Departmental hotline: 3442-2688 Question 22 15 pts . Consider the following information

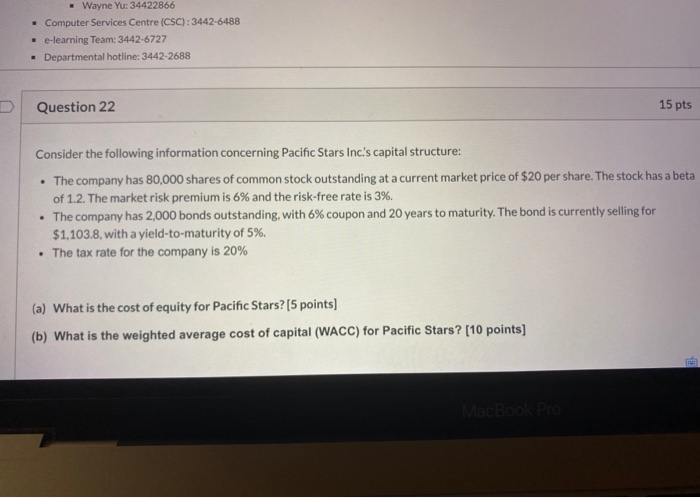

Wayne Yu: 34422866 Computer Services Centre (CSC): 3442-6488 - e-learning Team: 3442-6727 - Departmental hotline: 3442-2688 Question 22 15 pts . Consider the following information concerning Pacific Stars Inc's capital structure: The company has 80,000 shares of common stock outstanding at a current market price of $20 per share. The stock has a beta of 1.2. The market risk premium is 6% and the risk-free rate is 3%. The company has 2,000 bonds outstanding, with 6% coupon and 20 years to maturity. The bond is currently selling for $1,103.8, with a yield-to-maturity of 5%. The tax rate for the company is 20% (a) What is the cost of equity for Pacific Stars? [5 points) (b) What is the weighted average cost of capital (WACC) for Pacific Stars? (10 points] MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts