Question: We are evaluating a proiect that costs 5 7 8 8 , 4 9 0 , has a nineyear life, and has no salvage value.

We are evaluating a proiect that costs has a nineyear life, and has no salvage value. Rypume that depreciation is atraightline to aero over the ile of the project. Sales are projected at units per yeac. Price per unit is varlable cont per urit is $

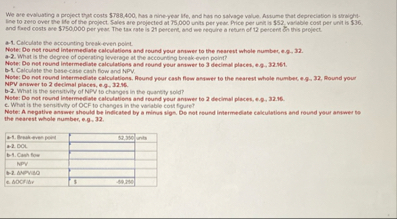

a Culculate the accounting break even poirt.

Nole: Do net round intermediate calculatiens and isund your antwer to the nearest whole number, eg

A What is the degree of osersting loverage at the accounting besakeven point?

Noter De net round intermediate calculations and round ybur aniwer to decimal placel, e

b C Calculate the basecase cash flow and NPV

Note: Do not round intermediate calculations. Apund your cash fow andwer to the nearent mhole mumbec, Round your NPY anvwer to derlmal plseet, eg

b What is the sensitivity of NPV to chasges in the quantity sold?

Nete: Do not rownd intermediate calculations and round ybur antwer to decimal places,

C What is the sernit vity of OCF to changes in the vasiable cost Fgart?? the mearest whole number, e

tablef Breah ives poed,ants DCLb Canh foerNPY ANPMAO,, acridit,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock