Question: We are evaluating a project that conts $ 6 7 0 7 0 0 , has a seven - year lile, and has ho sakage

We are evaluating a project that conts $ has a sevenyear lile, and has ho sakage value. Ausume flat depreciabon is staight line to zero over the life of the project. Sales ase profected at units per year. Pice per unt is varible coor per unt is

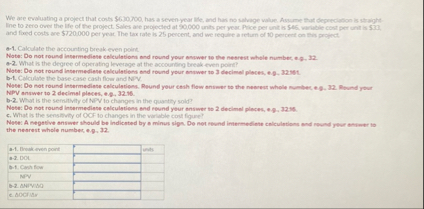

Caloulate the accounting break even point.

Note: Do not round innermediene celculetions nond round your onower te the neerest whele number ing,

Nate: Do not round insermediene celculetiens and tound your nntwer to decimel ploces, e:t

b Calculate the basecase cash flow and NDV Nithy snower to decimst plects, ese

b What is the sermitivity of MPV to changes in the quasticy sold?

Nese: Do nat round inbermediave celculetions ond reund yeur answer is decimel pleces, e

c What is the senstrvily of COF changes in the warlable cout figune? the nesrest whele numbec, e

table Drouk even pont,Unds DOL,b Cunh fow,NPYb ANVAC,c DOCHAs,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock