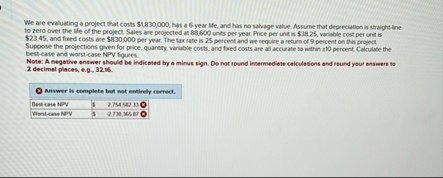

Question: We are evaluating a project that costs $ 1 8 3 0 , 0 0 0 , has a 6 year life, and hass no

We are evaluating a project that costs $ has a year life, and hass no salvage valve. Assume that depreciation is traight line to zero over the life of the project. Sales are projected at units per year. Price per une in variable cost per unit is $ and foed costs are $ per year. The tax rate is perceet and we require a refurn of percent on this propect Suppose the projections given for price, quanaty. virible costs, and fired costs are all accurate to mathin sto percent. Calculabe the bestcase and worstcase NPV figures.

Note: A negotive answer should be indiceted by a minus sign. De not round insermediate calculations and reund your ats mers so decimel pleces, e

Answer is complete beat not eentirely cerrect.

tableDeet case Nery,Whentcine NaVY,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock