Question: We are evaluating a project that costs $734,000, has a life of twelve years, and has no salvage value. Assume that depreciation is straight-line to

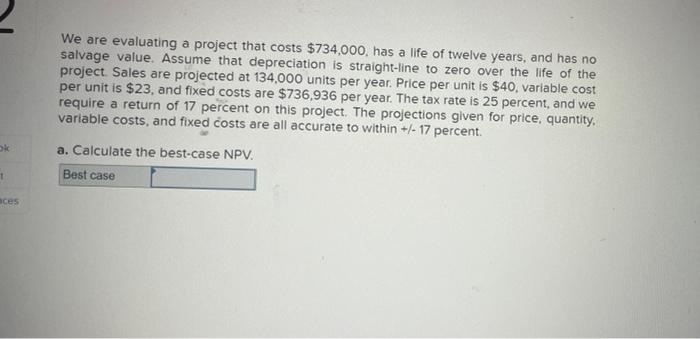

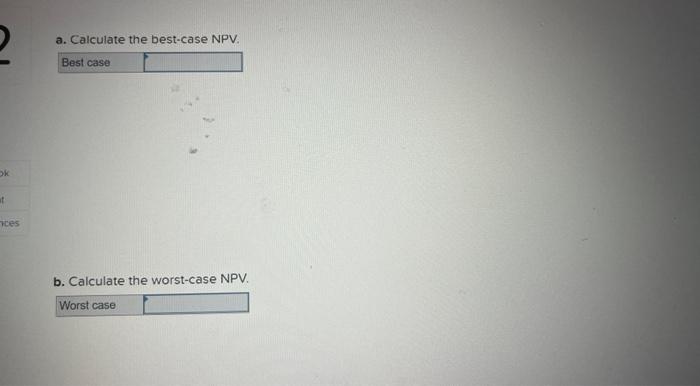

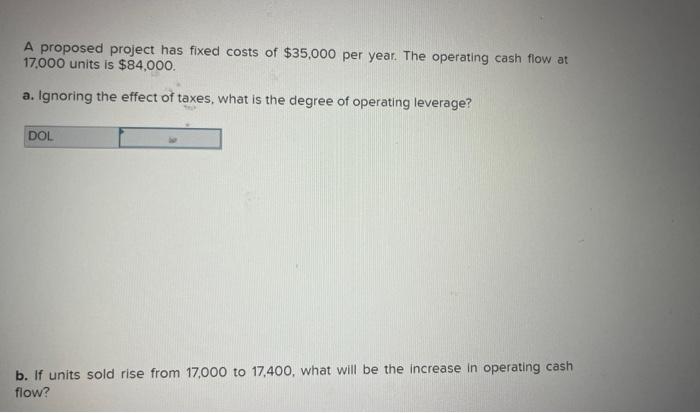

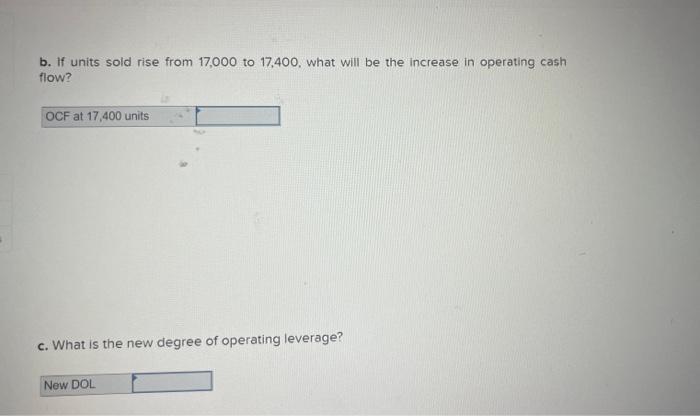

We are evaluating a project that costs $734,000, has a life of twelve years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 134,000 units per year. Price per unit is $40, variable cost per unit is $23, and fixed costs are $736,936 per year. The tax rate is 25 percent, and we require a return of 17 percent on this project. The projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/17 percent. a. Calculate the best-case NPV. a. Calculate the best-case NPV. Best case b. Calculate the worst-case NPV. A proposed project has fixed costs of $35,000 per year. The operating cash flow at 17,000 units is $84,000 a. Ignoring the effect of taxes, what is the degree of operating leverage? b. If units sold rise from 17,000 to 17,400 , what will be the increase in operating cash flow? b. If units sold rise from 17,000 to 17,400 , what will be the increase in operating cash flow? c. What is the new degree of operating leverage? A project has the following estimated data: price =$63 per unit; variable costs =$35.28 per unit; fixed costs =$6,900; required return =15 percent; initial investment =$14,000; life = seven years. Ignore the effect of taxes. a. What is the accounting break-even quantity? b. What is the cash break-even quantity? Cash break-even quantity c. What is the financial break-even quantity? d. What is the degree of operating leverage at the financial break-even ievel of outour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts