Question: We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over

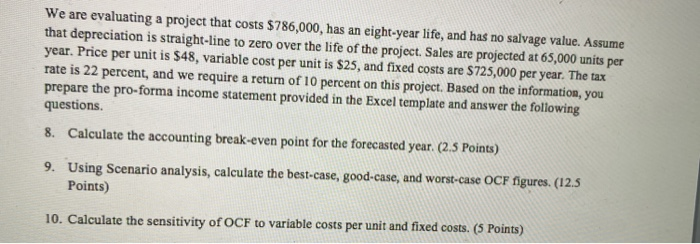

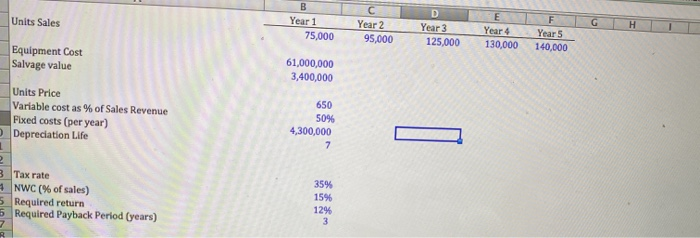

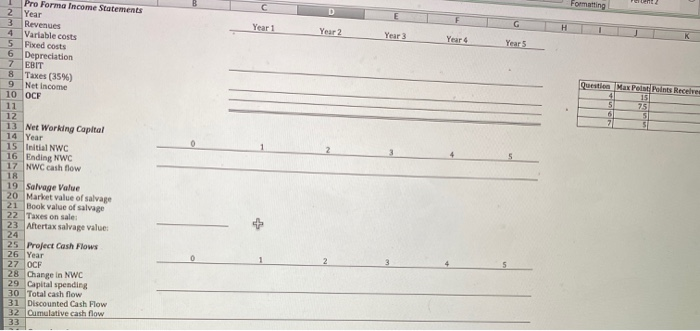

We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. Based on the information, you prepare the pro-forma income statement provided in the Excel template and answer the following questions 8. Calculate the accounting break-even point for the forecasted year. (2.5 Points) 9. Using Scenario analysis, calculate the best-case, good-case, and worst-case OCF figures. (12.5 Points) 10. Calculate the sensitivity of OCF to variable costs per unit and fixed costs. (5 Points) Units Sales Year 1 75,000 Year 2 95,000 Year 3 125,000 Year 4 130,000 Year 5 140,000 Equipment Cost Salvage value 61,000,000 3,400,000 650 50% Units Price Variable cost as % of Sales Revenue Fixed costs (per year) Depreciation Life 4,300,000 35% 15% Tax rate NWC (% of sales) Required return Required Payback Period (years) 12% Formatting Year 5 Pro Forma Income Statement Year Revenues Variable costs 5 Fixed costs 6 Depreciation EBIT Taxes (35%) 9 Net Income 10 OCF 12 13 Net Working Capital 14 Year 15 Initial NWC 16 Ending NWC 17 NWC cash flow 19 Salvage Value 20 Market value of salvage 21 Book value of salvage 22 Taxes on sale 23 Altertax salvage value: 25 Project Cash Flows 26 Year 27 OCF 28 Change in NWC 29 Capital spending 30 Total cash flow 31 Discounted Cash Flow 32 Cumulative cash flow We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. Based on the information, you prepare the pro-forma income statement provided in the Excel template and answer the following questions 8. Calculate the accounting break-even point for the forecasted year. (2.5 Points) 9. Using Scenario analysis, calculate the best-case, good-case, and worst-case OCF figures. (12.5 Points) 10. Calculate the sensitivity of OCF to variable costs per unit and fixed costs. (5 Points) Units Sales Year 1 75,000 Year 2 95,000 Year 3 125,000 Year 4 130,000 Year 5 140,000 Equipment Cost Salvage value 61,000,000 3,400,000 650 50% Units Price Variable cost as % of Sales Revenue Fixed costs (per year) Depreciation Life 4,300,000 35% 15% Tax rate NWC (% of sales) Required return Required Payback Period (years) 12% Formatting Year 5 Pro Forma Income Statement Year Revenues Variable costs 5 Fixed costs 6 Depreciation EBIT Taxes (35%) 9 Net Income 10 OCF 12 13 Net Working Capital 14 Year 15 Initial NWC 16 Ending NWC 17 NWC cash flow 19 Salvage Value 20 Market value of salvage 21 Book value of salvage 22 Taxes on sale 23 Altertax salvage value: 25 Project Cash Flows 26 Year 27 OCF 28 Change in NWC 29 Capital spending 30 Total cash flow 31 Discounted Cash Flow 32 Cumulative cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts