Question: We are evaluating a project that costs $ 8 7 4 , 8 0 0 , has a nine - yebr life, and has no

We are evaluating a project that costs $ has a nineyebr life, and has no salvage value. Assume that depreciation is straightIne to zero over the life of the project. Sales are projected at units per yeac. Price per unit is $ variable cost per unit is $

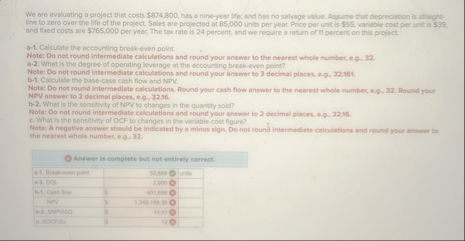

a Calculate the accounting breskeven point.

Note; Do not round intermedlate calculations and round your answor to the neareat mhole gumbec, eqs.

a What is the denree od operstiong lertrene ot the accourting breakoven pont?

Note; Do not round intermsediate calculations and round your answer to decimal places, e b Calculate the basecase cash flow and NPV Nour ansumer in derimal mlsce. at

b Whet is the senalivity of NPY to chonges in the quansty sold?

Note: Do not round intermediate calculations and round your answer to decimal places, e

c What is the sensitivity of OCF to changes in the variable cost figure?

Note; A negative answer should be indicated by a minus slign. Do not round imtermediate calculations and round your antural Whe nescent whole numbers, e

Answer is complete but not entirely cerrect.

Consider a project with the following deta: Accounting breakeven quantity units cash breakeven quartity unitx ilife six years; floed costs $; variable costs $ per unit; required return percent, lgnoring the effect of tavers, find the financlal break even auamtiv.

Noter Do not round intermediate calculations and round your answer to decimal places, e

tableDreakiven everity,

You are considering a new product launch. The project will cost $ have a fouryear ille, and have no salvage valut, depreciation is stroight line to zero. Sales are projected at units per year, price per unit wall be $ variabie cost per unt percect.

aveatd on your experience, you thirk the unit sales, variable cost, and traed cost projections given here are probably accurate is whin percent. What are the upper and lower bounds for these projections? What is the basecase NPM What are the bestcase andi whist iace ereharias? ta decimal phens, : Round your other answers to the nebrest whole numbec, te

tableScenerieUnit Bras,Veriatle Cont,Tised Ceste,neyfeieEBeet ase,,SETWryA

tvakape the senwtivty of your basecave NPV io changess in land cogts.

Note: A negwive anserer should be indicabed by a minus align. De net round i a decimal places ea

Wate: De net round lebermediate calculations and round your anywer to decieal places,

Kou bought one of Great White Shark Repellant Company's percent coupon bonds one year ago for $ Theie bonds make annual payments and mature years from now. Suppose you decide to sell your bonds todsy, when the required retum on the bonds is percent The bendt hive a par val se of $ If the intiation rate was pescent over the past year, what was your total real return on imestment?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to declimal places, e

Anvwer is comptete hut mot entirely cerrect.

Handen

marn

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock