Question: We are evaluating a project that costs $ 9 4 8 , 0 0 0 , has an 1 2 - year life, and has

We are evaluating a project that costs $ has an year life, and has no salvage value. Assume that depreciation is straightline to zero over the lie of the project. Sales are projected at units per year. Price per unit is $ variable cost per unit is $ and foxed costs are $ per year. The tax rate is percent, and we require a percent return on this project.

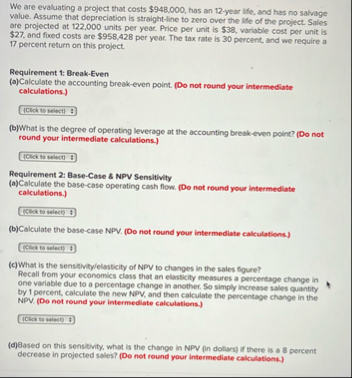

Requirement : BreakEven

aCalculate the accounting breakeven point. Do not round your intermediate calculations.

Click to select

bWhat is the degree of operating leverage at the accounting breakeven point? Do not round your intermediate calculations.

Requirement : BaseCase NPV Sensitivity

aCalculate the basecase operating cash flow. Do not round your intermediate calculations.

Whlea bo select

bCalculate the basecase NPVDo not round your intermediate calculations.

c What is the sensitivitylelasticity of NPV to changes in the sales figure?

Recall from your economics class that an elasticity measures a percentage change in one variable due to a percentage change in another. So simply increase sales quantity by percent, calculate the new NPV and then calculate the percentage change in the NPVDo not round your intermediate calculations.

d Based on this sensitivity what is the change in NPV in dollars if there is a percent decrease in projected sales? Do not round your intermediate calculations

bCalculate the basecase NPVDo not round your intermediate calculations.

TCKh wo select

c What is the sensitivitylelasticity of NPV to changes in the sales figure?

Recall from your economics class that an elasticity measures a percentage change in one variable due to a percentage change in another. So simply increase sales quantity by percent, calculate the now NPV and then calculate the percentage change in the NPVDo not round your intermediate calculations.

Click to satect!

dBased on this sensitivity what is the change in NPV in dollars if there is a percent decrease in projected sales? Do not round your intermediate calculations.

Clex to spipety #

Requirement : Sensitivity of OCF

aIn addition to NPV we can calculate the sensilivity of other things, such as OCF. What Is the sensilvity of basecase OCF to changes in the variable cost? Estimate the sensitivity by increasing variable costs by tolk. De not round your intermediate calculations.

bDased on this sensitivity estimate the change in OCF in doltars given a h decrease In the variable costs? De not round your intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock