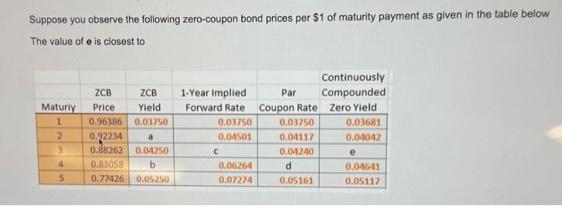

Question: Suppose you observe the following zero-coupon bond prices per $1 of maturity payment as given in the table below The value of e is

Suppose you observe the following zero-coupon bond prices per $1 of maturity payment as given in the table below The value of e is closest to Maturiy 1 2 3 4 5 ZCB ZCB Price Yield 0.96386 0.03750 0.22234 a 0.88262 0.04250 0.83058 b 0.77426 0.05250 1-Year Implied Forward Rate 0.03750 0.04501 0.06264 0.07274 Par Coupon Rate 0.03750 0.04117 0.04240 d 0.05161 Continuously Compounded Zero Yield 0.03681 0.04042 e 0.04641 0.05117

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Solution To solve for the values of a b c and d you can use the relationship between zerocoupon bond ... View full answer

Get step-by-step solutions from verified subject matter experts