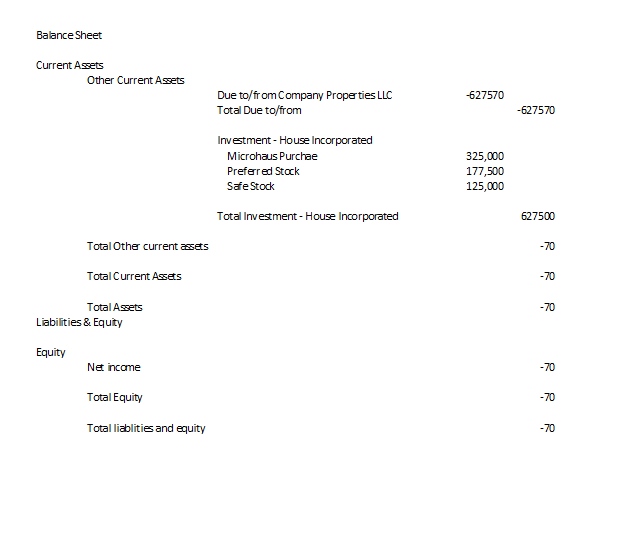

Question: We are looking at a LLC why does the corporation have a negative asset called Due/to from Company LLC ? Should this be an liability

We are looking at a LLC why does the corporation have a negative asset called Due/to from Company LLC ? Should this be an liability account instead of an asset ? Shouldnt the asset be higher and total equity/liablities be = 627500 which is same as assets? Please clarify

Balance Sheet Current Assets Other Current Assets Due to/fr om Compary Prope ties LLC Total Due to/from Invetment - House Incorporated Microhaus Purchae Prefered Stack SafeStock Total Investment - House Incorporated 627570 627570 325,000 177,500 125,000 627500 Total Othe current asets 70 Total Current Assets 70 Total Assets 70 Liabilities \& Equity Equity Net income 70 Total Equity 70 Total liablities and equity 70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts