Question: We are on 1 1 ? 2 0 2 4 . You are asked to evaluate the potential Management Buyout of a company called Dill

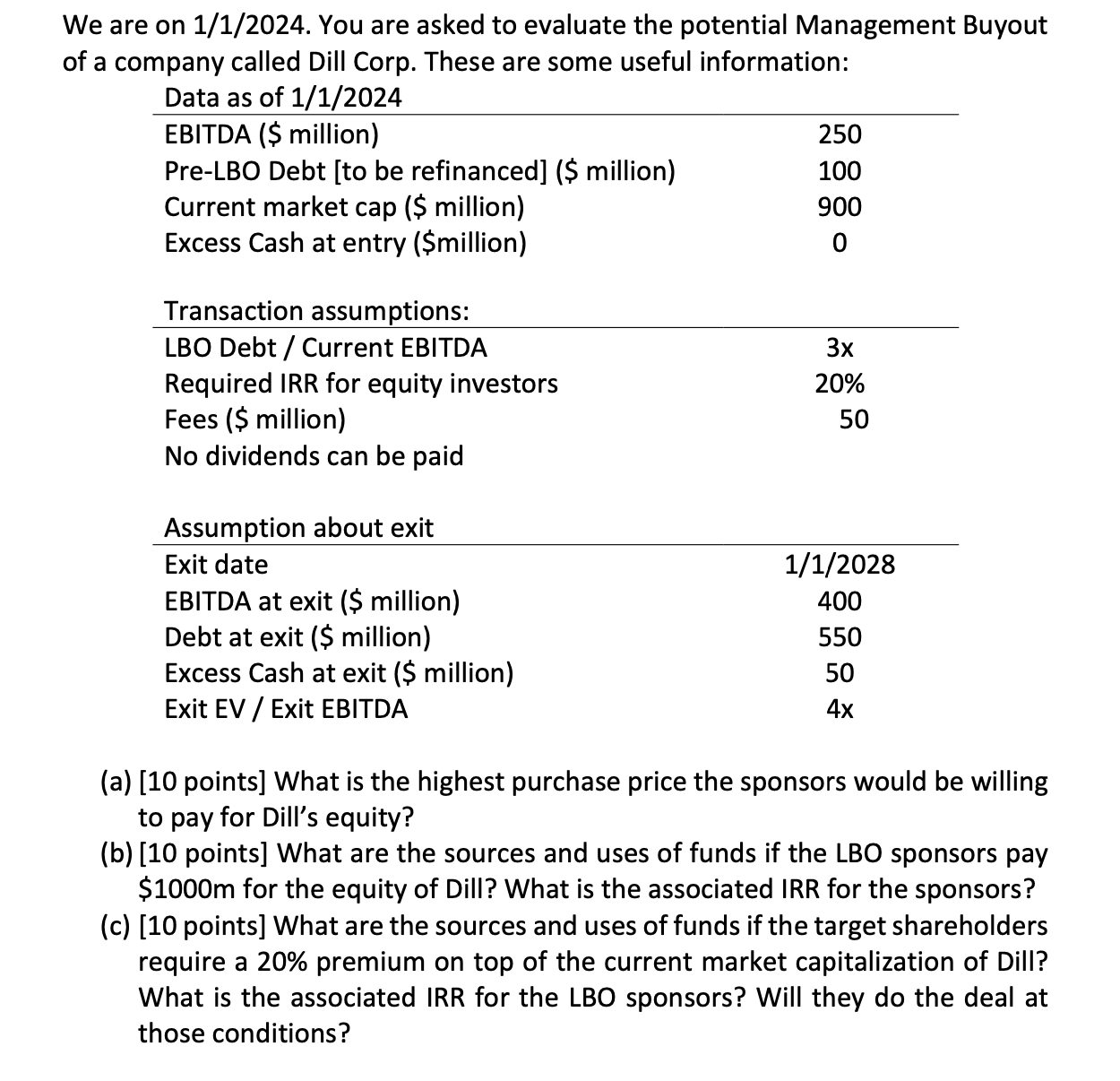

We are on You are asked to evaluate the potential Management Buyout

of a company called Dill Corp. These are some useful information:

a points What is the highest purchase price the sponsors would be willing

to pay for Dill's equity?

b points What are the sources and uses of funds if the LBO sponsors pay

$ for the equity of Dill? What is the associated IRR for the sponsors?

c points What are the sources and uses of funds if the target shareholders

require a premium on top of the current market capitalization of Dill?

What is the associated IRR for the LBO sponsors? Will they do the deal at

those conditions?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock