Question: We are only doing the indirect method Start by entering net income and dividends. Dividends were declared but not paid. Then run the

We are only doing the indirect method

· Start by entering net income and dividends. Dividends were declared but not paid.

· Then run the facts and the income statement for information. Here are some aids:

o Bad debt expenses and Lower of cost or market adjustments are straight noncash items that need to be added back to net income.

o Always “explain” allowance for bad debts before you try to explain change in accounts receivable. You need to know the write-offs before you can determine increase or decrease in accounts receivable.

o The gain on equipment makes me look for cost and accumulated depreciation on the asset – the notes tell you that. You want to get the gain out of operations and show the cash received under investing.

o The investments are “trading investments”. The proceeds of the sale go in cash investing. Take the gain out of cash operations and join it with cost to show the total cash received which is included in investing section of cash flow. Bottom line, you remove the gain and insert the cash received. .

o Just show cash received from stock issue as a single amount (par and paid-in excess are one amount).

o The factoring of the accounts receivable was without recourse. They knew they would sell the accounts and never established an allowance for them. They still have other accounts receivable and the allowance for bad debts applies to those accounts. You will be taking the loss out of cash from operations and you will insert the net cash received in operating cash.

o Land cost $25,000, but partial cash payment was only $7,000, The $7,000 goes under cash – investing. The $18,000 portion is shown in the schedule of non-cash transactions.

o Stock worth $40,000 was issued as payment for land. That appears in your statement of non-cash transactions.

o Your call on automating the worksheet. You can pre-enter the formula for the “balance” column. It is handy but might spoil you for exam. The formula is: debit balance – debit explanation – credit balance + credit change. You have explained the change when this amount is “0” I loaded the formula for accounts receivable and for the allowance for bad debts. You can decide if you want to use it.

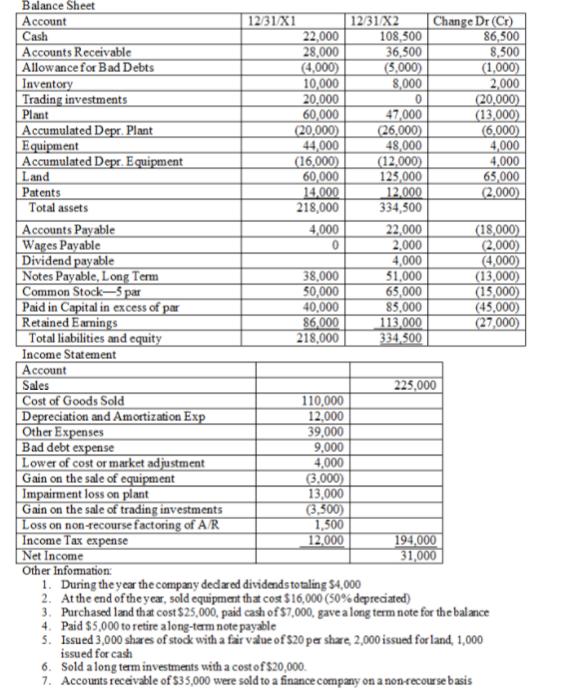

Balance Sheet 1231 X2 108,500 36,500 (5,000) 8,000 Account Cash Accounts Receivable Allowance for Bad Debts |Inventory Trading investments Plant Accumulated Depr. Plant Equipment Accumulated Depr. E quipment Land Patents Total assets 12/31/X1 22,000 28,000 (4,000) 10,000 20,000 60,000 (20,000) 44,000 (16,000) 60,000 14,000 218,000 47,000 (26.000) 48,000 (12,000) 125,000 12,000 334,500 Change Dr (Cr) 86,500 8,500 (1,000) 2,000 (20.000) (13,000) (6,000) 4,000 4,000 65,000 (2,000) Accounts Payable Wages Payable Dividend payable Notes Payable, Long Term Common Stock-S par Paid in Capital in excess of par Retained Earnings Total liabilities and equity Income Statement Account Sales Cost of Goods Sold Depreciation and Amortization Exp Other Expenses Bad debt expense Lower of cost or market adjustment Gain on the sale of equipment Impairment loss on plant Gain on the sale of trading investments Loss on non-recourse factoring of A/R Income Tax expense |Net Income Other Infomation: 1. During the year the company dedared dividends totaling $4,000 2. At the end of the year, sold equipment tha cost $16,000 (50% depreciated) 3. Purchased land that cost $25,000, paid cash of $7,000, gave a long term note for the balance 4. Paid $5,000 to retire along-tam note payable 5. Issued 3,000 shares of stock with a far value of $20 per share, 2,000 issued for land, 1,000 issued for cash 6. Sold a long term investments with a costof $20,000. 7. Accounts receivable of $35,000 were sold to a finance company on a noncecourse basis (18,000) (2,000) (4,000) (13,000) (15,000) (45,000) (27,000) 4,000 22,000 2,000 4,000 51,000 65,000 85,000 113,000 334,500 38,000 50,000 40,000 86,000 218,000 225,000 110,000 12,000 39,000 9,000 4,000 (3,000) 13,000 3.500) 1,500 12.000 194,000 31,000

Step by Step Solution

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts