Question: We are trying to value the technology company B&B 's share price. If the appropriate industry PE for this type of company is 5 and

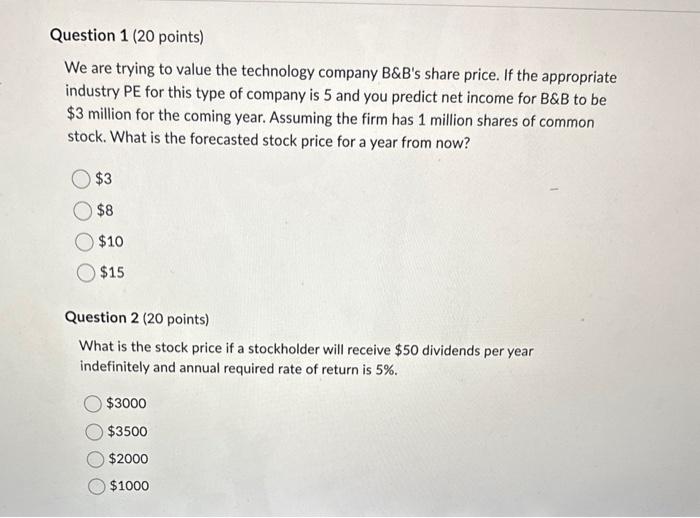

We are trying to value the technology company B&B 's share price. If the appropriate industry PE for this type of company is 5 and you predict net income for B&B to be $3 million for the coming year. Assuming the firm has 1 million shares of common stock. What is the forecasted stock price for a year from now? \begin{tabular}{|l|} \hline$3 \\ \hline$8 \\ \hline$10 \\ \hline$15 \\ \hline \end{tabular} Question 2 (20 points) What is the stock price if a stockholder will receive $50 dividends per year indefinitely and annual required rate of return is 5%. $3000$3500$2000$1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts