Question: We better get started on this report, said Hal to his assistant, Roger, as he straightened up in his seat and fired up his laptop

We better get started on this report, said Hal to his assistant, Roger, as he straightened up in his seat and fired up his laptop computer. Im sure Henry will expect a detailed analysis first thing Monday morning. Hal Burton, vice president for International Business Development at Siemens Technologies, and his assistant, Roger Manning, were returning to the United States from their seven-day trip to New Delhi, India.

Henry Black, president and chief executive officer of Siemens Technologies, had been contacted by Saini Electronics from India with a proposal of starting a joint venture for the production of circuit boards. Currently, Siemens Technologies was exporting 50,000 circuit boards a year to Indian importers at a per-unit price of $50 including shipping and insurance. The company had managed to obtain an import agreement from the Indian government for a 10-year period, which was due to expire within one year. The pre-tax profit on the exported circuit boards was $15 per unit (Table 1 for cost breakdown) and unit sales were expected to increase at the rate of 3% per year based on the projected increase in the gross domestic product in India.

Based on the discussions held with the Indian counterparts, Hal estimated that the cost of establishing the manufacturing facility in India would be around $3,000,000 at the prevailing exchange rate of $1 = 50 rupees. The Indian partner agreed to invest 50% of the initial outlay. In addition to

106

fixed assets, Hal estimated that $500,000 worth of working capital would be needed for start-up.

Under the tentative terms of the joint venture, Saini Electronics would manage the day-to-day operations of the business with overall supervision being the responsibility of an American chief engineer. Siemens Technologies would turn over the operation to Saini Electronics after seven years, in exchange for full reimbursement of the working capital and a purchase price amounting to 125% of the net book value of the fixed assets at that time. With the help of Romesh Saini, the managing director of Saini Electronics, Hal had managed to get the Indian government to reach a tentative agreement whereby at the end of each year, Siemens share of net cash flows from the joint venture could be remitted to the United Sates at the prevailing exchange rate.

Hal had checked with the tax authorities in India and found out that fixed assets could be depreciated on a straight-line basis over 10 years. The corporate tax rate in India was 40%, as it was in the United States. After meeting with various suppliers and checking quality control standards, Hal had worked out the details regarding the revised cost structure of the circuit boards (Table 2). The circuit boards manufactured in India would be made of a combination of domestic and U.S. components. Hal figured that the net cost of the components imported from the United States (manufactured by Siemens Technologies) would be $5 per unit and would be supplied to the joint venture at the rate of $8 per unit. He knew that by producing the circuit boards in India, there would be significant labor cost advantages.

As Roger and Hal began working out the cash flow details, Hal asked Roger, Do you think it would be better for us to raise the money in India at the rate of 15% per year, or borrow the dollars here at the rate of 10% and remit the funds to India after conversion at the prevailing exchange rate? Roger, who had earned an MBA in International Finance, said, I dont think it really matters, Hal. Based on the principle of covered interest arbitrage, there should be no real advantage one way or another. Thats assuming we can raise the money without significantly different transactions costs or other impediments in either country.

I knew that, said Hal. I was just checking to see if you were still awake. Somehow Roger wasnt convinced.

Hal knew that the required rate of return on projects of this nature was typically 15% in the United States. However, he realized that the nominal risk-free rate in India was 9% compared to 4% in America, while the inflation rate was 5% in India and only 3% here. Moreover, it was a policy at Siemens Technologies to estimate future foreign exchange rates on the basis of projected inflation rates. Accordingly, Hal had collected inflation rate forecasts for the next seven years for India and the United States (Table 3).

107

Hal knew that Henry would demand a comprehensive analysis of all relevant cash flows using both the home currency as well as the foreign currency approach. Just as he reached into his briefcase for his financial calculator, there was an announcement on the personal address system, This is your captain speaking. We are approaching some heavy cloud cover and expect some turbulence, which could be heavy at times. Please return to your seats and fasten your seatbelts until the sign is turned off. Thank you. Hal figured that he better put away the computer and get back to his analysis in the safety and comfort of his office.

Table 1

Cost Breakdown of Circuit Board (Exported)

| Components | $ 20 |

| Labor | 10 |

| Freight and Insurance | 5 |

| Total Cost Per Unit | 35 |

Table 2

Cost Breakdown of Circuit Boards Manufactured in India

| Indigenous Components | $12 |

| Imported Components (Supplied by Siemens) | 8 |

| Labor Cost Per Unit | 5 |

| Total Cost Per Unit | 25 |

Table 3

Projected Annual Inflation Rates

| United States | India | |

| Year 1 | 3% | 5% |

| Year 2 | 3% | 6% |

| Year 3 | 4% | 8% |

| Year 4 | 4% | 8% |

| Year 5 | 4% | 8% |

| Year 6 | 4% | 8% |

| Year 7

--------------------------------------

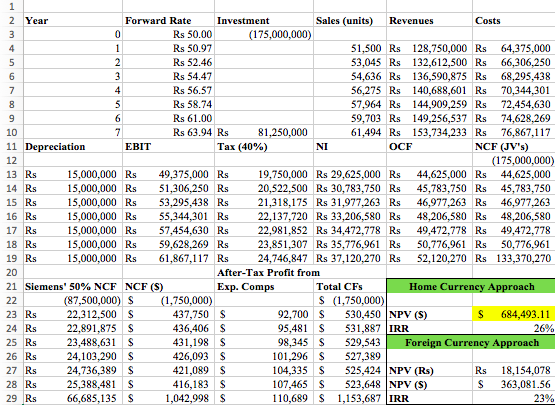

QUESTIONS (Please answer as as best as you can) 1. Based on the home currency approach what should Hal recommend? Please explain with the help of suitable calculations. 2. Based on the foreign currency approach what should Hal recommend? Please explain with the help of suitable calculations. 3. As Hal went over the numbers once again, he realized that he had made a major error. One of the machines, which were to be shipped over to India as part of Siemens Technologies initial investment, had been accounted for at its book value of $500,000, even though it had an estimated market value of $700,000. The machine could be depreciated on a straight-line basis over 7 years. What effect would this error have on Hals analysis and recommendation? (Hint: you do not have to recalculate the NPV, just identify the impact of this change in cash flow, i.e. amount, positive or negative.) 4. As Hal was inquiring about the tax provisions in India, he was told that there was a high probability that the Indian government would offer a reduced tax rate (20%) to foreign investors who used some indigenous raw materials and employed Indians. If this does happen, how would the analysis be affected? (Hint: You do not have to recalculate the NPV, just identify the direction of the impact to the project value.) 5. 1. Identify and explain two other risk factors Hal would have to take into consideration before making his recommendation, besides exchange rate fluctuations? | 4% | 9% |

Forward Rate Investment Sales (units) Revenues Rs 50.00 Rs 50.97 Rs 52.46 Rs 54.47 Rs 56.57 Rs 58.74 o) 51,500 Rs 128,750,000 Rs 64,375,000 53,045 Rs 132,612,500 Rs 66,306,250 54,636 Rs 136,590,875 Rs 68,295,438 56,275 Rs 140,688,601 Rs 70,344,301 57,964 Rs 144,909,259 Rs 72,454,630 59,703 Rs 149,256,537 Rs 74,628,269 61,494 Rs 153,734,233 Rs 76,867,117 Rs 63.94 Rs 1,250,000 11 Depreciation EBIT NCF (JV's) (175,000,000) 13 Rs 15,000,000 Rs 49,375,000 Rs19,750,000 Rs 29,625,000 Rs 44,625,000 Rs 44,625,000 14 Rs 15,000,000 Rs 51,306,250 Rs 20,522,500 Rs 30,783,750 Rs 45,783,750 Rs 45,783,750 15 Rs 15,000,000 Rs 53,295,438 Rs 21,318,175 Rs 31,977,263 Rs 46,977,263 Rs 46,977,263 16 Rs 15,000,000 Rs 55,344,301 Rs 22,137,720 Rs 33,206,580 Rs 48,206,580 Rs 48,206,580 17 Rs 15.000.000 Rs 57.454.630R 22.981.852 Rs 34.472.778 Rs49.472.778 Rs 49.472.778 18 Rs 15,000,000 Rs 59,628,269 Rs 23,851,307 Rs 35,776,961 Rs 50,776,961 Rs 50,776,961 19 Rs 15,000,000 Rs 61,867,117 Rs 24,746,847 Rs 37,120,270 Rs 52,120,270 Rs 133,370,270 After-Tax Profit from 21 Siemens' 50% NCF NCF (S) $-(1,750,000) Home Currency Approach 7.500.00)237250s 92,700 530450 S (1,750,000) 23 Rs 22,312,500 S 24 Rs 22,891,875 S 25 Rs 23,488,631 S 26 Rs 24,103,290 S 27 Rs 24,736,389 S 28 Rs 25,388,481 S 29 Rs 66,685,135 $ 1042,998 S 437,750 S 436,406S 431,198 426,093 S 421,089 S 416.1 S 92,700 95,481 530,450 NPV (S) 531,887 IRR S 684,493.11 98345 529,543 101,296 S 527,389 104,335 S 525,424 NPV (Rs) 107,465 S 523,648 NPV (S) 110,689 S 1,153,687 IRR Foreign Currency Approach Rs 18,154,078 $ 363.081.56 Forward Rate Investment Sales (units) Revenues Rs 50.00 Rs 50.97 Rs 52.46 Rs 54.47 Rs 56.57 Rs 58.74 o) 51,500 Rs 128,750,000 Rs 64,375,000 53,045 Rs 132,612,500 Rs 66,306,250 54,636 Rs 136,590,875 Rs 68,295,438 56,275 Rs 140,688,601 Rs 70,344,301 57,964 Rs 144,909,259 Rs 72,454,630 59,703 Rs 149,256,537 Rs 74,628,269 61,494 Rs 153,734,233 Rs 76,867,117 Rs 63.94 Rs 1,250,000 11 Depreciation EBIT NCF (JV's) (175,000,000) 13 Rs 15,000,000 Rs 49,375,000 Rs19,750,000 Rs 29,625,000 Rs 44,625,000 Rs 44,625,000 14 Rs 15,000,000 Rs 51,306,250 Rs 20,522,500 Rs 30,783,750 Rs 45,783,750 Rs 45,783,750 15 Rs 15,000,000 Rs 53,295,438 Rs 21,318,175 Rs 31,977,263 Rs 46,977,263 Rs 46,977,263 16 Rs 15,000,000 Rs 55,344,301 Rs 22,137,720 Rs 33,206,580 Rs 48,206,580 Rs 48,206,580 17 Rs 15.000.000 Rs 57.454.630R 22.981.852 Rs 34.472.778 Rs49.472.778 Rs 49.472.778 18 Rs 15,000,000 Rs 59,628,269 Rs 23,851,307 Rs 35,776,961 Rs 50,776,961 Rs 50,776,961 19 Rs 15,000,000 Rs 61,867,117 Rs 24,746,847 Rs 37,120,270 Rs 52,120,270 Rs 133,370,270 After-Tax Profit from 21 Siemens' 50% NCF NCF (S) $-(1,750,000) Home Currency Approach 7.500.00)237250s 92,700 530450 S (1,750,000) 23 Rs 22,312,500 S 24 Rs 22,891,875 S 25 Rs 23,488,631 S 26 Rs 24,103,290 S 27 Rs 24,736,389 S 28 Rs 25,388,481 S 29 Rs 66,685,135 $ 1042,998 S 437,750 S 436,406S 431,198 426,093 S 421,089 S 416.1 S 92,700 95,481 530,450 NPV (S) 531,887 IRR S 684,493.11 98345 529,543 101,296 S 527,389 104,335 S 525,424 NPV (Rs) 107,465 S 523,648 NPV (S) 110,689 S 1,153,687 IRR Foreign Currency Approach Rs 18,154,078 $ 363.081.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts