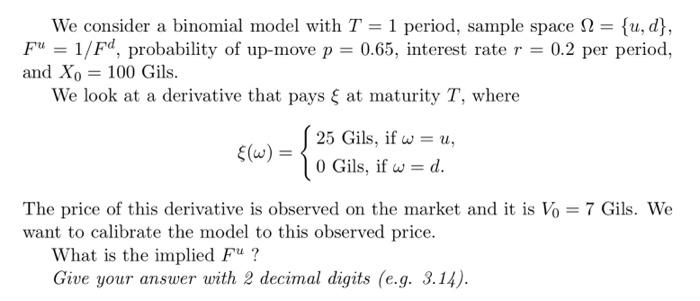

Question: We consider a binomial model with T = 1 period, sample space = {u, d}, Fu = 1/Fd, probability of up-move p = 0.65, interest

We consider a binomial model with T = 1 period, sample space = {u, d}, Fu = 1/Fd, probability of up-move p = 0.65, interest rate r = 0.2 per period, and Xo = 100 Gils. We look at a derivative that pays at maturity T, where 25 Gils, if wu, = {(w) = 0 Gils, if w= d. The price of this derivative is observed on the market and it is Vo = 7 Gils. We want to calibrate the model to this observed price. What is the implied F" ? Give your answer with 2 decimal digits (e.g. 3.14). We consider a binomial model with T = 1 period, sample space = {u, d}, Fu = 1/Fd, probability of up-move p = 0.65, interest rate r = 0.2 per period, and Xo = 100 Gils. We look at a derivative that pays at maturity T, where 25 Gils, if wu, = {(w) = 0 Gils, if w= d. The price of this derivative is observed on the market and it is Vo = 7 Gils. We want to calibrate the model to this observed price. What is the implied F" ? Give your answer with 2 decimal digits (e.g. 3.14)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts