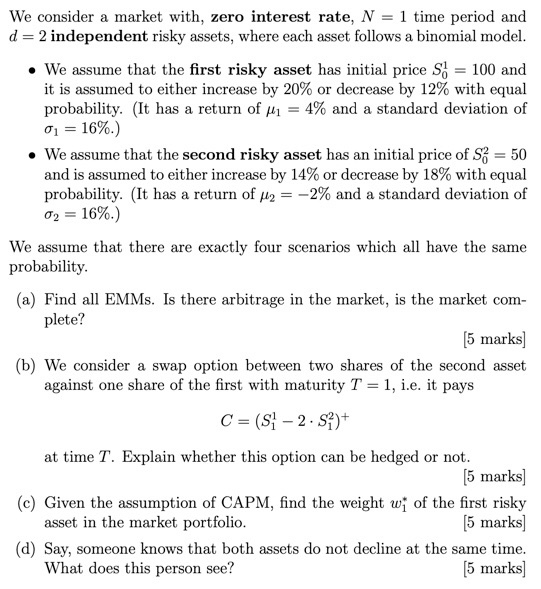

Question: We consider a market with, zero interest rate, N = 1 time period and d=2 independent risky assets, where each asset follows a binomial model.

We consider a market with, zero interest rate, N = 1 time period and d=2 independent risky assets, where each asset follows a binomial model. We assume that the first risky asset has initial price S) = 100 and it is assumed to either increase by 20% or decrease by 12% with equal probability. (It has a return of M1 = 4% and a standard deviation of 9 = 16%.) We assume that the second risky asset has an initial price of Sz = 50 and is assumed to either increase by 14% or decrease by 18% with equal probability. (It has a return of H2 = -2% and a standard deviation of 02 = 16%.) We assume that there are exactly four scenarios which all have the same probability (a) Find all EMMs. Is there arbitrage in the market, is the market com- plete? [5 marks) (b) We consider a swap option between two shares of the second asset against one share of the first with maturity T = 1, i.e. it pays C = (S - 2. s) at time T. Explain whether this option can be hedged or not. [5 marks] (e) Given the assumption of CAPM, find the weight w of the first risky asset in the market portfolio. (5 marks) (d) Say, someone knows that both assets do not decline at the same time. What does this person see? (5 marks] We consider a market with, zero interest rate, N = 1 time period and d=2 independent risky assets, where each asset follows a binomial model. We assume that the first risky asset has initial price S) = 100 and it is assumed to either increase by 20% or decrease by 12% with equal probability. (It has a return of M1 = 4% and a standard deviation of 9 = 16%.) We assume that the second risky asset has an initial price of Sz = 50 and is assumed to either increase by 14% or decrease by 18% with equal probability. (It has a return of H2 = -2% and a standard deviation of 02 = 16%.) We assume that there are exactly four scenarios which all have the same probability (a) Find all EMMs. Is there arbitrage in the market, is the market com- plete? [5 marks) (b) We consider a swap option between two shares of the second asset against one share of the first with maturity T = 1, i.e. it pays C = (S - 2. s) at time T. Explain whether this option can be hedged or not. [5 marks] (e) Given the assumption of CAPM, find the weight w of the first risky asset in the market portfolio. (5 marks) (d) Say, someone knows that both assets do not decline at the same time. What does this person see? (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts