Question: We consider a portfolio selection problem with n assets and N periods. At the beginning of each period, we re-invest our total wealth, redistributing

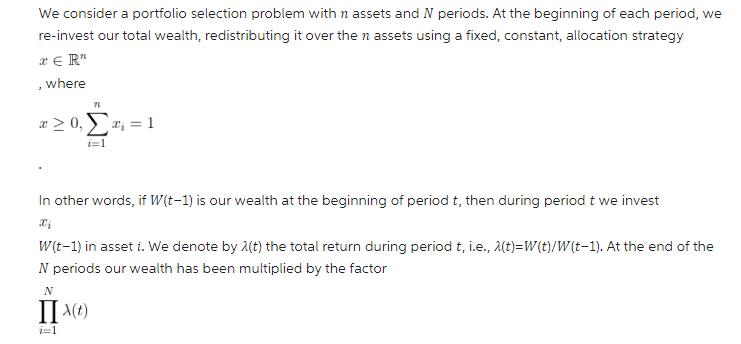

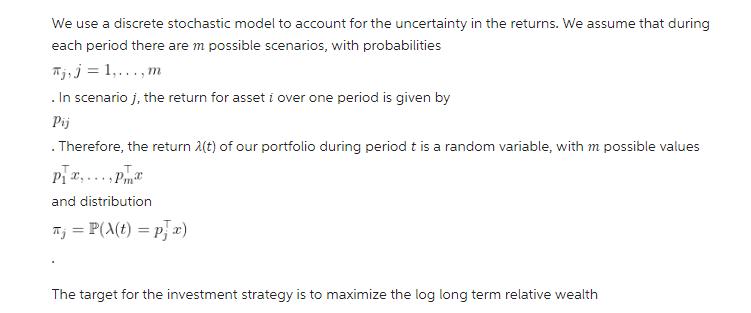

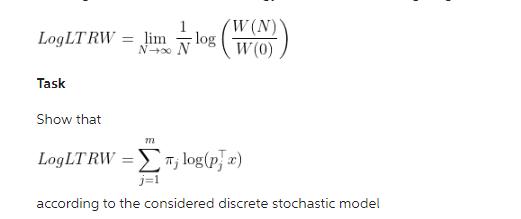

We consider a portfolio selection problem with n assets and N periods. At the beginning of each period, we re-invest our total wealth, redistributing it over the n assets using a fixed, constant, allocation strategy * ER" , where 72 20," = 1 In other words, if W(t-1) is our wealth at the beginning of period t, then during period t we invest Xi W(t-1) in asset i. We denote by 2(t) the total return during period t, i.e., 2(t)=W(t)/W(t-1). At the end of the N periods our wealth has been multiplied by the factor N II X(t) i=1 We use a discrete stochastic model to account for the uncertainty in the returns. We assume that during each period there are m possible scenarios, with probabilities Aj, j = 1,..., m . In scenario j, the return for asset i over one period is given by Pij . Therefore, the return 2(t) of our portfolio during period t is a random variable, with m possible values P,... P and distribution T = P(x(t) = px) The target for the investment strategy is to maximize the log long term relative wealth LogLT RW Task = lim N log N 772 W(N) W (0) Show that LogLT RW = log(px) Tj according to the considered discrete stochastic model

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

LogLT RW t 1 N log Wt1 Wt As 1 WtWt1t where t denotes the return during period t we can rewri... View full answer

Get step-by-step solutions from verified subject matter experts