Question: We consider a two - period binomial model with the following properties: each period lasts one year and the current stock price is (

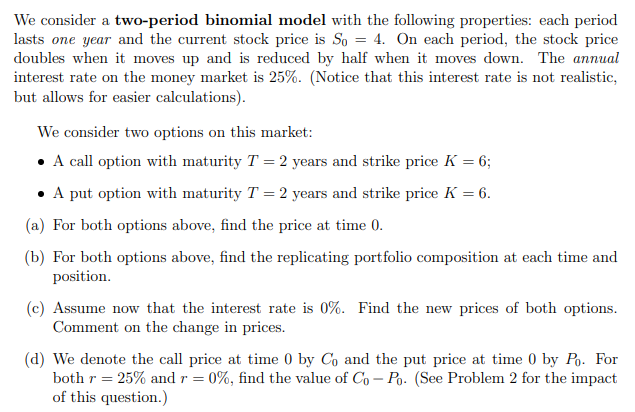

We consider a twoperiod binomial model with the following properties: each period lasts one year and the current stock price is S On each period, the stock price doubles when it moves up and is reduced by half when it moves down. The annual interest rate on the money market is Notice that this interest rate is not realistic, but allows for easier calculations

We consider two options on this market:

A call option with maturity T years and strike price K;

A put option with maturity T years and strike price K

a For both options above, find the price at time

b For both options above, find the replicating portfolio composition at each time and position.

c Assume now that the interest rate is Find the new prices of both options. Comment on the change in prices.

d We denote the call price at time by C and the put price at time by P For both r and r find the value of CPSee Problem for the impact of this question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock