Question: We consider an example of constructing a synthetic safe asset with two risky assets. Suppose that there are two periods: 0, and 1. We consider

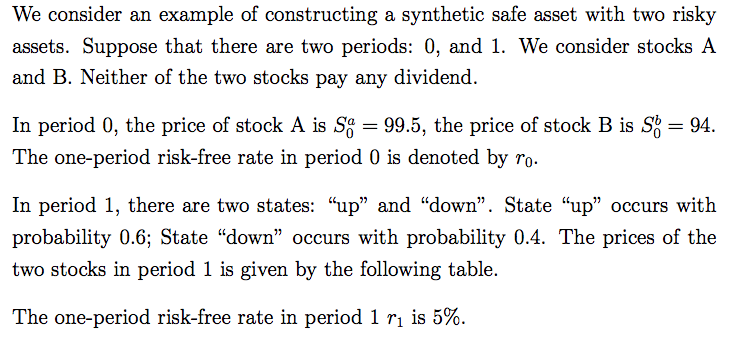

We consider an example of constructing a synthetic safe asset with two risky assets. Suppose that there are two periods: 0, and 1. We consider stocks A and B. Neither of the two stocks pay any dividend. In period 0, the price of stock A is Sa = 99.5, the price of stock B is so = 94. The one-period risk-free rate in period 0 is denoted by ro. In period 1, there are two states: up and down". State up occurs with probability 0.6; State "down" occurs with probability 0.4. The prices of the two stocks in period 1 is given by the following table. The one-period risk-free rate in period 1 r is 5%. sa Sb "up" 110 100 "down" 90 85 Let C(100) be the price of a European call option on stock A that expires in period 2 with the strike price 100. Let P(100) be the price of European put option on stock A that expires in period 2 with the strike price 100. (a) Solve for r. (5 points) (b) Calculate C(100) P(100) (5 points) We consider an example of constructing a synthetic safe asset with two risky assets. Suppose that there are two periods: 0, and 1. We consider stocks A and B. Neither of the two stocks pay any dividend. In period 0, the price of stock A is Sa = 99.5, the price of stock B is so = 94. The one-period risk-free rate in period 0 is denoted by ro. In period 1, there are two states: up and down". State up occurs with probability 0.6; State "down" occurs with probability 0.4. The prices of the two stocks in period 1 is given by the following table. The one-period risk-free rate in period 1 r is 5%. sa Sb "up" 110 100 "down" 90 85 Let C(100) be the price of a European call option on stock A that expires in period 2 with the strike price 100. Let P(100) be the price of European put option on stock A that expires in period 2 with the strike price 100. (a) Solve for r. (5 points) (b) Calculate C(100) P(100) (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts