Question: We could use the valuation equobon shown above to solve for a bond's value; however, it is more efficient to use a financial caiculator. Simply

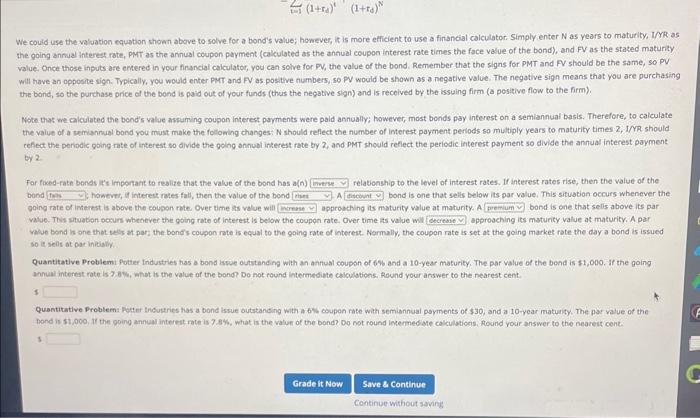

We could use the valuation equobon shown above to solve for a bond's value; however, it is more efficient to use a financial caiculator. Simply enter N as years to maturity, I/YR a the going annual interest rate, PMT as the annual coupon peyment (calculated as the annual coupon interest rate times the face value of the bond), and FV as the stated maturity value. Once those inputs are entered in your financial caiculatoc, you can solve for PV, the value of the bond. Remember that the slgns for PMT and PV should be the same, so PV will have an opposite sign. Typically, you would enter PMT and FV as positive numbers, so PV would be shown as a negative value. The negative sign means that you are purchasin the band, so the purchase price of the bond is paid out of your funds (thus the negative sign) and is received by the issuing firm (a pesitive flow to the firm). Note that we calculated the bond's value assuming coupon interest payments were paid annually; however, most bonds pay interest on a semiannual basls. Therefore, to calculate the value of a semiannual bond you must make the following changes: N should reflect the number of interest payment periods so multiply years to maturity times 2 , I/YR should refect the periodic going rate of interest so divide the ooing annubl inkerest rate by 2 , and PMT should refiect the periodic interest payment so divide the annual interest payment. by 2. For foxd-ratn bends lis important to realite that the value of the bond has a(n) bond hamever, if interet rates fall, then the value of the bond A bond is one that sells below its par value. This situation occurs whenever the. going rate of interest is above the coupon rote. Over time iss value will bond is one that selis above its par value. This situaton ocours whenever the going rate of interett is below the coopgn rate. Over time its value wil approaching its maturity value at maturity. A par value bond is one that tells at par; the bond's coupon rate is equal to the going rate of interent. Normally, the coupon rate is set at the going market rate the day a bond is issued so it rells at par initially Quantitative Problemi fotter industries has a bond aspe outstancing with an annual coupsn of 6%6 and a 10-year maturity, The par value of the bond is $1,000. If the going annual interest rate is ? . W, what is the value of the bond Do not round intermediate caloulbtions. Round your answer to the nearest cent 13 Quantitative Problemi Nater theutries has a bond issue outstanding with a 6w coupon rate with semiannual payments of \$30, and a 10-year matuaity. The par value of the fond is s1,000, If the poing annual intereit rate is 7.8%, what is the value of the bond? 00 not round igermedafe calculstions. found your answer to the neareit cent. 3 We could use the valuation equobon shown above to solve for a bond's value; however, it is more efficient to use a financial caiculator. Simply enter N as years to maturity, I/YR a the going annual interest rate, PMT as the annual coupon peyment (calculated as the annual coupon interest rate times the face value of the bond), and FV as the stated maturity value. Once those inputs are entered in your financial caiculatoc, you can solve for PV, the value of the bond. Remember that the slgns for PMT and PV should be the same, so PV will have an opposite sign. Typically, you would enter PMT and FV as positive numbers, so PV would be shown as a negative value. The negative sign means that you are purchasin the band, so the purchase price of the bond is paid out of your funds (thus the negative sign) and is received by the issuing firm (a pesitive flow to the firm). Note that we calculated the bond's value assuming coupon interest payments were paid annually; however, most bonds pay interest on a semiannual basls. Therefore, to calculate the value of a semiannual bond you must make the following changes: N should reflect the number of interest payment periods so multiply years to maturity times 2 , I/YR should refect the periodic going rate of interest so divide the ooing annubl inkerest rate by 2 , and PMT should refiect the periodic interest payment so divide the annual interest payment. by 2. For foxd-ratn bends lis important to realite that the value of the bond has a(n) bond hamever, if interet rates fall, then the value of the bond A bond is one that sells below its par value. This situation occurs whenever the. going rate of interest is above the coupon rote. Over time iss value will bond is one that selis above its par value. This situaton ocours whenever the going rate of interett is below the coopgn rate. Over time its value wil approaching its maturity value at maturity. A par value bond is one that tells at par; the bond's coupon rate is equal to the going rate of interent. Normally, the coupon rate is set at the going market rate the day a bond is issued so it rells at par initially Quantitative Problemi fotter industries has a bond aspe outstancing with an annual coupsn of 6%6 and a 10-year maturity, The par value of the bond is $1,000. If the going annual interest rate is ? . W, what is the value of the bond Do not round intermediate caloulbtions. Round your answer to the nearest cent 13 Quantitative Problemi Nater theutries has a bond issue outstanding with a 6w coupon rate with semiannual payments of \$30, and a 10-year matuaity. The par value of the fond is s1,000, If the poing annual intereit rate is 7.8%, what is the value of the bond? 00 not round igermedafe calculstions. found your answer to the neareit cent. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts