Question: We have a technical analysis chart for a commodity trading using MACD rule from 01/10/2020 Through 31/05/2022 an evaluation of how MACD (Moving Average Convergence

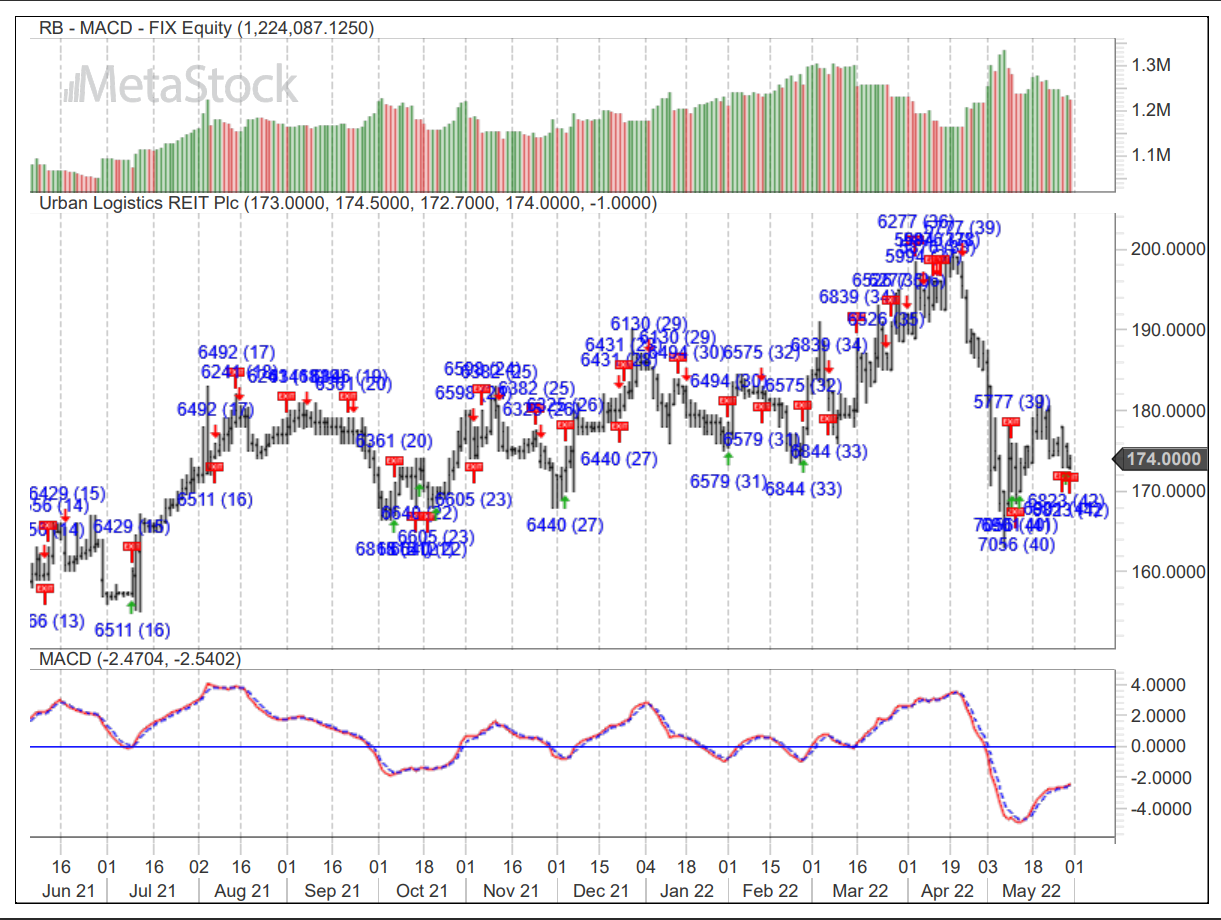

We have a technical analysis chart for a commodity trading using MACD rule from 01/10/2020 Through 31/05/2022

an evaluation of how MACD (Moving Average Convergence and Divergence) have performed in the prediction set (2021-22), including benchmarking against plausible alternative uses of the client's funds, and possible interventions during this period.

an evaluation of how MACD (Moving Average Convergence and Divergence) have performed in the prediction set (2021-22), including benchmarking against plausible alternative uses of the client's funds, and possible interventions during this period.

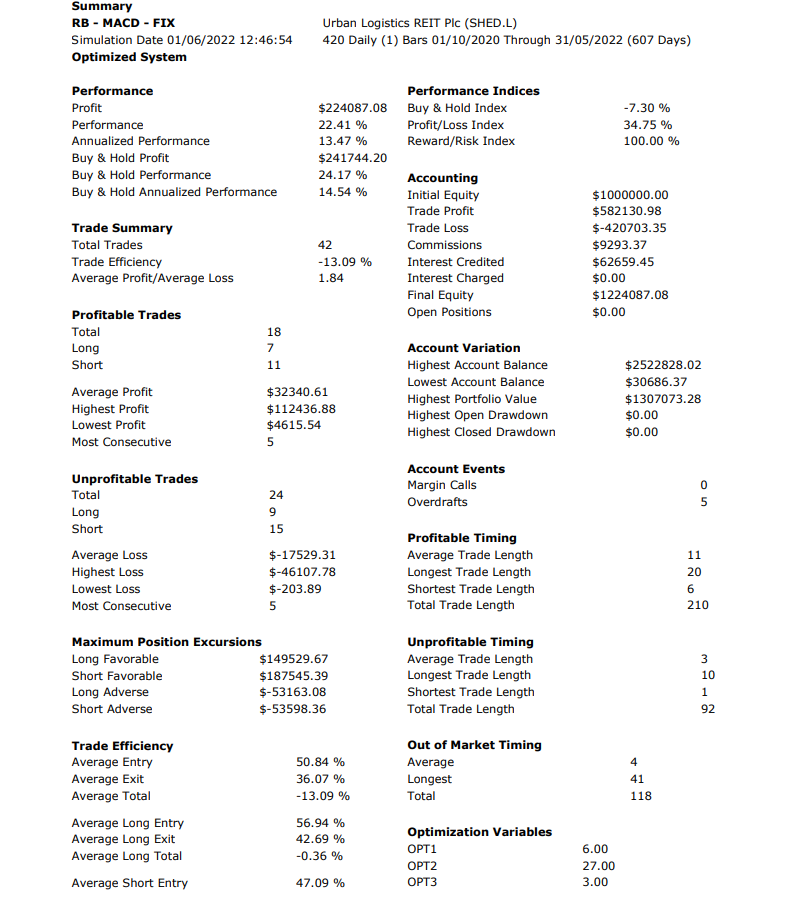

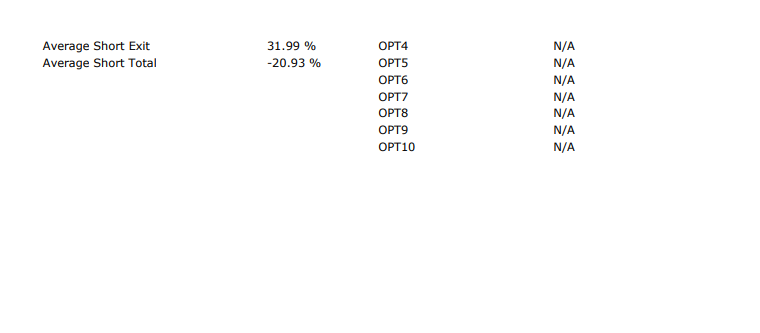

Summary Urban Logistics REIT Plc (SHED.L) RB - MACD - FIX 420 Daily (1) Bars 01/10/2020 Through 31/05/2022 (607 Days) Optimized System UnprofitableTradesTotalLongShortAverageLossHighestLossLowestLossMostConsecutive24915$17529.31$46107.78$203.895AccountEventsMarginCallsOverdraftsProfitableTimingAverageTradeLengthLongestTradeLengthShortestTradeLengthTotalTradeLength11 MaximumPositionExcursionsLongFavorableShortFavorableLongAdverseShortAdverseUnprofitableTiming$149529.67$187545.39$53163.08$53598.36AverageTradeLengthLongestTradeLengthShortestTradeLengthTotalTradeLength101 TradeEfficiencyAverageEntryAverageExitAverageTotalAverageLongEntryAverageLongExitAverageLongTotal50.84%36.07%13.09%56.94%42.69%0.36%OutofMarketTimingAverageLongestTotalOptimizationVariablesOPT1OPT24411186.0027.00 Average Short Exit 31.99%20.93%OPT4OPT5OPT6OPT7OPT8OPT9OPT10N/AN/AN/AN/AN/AN/AN/A N/A Summary Urban Logistics REIT Plc (SHED.L) RB - MACD - FIX 420 Daily (1) Bars 01/10/2020 Through 31/05/2022 (607 Days) Optimized System UnprofitableTradesTotalLongShortAverageLossHighestLossLowestLossMostConsecutive24915$17529.31$46107.78$203.895AccountEventsMarginCallsOverdraftsProfitableTimingAverageTradeLengthLongestTradeLengthShortestTradeLengthTotalTradeLength11 MaximumPositionExcursionsLongFavorableShortFavorableLongAdverseShortAdverseUnprofitableTiming$149529.67$187545.39$53163.08$53598.36AverageTradeLengthLongestTradeLengthShortestTradeLengthTotalTradeLength101 TradeEfficiencyAverageEntryAverageExitAverageTotalAverageLongEntryAverageLongExitAverageLongTotal50.84%36.07%13.09%56.94%42.69%0.36%OutofMarketTimingAverageLongestTotalOptimizationVariablesOPT1OPT24411186.0027.00 Average Short Exit 31.99%20.93%OPT4OPT5OPT6OPT7OPT8OPT9OPT10N/AN/AN/AN/AN/AN/AN/A N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts