Question: We have been requested by a large retailer to submit a bid for a new point-of-sale credit checking system. The system would be installed, by

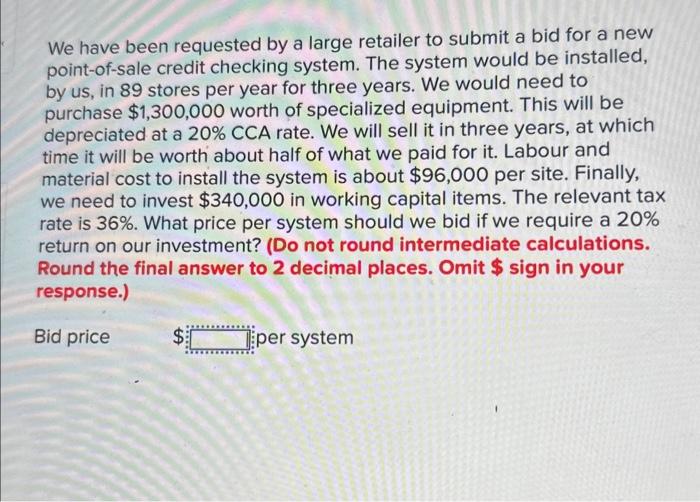

We have been requested by a large retailer to submit a bid for a new point-of-sale credit checking system. The system would be installed, by us, in 89 stores per year for three years. We would need to purchase $1,300,000 worth of specialized equipment. This will be depreciated at a 20% CCA rate. We will sell it in three years, at which time it will be worth about half of what we paid for it. Labour and material cost to install the system is about $96,000 per site. Finally, we need to invest $340,000 in working capital items. The relevant tax rate is 36%. What price per system should we bid if we require a 20% return on our investment? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Bid price $ per system We have been requested by a large retailer to submit a bid for a new point-of-sale credit checking system. The system would be installed, by us, in 89 stores per year for three years. We would need to purchase $1,300,000 worth of specialized equipment. This will be depreciated at a 20% CCA rate. We will sell it in three years, at which time it will be worth about half of what we paid for it. Labour and material cost to install the system is about $96,000 per site. Finally, we need to invest $340,000 in working capital items. The relevant tax rate is 36%. What price per system should we bid if we require a 20% return on our investment? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Bid price $ per system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts