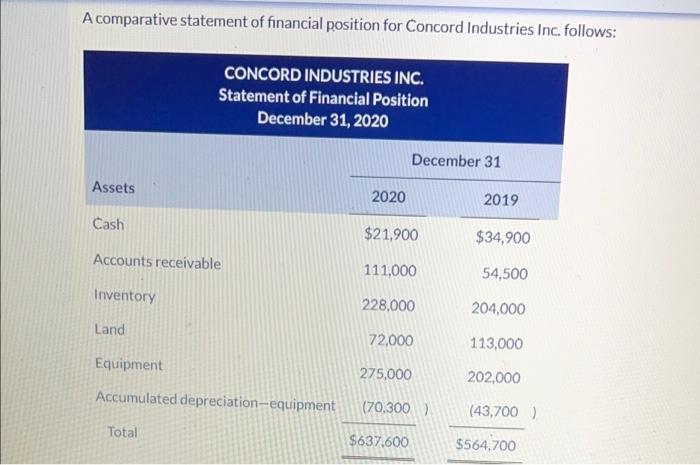

Question: we have to prepare a cash flow statement A comparative statement of financial position for Concord Industries Inc. follows: CONCORD INDUSTRIES INC. Statement of Financial

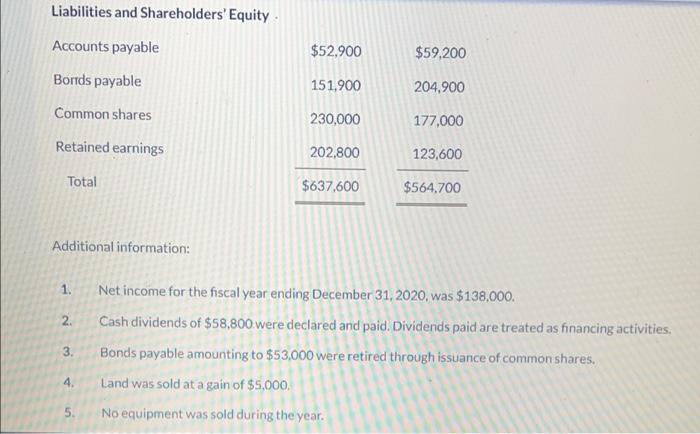

A comparative statement of financial position for Concord Industries Inc. follows: CONCORD INDUSTRIES INC. Statement of Financial Position December 31, 2020 December 31 Assets 2020 2019 Cash $21.900 $34,900 Accounts receivable 111,000 54,500 Inventory 228,000 204,000 Land 72,000 113,000 Equipment 275,000 202,000 Accumulated depreciation equipment (70,300) (43,700) Total $637,600 $564.700 Liabilities and Shareholders' Equity Accounts payable Bords payable $52,900 $59,200 151,900 204,900 Common shares 230,000 177,000 Retained earnings 202,800 123,600 Total $637,600 $564.700 Additional information: 1. 2 3. Net income for the fiscal year ending December 31, 2020, was $138,000. Cash dividends of $58,800 were declared and paid. Dividends paid are treated as financing activities. Bonds payable amounting to $53,000 were retired through issuance of common shares. Land was sold at a gain of $5,000. No equipment was sold during the year. 4. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts