Question: 5. We have two B-rated bonds, with one-year default probability at 3.5%. Suppose that the = 0.6, interest rate is 4.1%, and their default

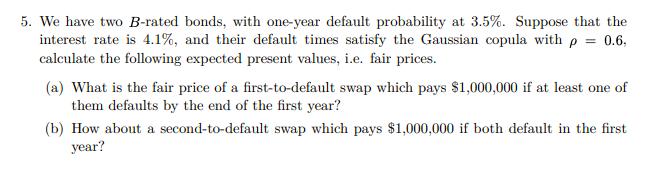

5. We have two B-rated bonds, with one-year default probability at 3.5%. Suppose that the = 0.6, interest rate is 4.1%, and their default times satisfy the Gaussian copula with p calculate the following expected present values, i.e. fair prices. (a) What is the fair price of a first-to-default swap which pays $1,000,000 if at least one of them defaults by the end of the first year? (b) How about a second-to-default swap which pays $1,000,000 if both default in the first year?

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

a what is the fair price of a first to default swap which pays 1 000 000 if at least one of ... View full answer

Get step-by-step solutions from verified subject matter experts