Question: We know that when companies evaluate a potential project, they will consider the probability of success and failure of a project. Suppose the following scenario

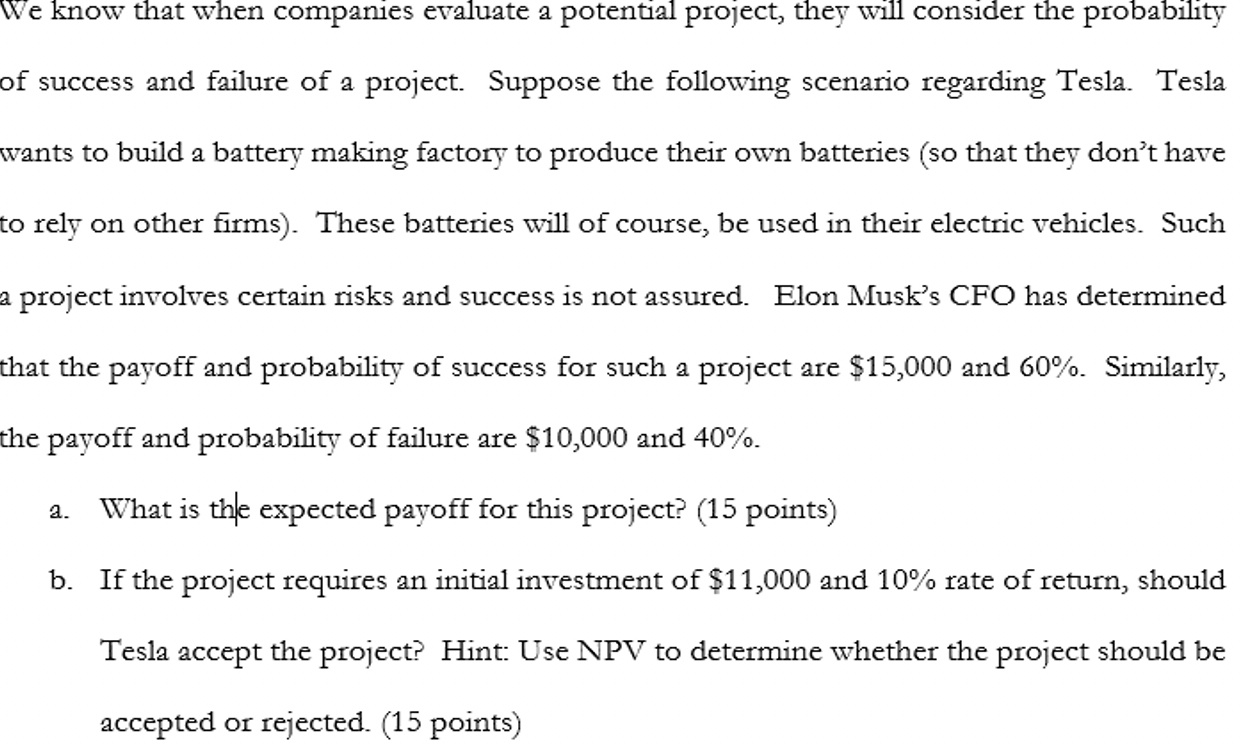

We know that when companies evaluate a potential project, they will consider the probability of success and failure of a project. Suppose the following scenario regarding Tesla. Tesla wants to build a battery making factory to produce their own batteries (so that they don't have to rely on other firms). These batteries will of course, be used in their electric vehicles. Such a project involves certain risks and success is not assured. Elon Musk's CFO has determined that the payoff and probability of success for such a project are $15,000 and 60%. Similarly, the payoff and probability of failure are $10,000 and 40%. a. What is the expected payoff for this project? (15 points) b. If the project requires an initial investment of $11,000 and 10% rate of return, should Tesla accept the project? Hint: Use NPV to determine whether the project should be accepted or rejected. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts