Question: We need to answer each A), B), C), D), etc. that is shown in the excel. I am having trouble knowing the calculations for each

We need to answer each A), B), C), D), etc. that is shown in the excel. I am having trouble knowing the calculations for each question.

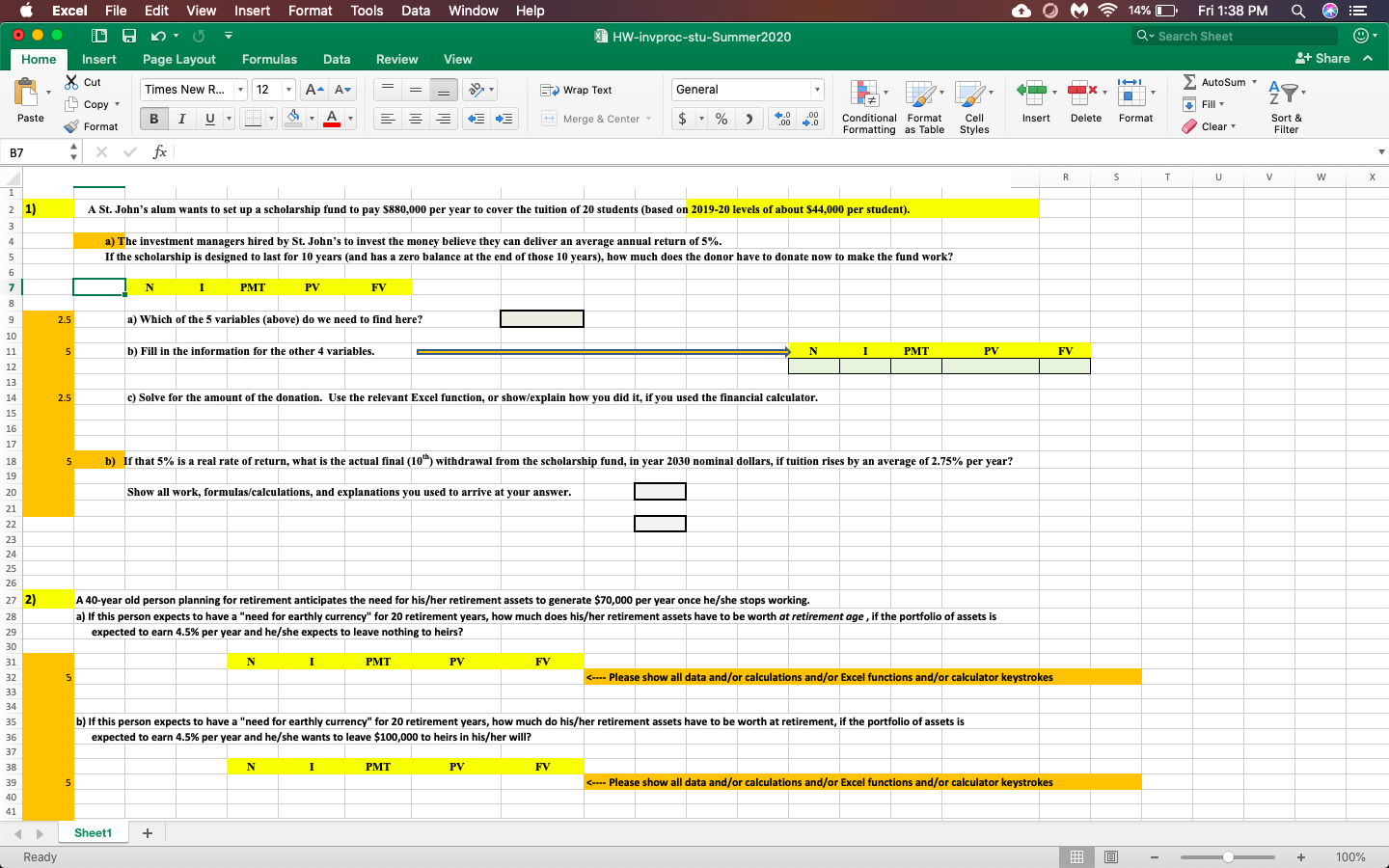

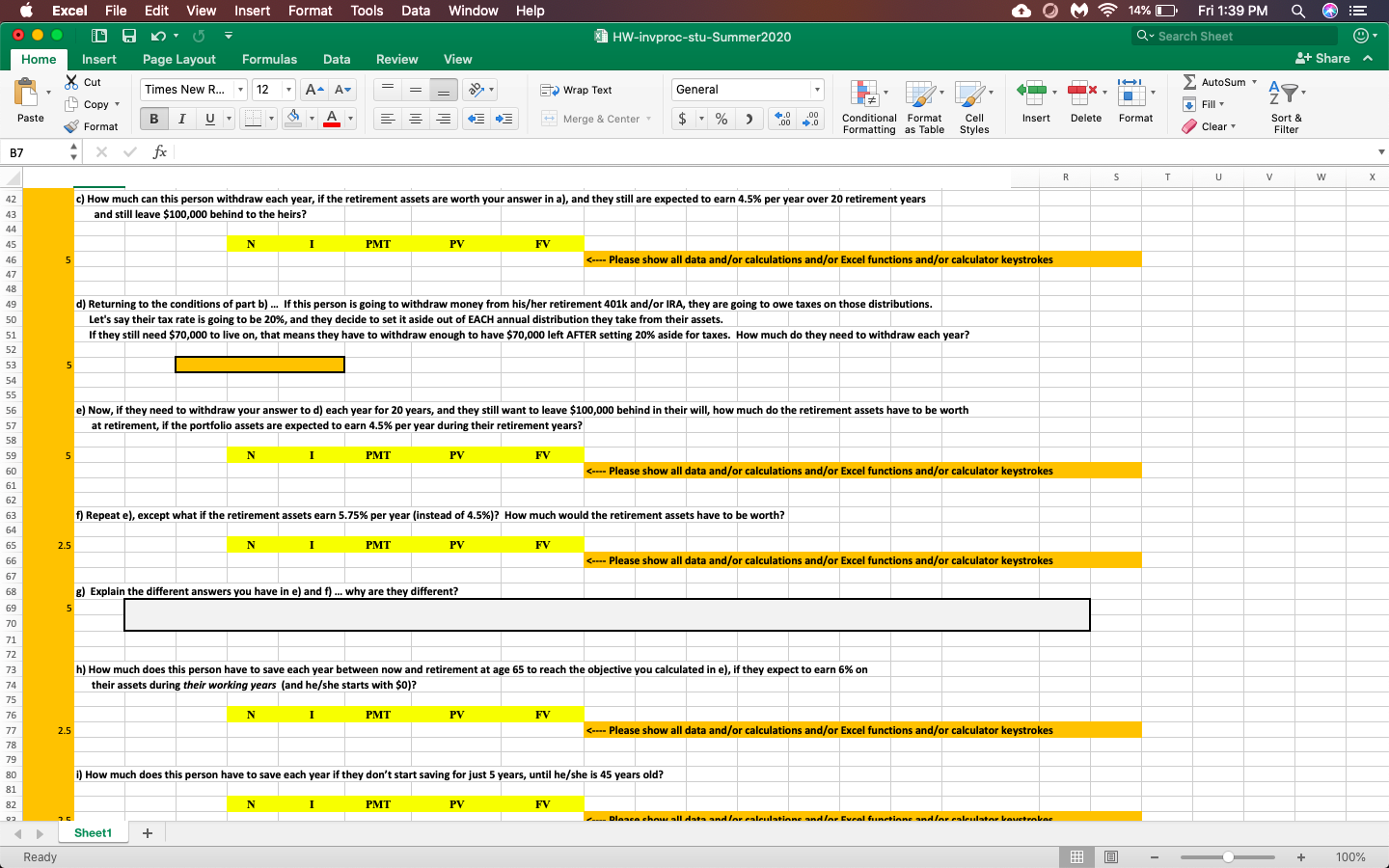

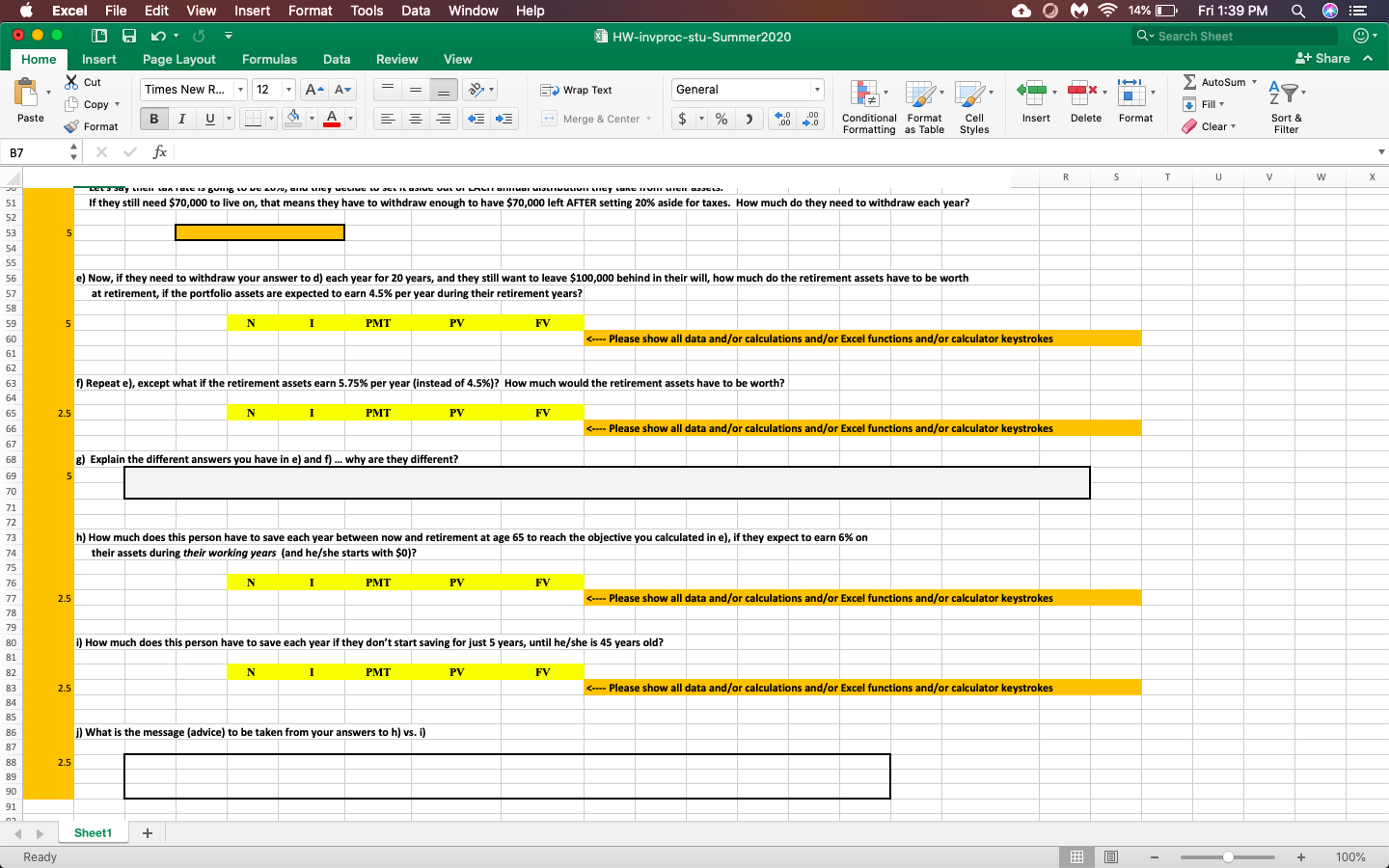

Excel File Edit View Insert Format Tools Data Window Window Help 14%O Fri 1:38 PM a L X HW-invproc-stu-Summer2020 Q Search Sheet Home Insert Page Layout Formulas Data Review View 9+ Share Cut 14! Auto Sum Times New R... 12 A- A+ Wrap Text General X 49 Copy Fill Paste BI U M T A Merge & Center $ %) 4.0 .00 .00 0 Insert Delete Format Format Conditional Format Formatting as Table Cell Styles Clear Sort & Filter B7 fx R s T U y W X 1 21) 3 A St. John's alum wants to set up a scholarship fund to pay $880,000 per year to cover the tuition of 20 students (based on 2019-20 levels of about $44,000 per student). 4 5 6 a) The investment managers hired by St. John's to invest the money believe they can deliver an average annual return of 5%. If the scholarship is designed to last for 10 years and has a zero balance at the end of those 10 years), how much does the donor have to donate now to make the fund work? N I PMT PV FV 8 9 2.5 a) Which of the 5 variables (above) do we need to find here? 10 5 b) Fill in the information for the other 4 variables. N I PMT PV FV 2.5 c) Solve for the amount of the donation. Use the relevant Excel function, or show/explain how you did it, if you used the financial calculator. 12 13 14 15 16 17 18 19 20 5 b) If that 5% is a real rate of return, what is the actual final (10) withdrawal from the scholarship fund, in year 2030 nominal dollars, if tuition rises by an average of 2.75% per year? Show all work, formulas/calculations, and explanations you used to arrive at your answer. Il 21 22 23 24 25 26 27 2) 28 A 40-year old person planning for retirement anticipates the need for his/her retirement assets to generate $70,000 per year once he/she stops working. a) If this person expects to have a "need for earthly currency" for 20 retirement years, how much does his/her retirement assets have to be worth at retirement age, if the portfolio of assets is expected to earn 4.5% per year and he/she expects to leave nothing to heirs? N I PMT PV FV 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts