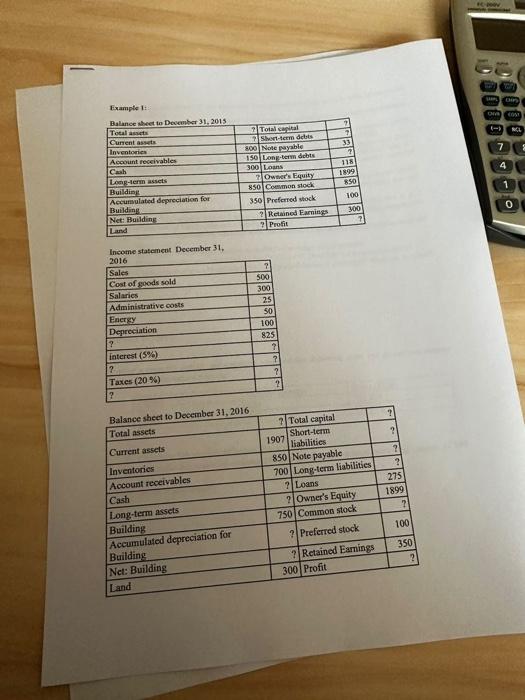

Question: we need to do this case with the informations from the tables Inceme stasemed December 31 . a) Fill question marks if you know that

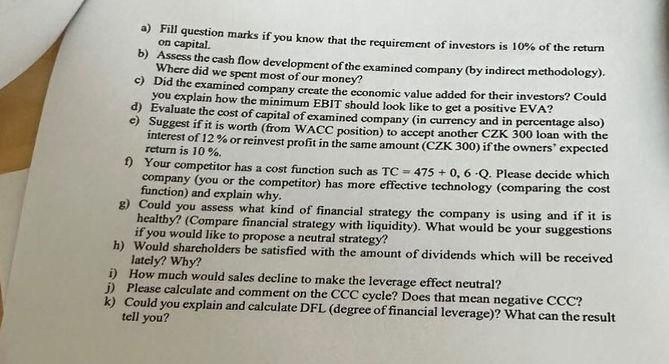

Inceme stasemed December 31 . a) Fill question marks if you know that the requirement of investors is 10% of the return on capital. b) Assess the cash flow development of the examined company (by indirect methodology). Where did we spent most of our money? c) Did the examined company create the economic value added for their investors? Could you explain how the minimum EBIT should look like to get a positive EVA? d) Evaluate the cost of capital of examined company (in currency and in percentage also) e) Suggest if it is worth (from WACC position) to accept another CZK 300 loan with the interest of 12% or reinvest profit in the same amount (CZK 300) if the owners' expected return is 10%. f) Your compctitor has a cost function such as TC=475+0,6Q. Please decide which company (you or the competitor) has more effective technology (comparing the cost function) and explain why. g) Could you assess what kind of financial strategy the company is using and if it is healthy? (Compare financial strategy with liquidity). What would be your suggestions if you would like to propose a neutral strategy? h) Would shareholders be satisfied with the amount of dividends which will be received lately? Why? i) How much would sales decline to make the leverage effect neutral? Please calculate and comment on the CCC cycle? Does that mean negative CCC? Could you explain and calculate DFL (degree of financial leverage)? What can the result tell you? Inceme stasemed December 31 . a) Fill question marks if you know that the requirement of investors is 10% of the return on capital. b) Assess the cash flow development of the examined company (by indirect methodology). Where did we spent most of our money? c) Did the examined company create the economic value added for their investors? Could you explain how the minimum EBIT should look like to get a positive EVA? d) Evaluate the cost of capital of examined company (in currency and in percentage also) e) Suggest if it is worth (from WACC position) to accept another CZK 300 loan with the interest of 12% or reinvest profit in the same amount (CZK 300) if the owners' expected return is 10%. f) Your compctitor has a cost function such as TC=475+0,6Q. Please decide which company (you or the competitor) has more effective technology (comparing the cost function) and explain why. g) Could you assess what kind of financial strategy the company is using and if it is healthy? (Compare financial strategy with liquidity). What would be your suggestions if you would like to propose a neutral strategy? h) Would shareholders be satisfied with the amount of dividends which will be received lately? Why? i) How much would sales decline to make the leverage effect neutral? Please calculate and comment on the CCC cycle? Does that mean negative CCC? Could you explain and calculate DFL (degree of financial leverage)? What can the result tell you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts