Question: we need to solve those questions. there are from different topics I have added a new image QUESTION ONE The following med information befor returns

we need to solve those questions. there are from different topics

I have added a new image

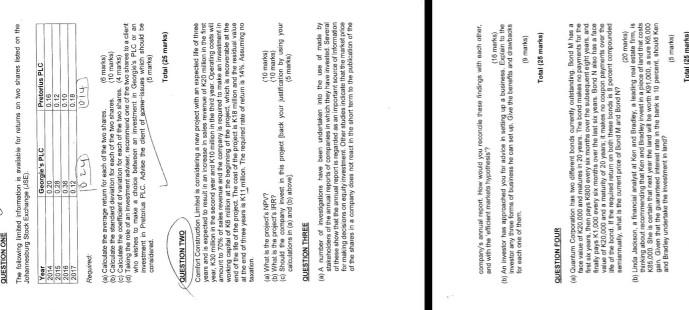

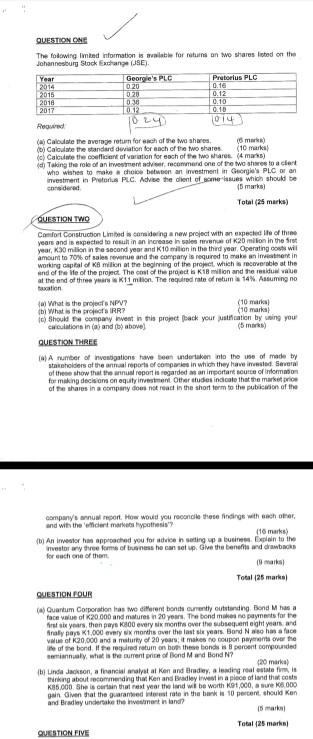

QUESTION ONE The following med information befor returns on we shares listed on the Johannesburg Stockdang (JSE). Year George's PLC Pretorius PLC 2014 0.20 0.16 2015 028 0.12 2018 0.38 0.10 2017 10-12 0.18 0 24 014 Her (a) Catulate the manage return for each of the two share (6) Calculate the standard deviation for each of the two shares 10 marka Calcune the coffint of variation for each of the two shares (4 marts Taking the role of an inement recommend one of the weshwe to a cert who wishes to make a choice between an investment in George's PLC or an investment in Pretorius PLC Advise the client of mens which should be considered 10 marks Total (25 marks) QUESTION TWO Comfort Construction Limited coming a new project with a pected He of the year and is expected to result in an este in sales tenue of 20 million in the first year, 30 million in the second year and 10 milion in the third year. Operating costs wil amount to 70% of sales revenue and the company is required to make an inentin working capital of 6 milion at the beginning of the promit Which recoverable at the end of treife of the project. The cost of the project is ki milion and the rest value at the end of three year 11 milion. The required rate of return 14%. Assuming no ation What is the grow NPV? (10 m What there IRRY Should recomay invest in this propietack your cation by using you calculations in (a) and (b) abovej (5mark) QUESTION THREE Autofnvestigatione have been undertaken into the use of made by stakeholdere al reports of companies in which they had several all these show that the report is regarded an important. Information for making decision on equity investment Other studies indicate that the marketi of the shares in a company does not react in the short term to the pion of the 10 mare company's annual report. How would you reconde hands with each other, and with the interpress 116 mars In An livestor approached you for advice in lingua i Bolintu te vasto any form of business hotel Give the benefits and drawbacks for each one of them Total (26 marks QUESTION FOUR (Quartum Corporation has two different bonds currently sing Bond Mha face of K20 000 and matures in 20 years. The band mes no payments for the Okyears, then pays K00 every month over the womaght years, and Analy pays K1,000 overy six months over the years. Bord N has a face www of K20,000 and a mully of 20 years, there coupon payments over the te of the bond leered return on both the band percent compounded Semily, what is the current price of Bond Mand Blond N? (20 mars bi na Jackson, a financial Analyst al ken and Bradey, ang malam, Waking about commending that en andey Invest in pece of land the costs K186.000 She is certain that restare and will be worth 1.000, a wreKA 000 gainen that the barried wererate in the bank 10 percent should Ken and Bradley undertake the women in land? in maki Totalmol and QUESTION ONE The following med information is wailable for returns on to shares listed on the Johannesburg Stock Exchange (JSE). Year George's PLC Pretorius PLC 2014 020 0.16 2015 020 0.12 2010 038 0.10 2017 TOK2 0.16 1024 014 Rooww (al Calculate the average return for sich of the two share ma) (O) Calculate the standard deviation for each of the two shares (10 marka Io Calculate the efficient of variation for each of the others. (4 marks) Taking the role of an womentar recommand one of the two shwe to a cert who wishes to make a choice to an investment in George's PLC or an investment in Pretorius PLC. Advibe the dient of some which should be ondered (5 mars Total (26 marks) QUESTION TWO Comfort Construction Limited or doing a new project with an expected ite of the years and is expected to result in an increase in sales of 20 milion in the first year, Ko milion in the second year and 10 million in the thed your Operating chwil amount to 70% of sales revenue and the company is requred to make an imtin project wich is recoverable at the at the end of three year 11 million. The required rate ofretum 14%. Assuming no taxation What is the projects NPV? (10 mars bi What is the IRRY (10 mars Should the company invest in this project back your unication by wing you cwculations in (a) and above (5) QUESTION THREE A number of ventigations have been undertaken to the use of made ty stakeholders of the annual reports of companies in which they have investeeri of the show that the wins report is regarded as an important of information for making decision on equity in other studies indicate that the market price of the shares in a company does not read in the short term to the publication of the company ant How would you reconcile these findings with each other and will the war marketypothesis 110 mars () An investor approached you for which wiling pa bi se to the strany vekom obness he can set Give the benefit and drawbacks for each one of them mais! Total 25 marka QUESTION POUR (4) Quartum Corporation has two different bon rently outstanding Bond Ma face value of 20000 and matures in 20 years. The band makes no payments for first six years then pays K00 every six month over the subsequenight years, and final para 1.000 evry wx months over the last years. Bord No him a face Www of K20,000 and a matury of 20 years, makes to support over the e of the bond if ever return on the band is parent compounded ly, what is the current print of Bond Mand Blond N? (20 mark Linda Jackson, Financial Analyst at Ken and Bradley, a leading real estatem thinking about recommending the Ken and lady invest in a place of land that could K36.000 She is curtain the rest year the land i be worth $1,000, a sve 8.000 Dun Given that the guaranteed role in the banks 10 percent should kan and Bradley undertake the mentinand Total 25 martin QUESTION FIVE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts