Question: We observe two random variables: D takes value 1 if a portfolio of corporate bonds does not default within a year and zero if it

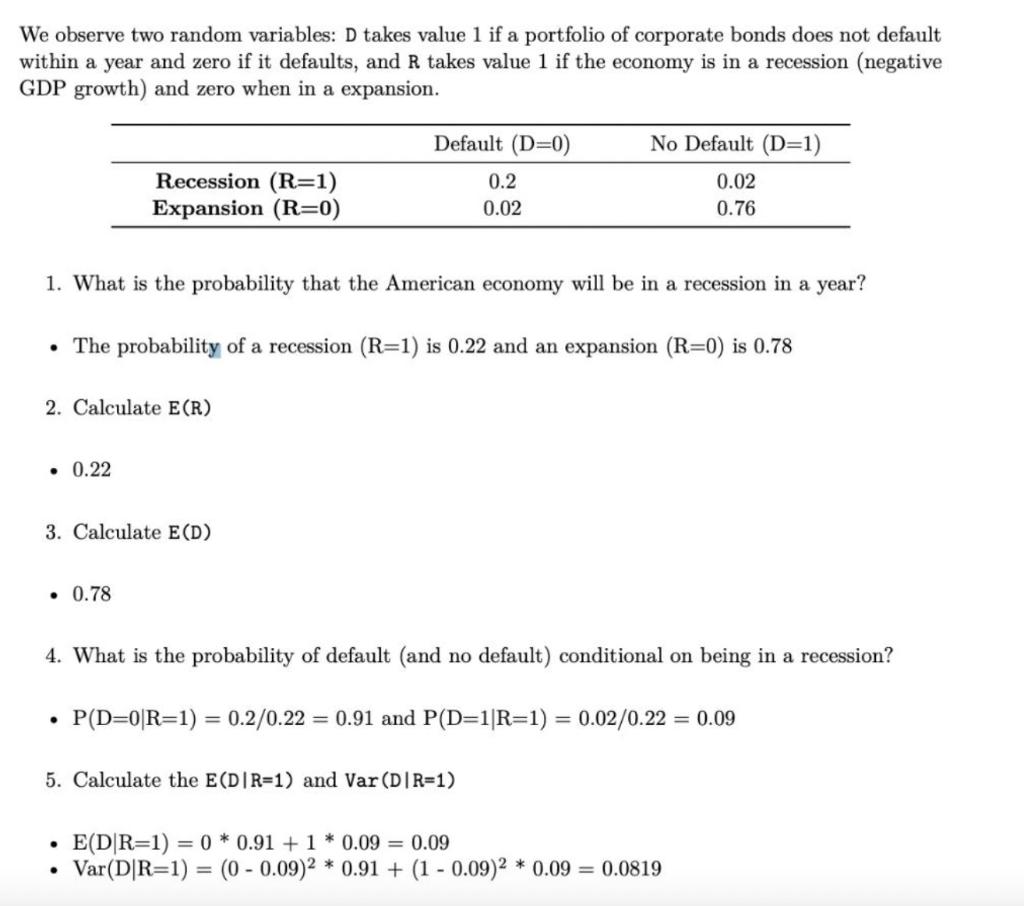

We observe two random variables: D takes value 1 if a portfolio of corporate bonds does not default within a year and zero if it defaults, and R takes value 1 if the economy is in a recession (negative GDP growth) and zero when in a expansion. Default (D=0) No Default (D=1) Recession (R=1) Expansion (R=0) 0.2 0.02 0.02 0.76 1. What is the probability that the American economy will be in a recession in a year? The probability of a recession (R=1) is 0.22 and an expansion (R=0) is 0.78 2. Calculate E(R) 0.22 3. Calculate E(D) 0.78 4. What is the probability of default (and no default) conditional on being in a recession? . P(D=0R=1) 0.270.22 = 0.91 and P(D=1/R=1) = 0.02/0.22 = 0.09 5. Calculate the E(DIR=1) and Var (DIR=1) E(D R=1) = 0 * 0.91 +1 * 0.09 = 0.09 Var(D/R=1) = (0 - 0.09)2 * 0.91 + (1 - 0.09)2 * 0.09 = 0.0819 . We observe two random variables: D takes value 1 if a portfolio of corporate bonds does not default within a year and zero if it defaults, and R takes value 1 if the economy is in a recession (negative GDP growth) and zero when in a expansion. Default (D=0) No Default (D=1) Recession (R=1) Expansion (R=0) 0.2 0.02 0.02 0.76 1. What is the probability that the American economy will be in a recession in a year? The probability of a recession (R=1) is 0.22 and an expansion (R=0) is 0.78 2. Calculate E(R) 0.22 3. Calculate E(D) 0.78 4. What is the probability of default (and no default) conditional on being in a recession? . P(D=0R=1) 0.270.22 = 0.91 and P(D=1/R=1) = 0.02/0.22 = 0.09 5. Calculate the E(DIR=1) and Var (DIR=1) E(D R=1) = 0 * 0.91 +1 * 0.09 = 0.09 Var(D/R=1) = (0 - 0.09)2 * 0.91 + (1 - 0.09)2 * 0.09 = 0.0819

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts