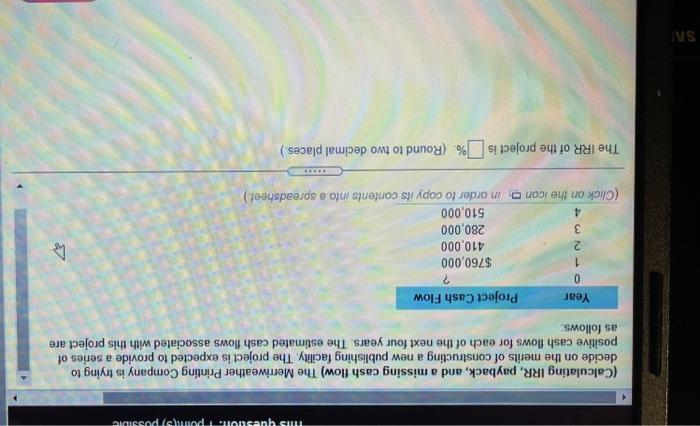

Question: . We questo pomposto (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing

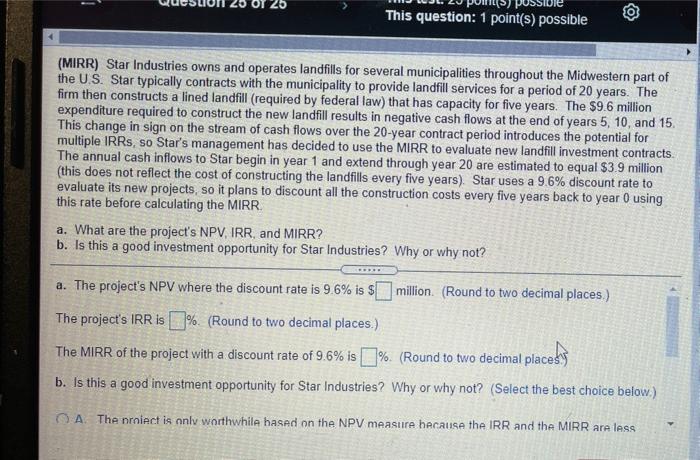

. We questo pomposto (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year Project Cash Flow 0 ? 1 $760,000 2 410,000 3 280,000 4 510,000 (Click on the icon in order to copy its contents into a spreadsheet.) i The IRR of the project is % (Round to two decimal places.) SA OT 26 STORE This question: 1 point(s) possible (MIRR) Star Industries owns and operates landfills for several municipalities throughout the Midwestern part of the U.S. Star typically contracts with the municipality to provide landfill services for a period of 20 years. The firm then constructs a lined landfill (required by federal law) that has capacity for five years. The $9.6 million expenditure required to construct the new landfill results in negative cash flows at the end of years 5, 10, and 15. This change in sign on the stream of cash flows over the 20-year contract period introduces the potential for multiple IRRs, so Star's management has decided to use the MIRR to evaluate new landfill investment contracts. The annual cash inflows to Star begin in year 1 and extend through year 20 are estimated to equal $3.9 million (this does not reflect the cost of constructing the landfills every five years). Star uses a 9.6% discount rate to evaluate its new projects, so it plans to discount all the construction costs every five years back to year 0 using this rate before calculating the MIRR. a. What are the project's NPV, IRR, and MIRR? b. Is this a good investment opportunity for Star Industries? Why or why not? a. The project's NPV where the discount rate is 9.6% is $ million (Round to two decimal places) The project's IRR is % (Round to two decimal places.) The MIRR of the project with a discount rate of 9.6% is 0% (Round to two decimal placety b. Is this a good investment opportunity for Star Industries? Why or why not? (Select the best choice below.) A. The proiect is only worthwhile based on the NPV measure because the IRR and the MIRR are less . We questo pomposto (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year Project Cash Flow 0 ? 1 $760,000 2 410,000 3 280,000 4 510,000 (Click on the icon in order to copy its contents into a spreadsheet.) i The IRR of the project is % (Round to two decimal places.) SA OT 26 STORE This question: 1 point(s) possible (MIRR) Star Industries owns and operates landfills for several municipalities throughout the Midwestern part of the U.S. Star typically contracts with the municipality to provide landfill services for a period of 20 years. The firm then constructs a lined landfill (required by federal law) that has capacity for five years. The $9.6 million expenditure required to construct the new landfill results in negative cash flows at the end of years 5, 10, and 15. This change in sign on the stream of cash flows over the 20-year contract period introduces the potential for multiple IRRs, so Star's management has decided to use the MIRR to evaluate new landfill investment contracts. The annual cash inflows to Star begin in year 1 and extend through year 20 are estimated to equal $3.9 million (this does not reflect the cost of constructing the landfills every five years). Star uses a 9.6% discount rate to evaluate its new projects, so it plans to discount all the construction costs every five years back to year 0 using this rate before calculating the MIRR. a. What are the project's NPV, IRR, and MIRR? b. Is this a good investment opportunity for Star Industries? Why or why not? a. The project's NPV where the discount rate is 9.6% is $ million (Round to two decimal places) The project's IRR is % (Round to two decimal places.) The MIRR of the project with a discount rate of 9.6% is 0% (Round to two decimal placety b. Is this a good investment opportunity for Star Industries? Why or why not? (Select the best choice below.) A. The proiect is only worthwhile based on the NPV measure because the IRR and the MIRR are less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts