Question: We start with the same scenario. Matt is a real estate developer and owns a strip mall in Canton, MI. The property recently appraised and

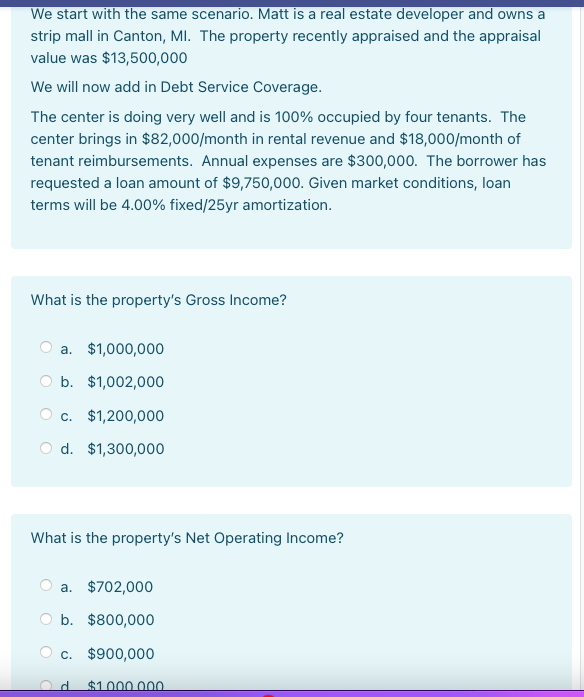

We start with the same scenario. Matt is a real estate developer and owns a strip mall in Canton, MI. The property recently appraised and the appraisal value was $13,500,000 We will now add in Debt Service Coverage. The center is doing very well and is 100% occupied by four tenants. The center brings in $82,000/month in rental revenue and $18,000/month of tenant reimbursements. Annual expenses are $300,000. The borrower has requested a loan amount of $9,750,000. Given market conditions, loan terms will be 4.00% fixed/25yr amortization. What is the property's Gross Income? a. $1,000,000 b. $1,002,000 O c. $1,200,000 Od $1,300,000 What is the property's Net Operating Income? a. $702,000 b. $800,000 O c. $900,000 $1.000.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts