Question: We Time left 2:54:5 Part Two: (27 points) Exercise 1(7 points) In your internship, the financial manager of ABC firm, specialized in production and commercialization

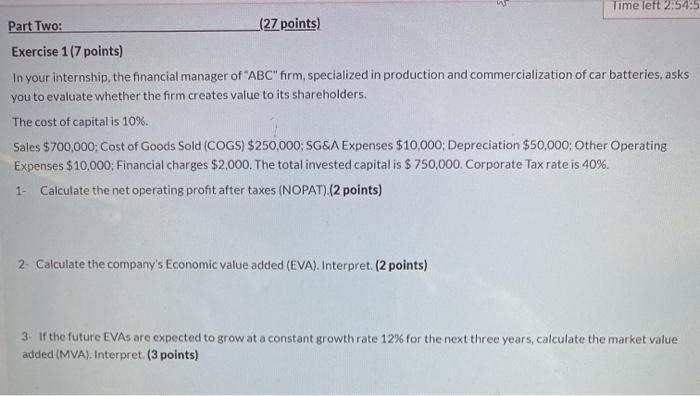

We Time left 2:54:5 Part Two: (27 points) Exercise 1(7 points) In your internship, the financial manager of "ABC" firm, specialized in production and commercialization of car batteries, asks you to evaluate whether the firm creates value to its shareholders. The cost of capital is 10%. Sales $700,000; Cost of Goods Sold (COGS) $250,000; SG&A Expenses $10,000; Depreciation $50,000; Other Operating Expenses $10,000; Financial charges $2,000. The total invested capital is $ 750,000. Corporate Tax rate is 40%. 1- Calculate the net operating profit after taxes (NOPAT).(2 points) 2- Calculate the company's Economic value added (EVA). Interpret. (2 points) 3. If the future EVAs are expected to grow at a constant growth rate 12% for the next three years, calculate the market value added (MVA). Interpret. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts