Question: We use the Jensen's alpha analysis evaluate if a mutual fund manager outperform or underperform than the market expected. If the alpha of the fund

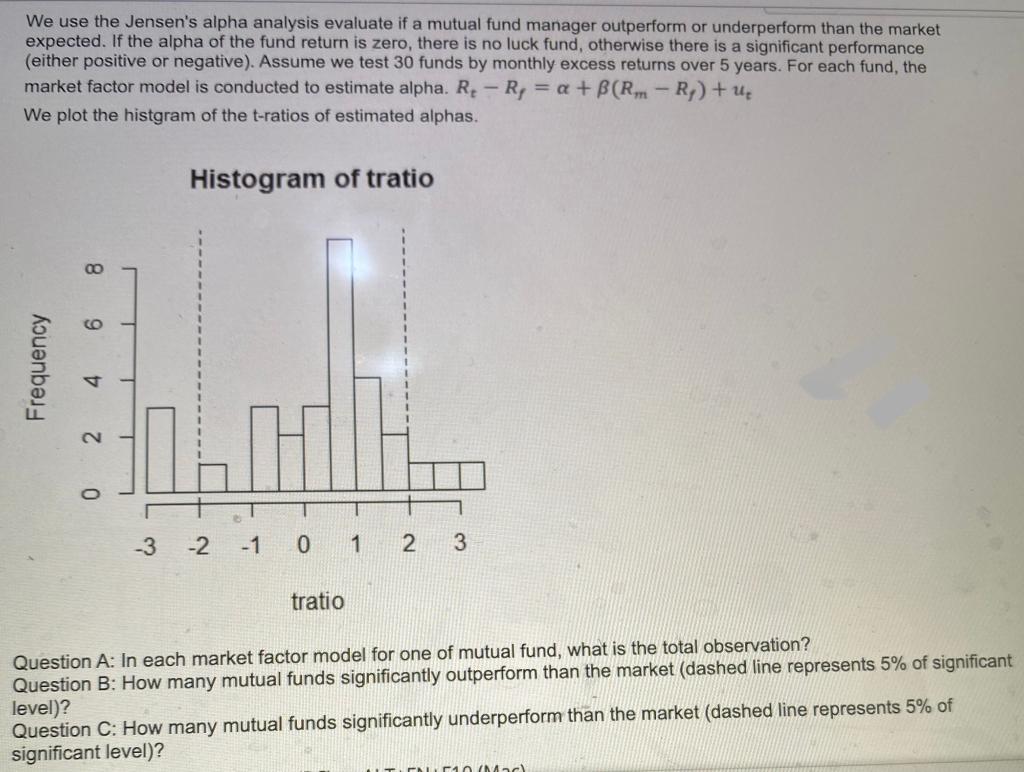

We use the Jensen's alpha analysis evaluate if a mutual fund manager outperform or underperform than the market expected. If the alpha of the fund return is zero, there is no luck fund, otherwise there is a significant performance (either positive or negative). Assume we test 30 funds by monthly excess returns over 5 years. For each fund, the market factor model is conducted to estimate alpha. R: - R = a + b (RM-R,) + ut We plot the histgram of the t-ratios of estimated alphas. Histogram of tratio 8 9 Frequency 2 0 -3 -2 -1 0 1 2 3 tratio Question A: In each market factor model for one of mutual fund, what is the total observation? Question B: How many mutual funds significantly outperform than the market (dashed line represents 5% of significant level)? Question C: How many mutual funds significantly underperform than the market (dashed line represents 5% of significant level)? 10 Mac We use the Jensen's alpha analysis evaluate if a mutual fund manager outperform or underperform than the market expected. If the alpha of the fund return is zero, there is no luck fund, otherwise there is a significant performance (either positive or negative). Assume we test 30 funds by monthly excess returns over 5 years. For each fund, the market factor model is conducted to estimate alpha. R: - R = a + b (RM-R,) + ut We plot the histgram of the t-ratios of estimated alphas. Histogram of tratio 8 9 Frequency 2 0 -3 -2 -1 0 1 2 3 tratio Question A: In each market factor model for one of mutual fund, what is the total observation? Question B: How many mutual funds significantly outperform than the market (dashed line represents 5% of significant level)? Question C: How many mutual funds significantly underperform than the market (dashed line represents 5% of significant level)? 10 Mac

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts