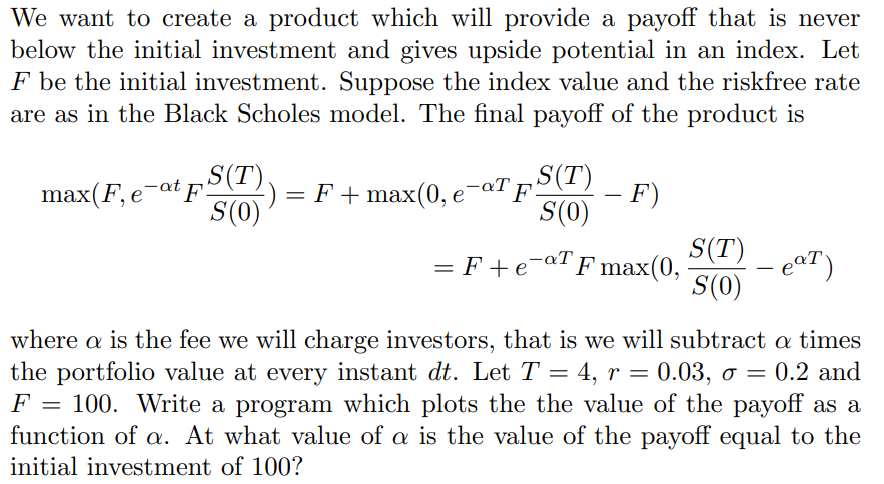

Question: We want to create a product which will provide a payoff that is never below the initial investment and gives upside potential in an index.

We want to create a product which will provide a payoff that is never below the initial investment and gives upside potential in an index. Let F be the initial investment. Suppose the index value and the riskfree rate are as in the Black Scholes model. The final payoff of the product is max(F, e-at FS(T) S(0) S(T) = F + max(0, e-aTF F) S(0) S(T) F+e-al F max(0, S(0) at eaT) . where a is the fee we will charge investors, that is we will subtract a times the portfolio value at every instant dt. Let T = 4, r = = 0.03, o = 0.2 and F F = 100. Write a program which plots the the value of the payoff as a function of a. At what value of a is the value of the payoff equal to the initial investment of 100? We want to create a product which will provide a payoff that is never below the initial investment and gives upside potential in an index. Let F be the initial investment. Suppose the index value and the riskfree rate are as in the Black Scholes model. The final payoff of the product is max(F, e-at FS(T) S(0) S(T) = F + max(0, e-aTF F) S(0) S(T) F+e-al F max(0, S(0) at eaT) . where a is the fee we will charge investors, that is we will subtract a times the portfolio value at every instant dt. Let T = 4, r = = 0.03, o = 0.2 and F F = 100. Write a program which plots the the value of the payoff as a function of a. At what value of a is the value of the payoff equal to the initial investment of 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts