Question: We will conduct this assignment in class. Please consider the questions below and come to class ready to analyze these questions. Beta for a firm

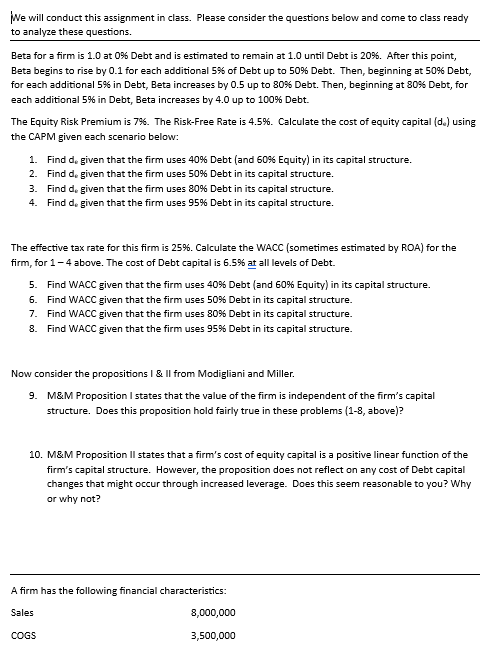

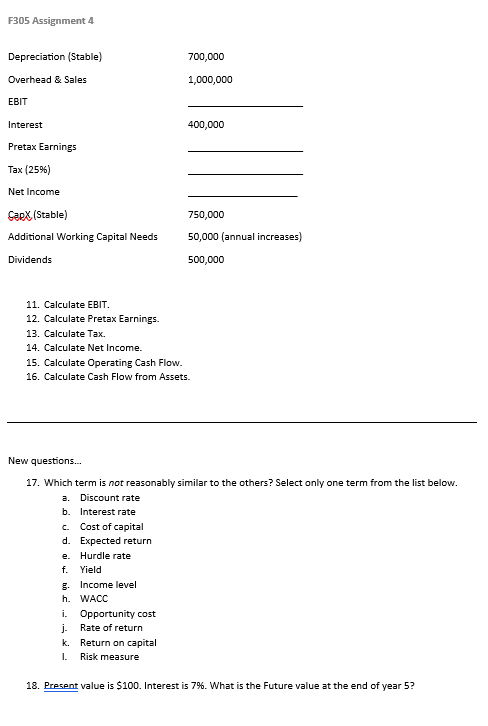

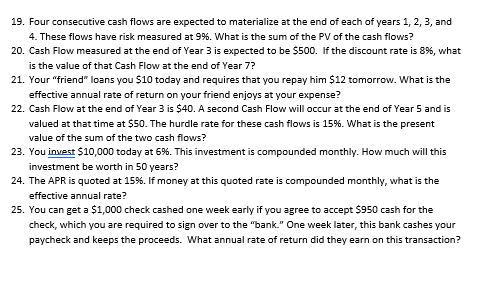

We will conduct this assignment in class. Please consider the questions below and come to class ready to analyze these questions. Beta for a firm is 1.0 at 0% Debt and is estimated to remain at 1.0 until Debt is 20%. After this point, Beta begins to rise by 0.1 for each additional 5% of Debt up to 50% Debt. Then, beginning at 50% Debt, for each additional 5% in Debt, Beta increases by 0.5 up to 80% Debt. Then, beginning at 80% Debt, for each additional 5% in Debt, Beta increases by 4.0 up to 100% Debt. The Equity Risk Premium is 7\%. The Risk-Free Rate is 4.5%. Calculate the cost of equity capital (d de) using the CAPM given each scenario below: 1. Find de given that the firm uses 40% Debt (and 60% Equity) in its capital structure. 2. Find de given that the firm uses 50% Debt in its capital structure. 3. Find d given that the firm uses 80% Debt in its capital structure. 4. Find d given that the firm uses 95% Debt in its capital structure. The effective tax rate for this firm is 25%. Calculate the WACC (sometimes estimated by ROA) for the firm, for 14 above. The cost of Debt capital is 6.5% at all levels of Debt. 5. Find WACC given that the firm uses 40% Debt (and 60% Equity) in its capital structure. 6. Find WACC given that the firm uses 50% Debt in its capital structure. 7. Find WACC given that the firm uses 80% Debt in its capital structure. 8. Find WACC given that the firm uses 95% Debt in its capital structure. Now consider the propositions I \& II from Modigliani and Miller. 9. M\&M Proposition I states that the value of the firm is independent of the firm's capital structure. Does this proposition hold fairly true in these problems (1-8, above)? 10. M\&M Proposition II states that a firm's cost of equity capital is a positive linear function of the firm's capital structure. However, the proposition does not reflect on any cost of Debt capital changes that might occur through increased leverage. Does this seem reasonable to you? Why or why not? A firm has the following financial characteristics: New questions... 17. Which term is not reasonably similar to the others? Select only one term from the list below. a. Discount rate b. Interest rate c. Cost of capital d. Expected return e. Hurdle rate f. Yield g. Income level h. WACC i. Opportunity cost j. Rate of return k. Return on capital I. Risk measure 18. Present value is $100. Interest is 7%. What is the Future value at the end of year 5 ? 19. Four consecutive cash flows are expected to materialize at the end of each of years 1,2,3, and 4. These flows have risk measured at 9%. What is the sum of the PV of the cash flows? 20. Cash Flow measured at the end of Year 3 is expected to be $500. If the discount rate is 8%, what is the value of that Cash Flow at the end of Year 7 ? 21. Your "friend" loans you $10 today and requires that you repay him $12 tomorrow. What is the effective annual rate of return on your friend enjoys at your expense? 22. Cash Flow at the end of Year 3 is $40. A second Cash Flow will occur at the end of Year 5 and is valued at that time at $50. The hurdle rate for these cash flows is 15%. What is the present value of the sum of the two cash flows? 23. You invest $10,000 today at 6%. This investment is compounded monthly. How much will this investment be worth in 50 years? 24. The APR is quoted at 15%. If money at this quoted rate is compounded monthly, what is the effective annual rate? 25. You can get a $1,000 check cashed one week early if you agree to accept $950 cash for the check, which you are required to sign over to the "bank." One week later, this bank cashes your paycheck and keeps the proceeds. What annual rate of return did they earn on this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts