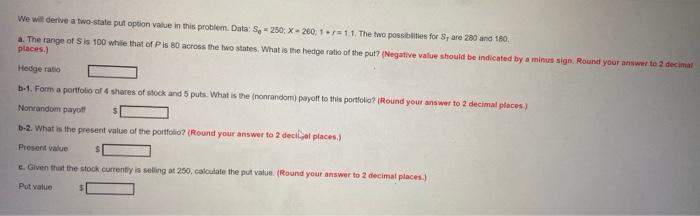

Question: We will derive a two-state put option value in this problem. Data: S-250 X 200 1.15 1.1. The two possibilities for Sy are 280 and

We will derive a two-state put option value in this problem. Data: S-250 X 200 1.15 1.1. The two possibilities for Sy are 280 and 180 a. The range of Sis 100 while that of Pis 80 across the two states. What is the hedge ratio of the pat? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Hedge ratio b-1. Forma portfolio of 4 shares of stock and 5 puts. What is the nonrandom) payoff to this portfolio? (Round your answer to 2 decimal places) Nonrandom payoff 6.2. What is the present value of the portfolio? (Round your answer to 2 decilijat places) Present value e. Given that the stock currently is selling at 250, calculate the pot value. (Round your answer to 2 decimal places. Put value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts