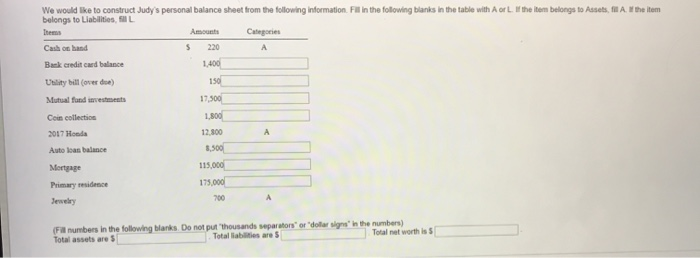

Question: We would like to construct Judy's personal balance sheet from the following information. Fill in the following blanks in the table with A or L.

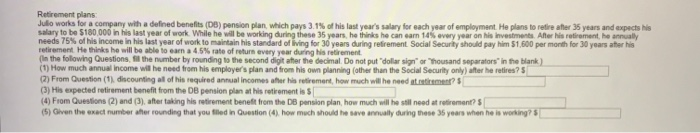

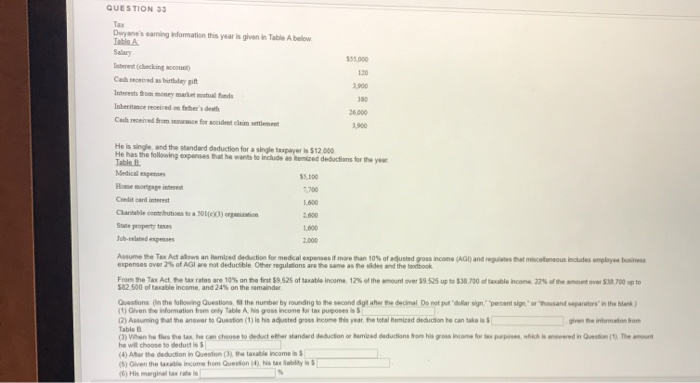

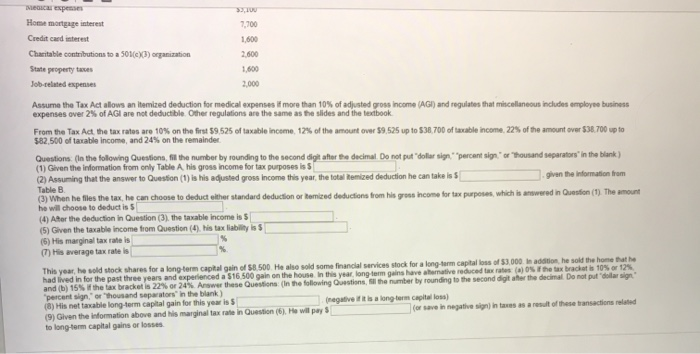

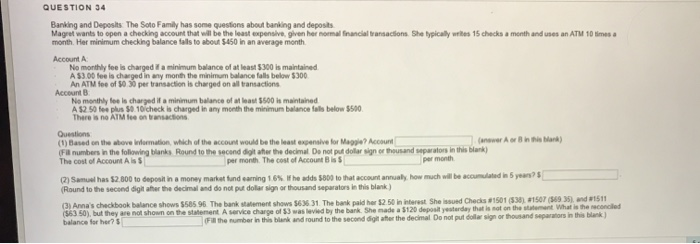

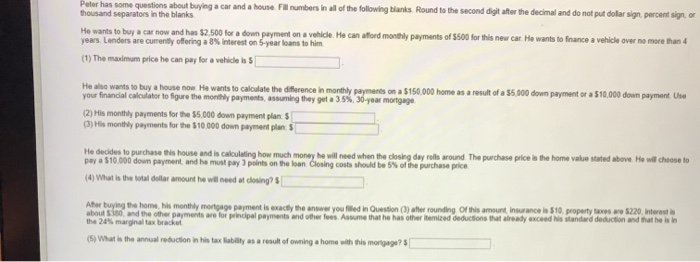

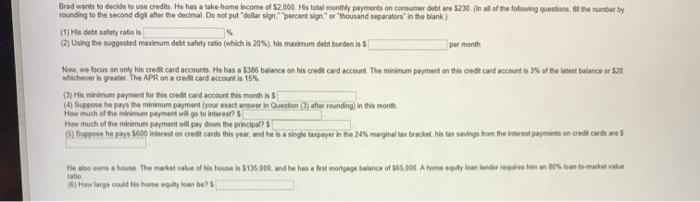

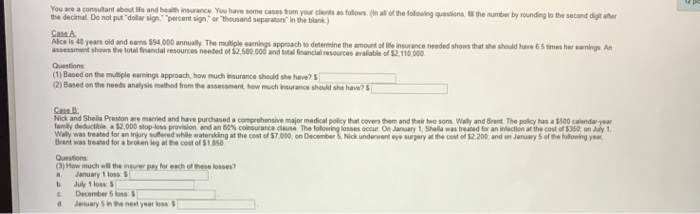

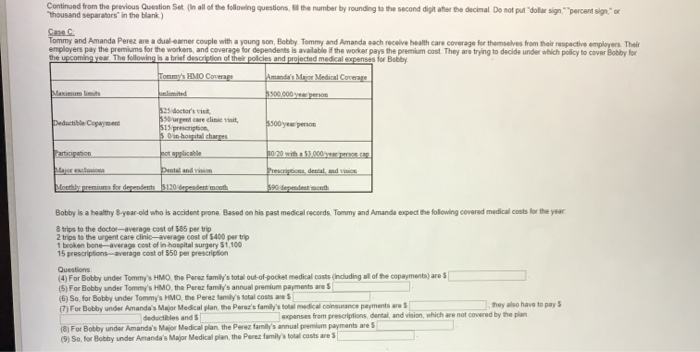

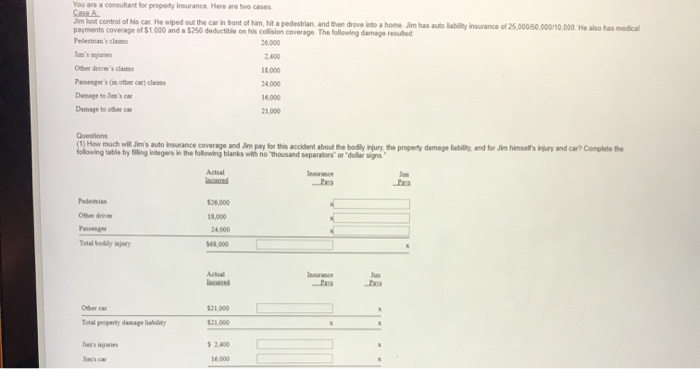

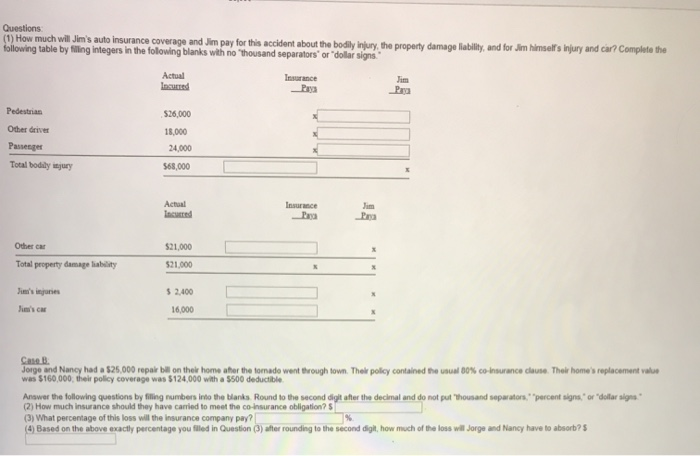

We would like to construct Judy's personal balance sheet from the following information. Fill in the following blanks in the table with A or L. If the item belongs to Assets, fl. ll the item belongs to Liabilities, SL Item Amounts Categories Cash on hand $ 220 Back credit card balance 1.400 Utility bill (overde) 150 Mutual fund investments 17,500 Coin collection 1.800 2017 Honda 12.800 Auto load balance 8.500 Mortgage 115.000 Primary residence 175.000 Jewelry 700 A (Fil numbers in the following blanks. Do not put thousands separators" or "dollar signs in the numbers) Total assets are $ Total abilities are Total net worth is 5 Retirement plans Jullo works for a company with a defined benefits (DB) pension plan, which pays 3.1% of his last year's salary for each year of employment. He plans to retire after 35 years and expects his salary to be 5180,000 in his last year of work. While he will be working during these 35 years, he thinks he can earn 145 every year on his Investments. After his retirement, he annually needs 75% of his income in his last year of work to maintain his standard of living for 30 years during retirement Social Security should pay him 51,500 per month for 30 years after his retirement He thinks he will be able to cam a 4.5% rate of return every year during his retirement In the following Questions, the number by rounding to the second digit atter the decimal. Do not put dollar sig" or "housand separators in the blank) (1) How much annual income will he need from his employer's plan and from his own planning (other than the Social Security only after he retires? (2) From Question (1) discounting all of his required annual incomes after his retirement, how much will he need time? (3) His expected retirement benefit from the DB pension plan at his retirement is (4) From Questions (2) and (3), after taking his retirement benefit from the DB pension plan, how much will he still need at retirement? (5) Given the exact number after rounding that you filled in Question (4) how much should he save annually during these 35 years when he is working? QUESTION 33 Tax Dwyane's caming Information this year is given in Table A below Tatie A Salary Cashmonived as birthday in Interests throm money matt funde Inheritance father's death Cash received from www.ce for de chimie $55.000 120 3.900 330 26.000 3.900 He is single, and the standard deduction for a single taxpayer la $12.000 He has the following expenses that he wants to Indude as temized deductions for the year Table Medical expens Home more interest Condit and interest 1.600 Charitable contributions to a 501) State property taxes 1.600 Tubades Assume the Tax Act allows an embed eduction for medical expenses it more than 10% of adjusted gross income (AGI) andrea scelaneous Includes employee business expenses over 2 of GI are not deductible Other regulations are the same as the sides and the book From the Tax Act the tax rates are 10% on the first $9.525 of taxable income, 12% of the amount over 59.525 up to 530 700 of taxable income 22% of the amount over 700 up to 582.500 of taxable income, and 24% on the remainder Questions in the following Questions, the number by rounding to the second dig aller the decimal. Do not put dolor in percent in or Thousand separators in the blank) (1) Given the information from only Table A his gross income for purposes 2) Assuming that the answer to Question (1) is his adjusted gross income this year, the total temized deduction he can take is Table ) When he fleste tax, he can choose to deduct other standard deduction or med deductions from his gross income for tax purposes, which is werd in Question (1) The amount he will choose to deductis (1) Ater the deduction in Question (3) the taxable income (5) Given the income from Question (4) History Mealexper 2,100 Home mortgage interest 7,700 Credit card interest 1,600 Charitable contributions to a 501(c)(3) organization 2.600 State property taxes Job-related expenses 2,000 Assume the Tax Act allows an itemized deduction for medical expenses if more than 10% of adjusted gross income (AGI) and regulates that miscellaneous includes employee business expenses over 2% of AGI are not deductible Other regulations are the same as the slides and the textbook From the Tax Act, the tax ratos are 10% on the first 59,525 of taxable income, 12% of the amount over 59,525 up to 538,700 of taxable income, 22% of the amount over $38.700 up to 582.500 of taxable income, and 24% on the remainder Questions. In the following Questions, fl the number by rounding to the second digit after the decimal. Do not put "dollar sign." "percent sign, " or "Thousand separators" in the blank) (1) Given the information from only Table A his gross income for tax purposes is (2) Assuming that the answer to Question (1) is his adjusted gross income this year, the total emized deduction he can take is given the information from Table B (3) When he files the tax he can choose to deduct other standard deduction or homized deductions from his grus ncome for tax purposes, which is answered in Question (1) The amount ho will choose to deductis 5 (4) Ater the deduction in Question (3) the taxable income is 5 (5) Given the taxable income from Question (4). his tax liability is $ (5) His marginal tax rate is His average tax rate is This year, he sold stock shares for a long-term capital gain of $8.500. He also sold some financial services stock for a long-term capital loss of $3.000. In addition, he sold the home that he had lived in for the past three years and experienced a 516 500 gain on the house in this year long term gains have shorative reduced tax rates (she tax bracket is 105 or 12% and (b) 15% the tax bracket is 22% or 24% Answer these Questions in the following Questions, the number by rounding to the second dig atter the decimal Do not put dollarsign "percent sign," or "thousand separators in the blank) (8) His net taxable long-term capital gain for this year is 5 (negative it is a long term capital loss) (9) Given the information above and his marginal tax rate in Question (6). He will pays for save in negative si in taxes as a result of these transactions related to long-term capital gains or losses QUESTION 34 Banking and Deposls The Soto Family has some questions about banking and deposits Magret wants to open a checking account that will be the least expensive, given her normal financial transactions. She typically writes 15 checks a month and uses an ATM 10 times a month. Her minimum checking balance falls to about $450 in an average month Account A No monthly fee is charged a minimum balance of at least 5300 is maintained A $3.00 fee is charged in any month the minimum balance falls below 5300 An ATM fee of 50 30 per transaction is charged on all transactions Account B Ne monthly fee is charged it a minimum balance of at least 5500 is maintained A $2.50 for plus $0.10 check is charged in any month the minimum balance fails below 5500 There is no ATM Ice on transactions Questions (1) Based on the whove Wormation, which of the account would be the least expensive for Maggie? Account w Ar Binti Bank) (Fil numbers in the following banks Round to the second diolah the decimal Do not put dollar sign or thousand separators in this blank) The cost of Account Ass per month The cost of Account is per month (2) Samuel has 52.800 to deposit in a money market fund earning 16%. If he adds 5000 to that account annually, how much will be accumulated in 5 years? (Round to the second digitaar the decimal and do not put dolor sign or thousand separators in this blank) (3) Anna's checkbook balance shows $58596. The bank statement shows $636 31. The bank paid her $2.50 in interest She issued Checks 1501 (533). 1507 (569 351 and 1511 (563 50), but they are not shown on the statement A service charge of 53 was levied by the bank. She made a 3120 deposit yesterday that is not on the statement What is the reconciled balance for her? Fill the number in this blank and round to the second digit after the decimal Do not put doller signor thousand separators in this blank) Peter has some questions about buying a car and a house. Fill numbers in all of the following blanks. Round to the second digit after the decimal and do not put dolar sign, percent sign, or thousand separators in the blanks He wants to buy a car now and has $2,500 for a down payment on a vehicle. He can afford monthly payments of $500 for this new car. He wants to finance a vehicle over no more than 4 years. Lenders are currently offering a 8% interest on 5-year loans to him (1) The maximum price he can pay for a vehide las He also wants to buy a house now. He wants to calculate the diference in monthly payments on a 5150,000 home as a result of a $5,000 down payment or a $10,000 down payment Use your financial calculator to figure the monthly payments, assuming they get a 35% 36-year mortgage (2) His monthly payments for the 55,000 down payment plan 5 (3) His monthly payments for the 510.000 down payment plans He decides to purchase this house and is calculating how much money he will need when the closing day rolls around. The purchase price is the home value stated above. He will choose to pay a 510.000 down payment and he must pay points on the loan Closing costs should be 5% of the purchase price (4) What is the total dolar amount he will need at closing Atur buying the home, his monthly mortgage payment is exactly the answer you filled in Question (1) aterrounding of this amount insurance is $10, property taxes are $220.interest in about 100, and the other payments are for principal payments and other fous. Assume that he has other itemized deductions that already exceed is standard deduction and that he is in the 20% marginal tax bracket (5) What is the annual reduction in his taxabilly as a result of owning a home with this mortgage? per month Brad wants to decide to use credits. He has a take home income of $2.000. He total monthly payments on consumer dubtare $230. (In all of the following questions, the number by rounding to the second dit after the decimal. Do not put "dollar sign percent signor Thousand separators in the blank) (1) His debt safety ratio is (2) Using the suggested maximum debt safety ratio (which is 20%), his macimum debt burden in Now, we focus on only his credit card accounts. He has a 5386 balance on his credit card account. The minimum payment on this credit card account is 3% of the latest balance or $20, whichever is greater The APR on a credit card account is 15% (3) His minimum payment for this credit card account this month is (4) Suppose he pays the minimum payment your exact answer in Question () atter rounding in this month How much of the minimum payment will go to interes How much of the minimum payment will pay down the principal? (5) Suppose he pays 5600 interest on credit cards this year, and he is a single taxpayer in the 24% marginal tax bracket, his tax savings from the Interest payments on credit cards are ho to owns a house. The market value of Nis house lo 5135,000, and he has a first mortgage balance of 565,000. A home owly loan lunder requires him un to loan to market value (6) How large could his home qully loan be? You are a consultant about it and health Insurance. You have some cases from you clents as follows (in all of the following questions, fl the number by rounding to the second dig after the decimal Do not put "dolar sign percent signor Thousand separators in the blank) Case Alce is 48 years old and ears 594,000 annually. The multiple earnings approach to determine the amount of the insurance needed shows that she should have 65 times her earnings. An assement shows the total financial resources needed of $2.500.000 and total financial resources walable of 52.110.000 Questions (1) Based on the multiple earnings approach, how much Insurance should she have? (2) Based on the needs analysis method from the ment, how much insurance should she have? Case Nick and Shela Preston are married and have purchased a comprehensive major medical policy that covers them and their two sons, Wally and Brent. The policy has a 3500 calendar year family deductible 12.000 Mop los provision and an 80% consurance cause. The following losses occur on January 1, Sholawas treated for an infection at the cost of $350 on July 1, Wally was treated for an injury suffered while watersking at the cost of $7,000 on December 5, Nick underwenty supoy at the cost of 2.200, and on January 5 of the following you Brent was treated for a broken the cost of $1.050 Questions (3) How much will the inever pay for each of these losses? January 1 loss 5 July 1 loss 5 December 5 loss d January next year los Continued trom the previous Question Set (In all of the following questions, fit the number by rounding to the second digt ater the decimal. Do not put "dolar sign." "percent sign," or thousand separators in the blank) Canec Tommy and Amanda Perez are a dualeaner couple with a young son, Bobby Tommy and Amanda each receive health care coverage for themselves from their respective employers. Their employers pay the premiums for the workers and coverage for dependents is available if the worker pays the premium cost. They are trying to decide under which policy to cover Bobby for the upcoming year. The following is a brief description of the policies and projected medical expenses for Bobby Tommy's HMO Coverage Amanda's Major Medical Coverage Limited 500.000 year person $25 doctor's Pete Copa surat are cline visit $15 prescription S500 yeyeon Soin hospital charges Participation not applicable 1020 with a $1.000 ) Precio dental and Monthly premiums for dependents $120 dependent mouth $90 dependem Bobby is a healthy B-year-old who is accident prone. Based on his past medical records. Tommy and Amanda expect the following covered medical costs for the year. 8 trips to the doctor-average cost of 585 per trip 2 trips to the urgent care clinic-average cost of $400 per trip 1 broken bone-average cost of in hospital surgery 51.100 15 prescriptions-average cost of 550 per prescription Questions (4) For Bobby under Tommy's HMO, the Perez family's total out-of-pocket medical costs (Including all of the copayments) are 5 (5) For Bobby under Tommy's HMO, the Perez family's annual premium payments are (6) So for Bobby under Tommy's HMO, the Perez family's total costs are (7) For Bobby under Amanda's Major Medical plan, the Perez's family's total medical constance payments are they also have to pay 5 deductibles and expenses from prescriptions, dental, and vision, which are not covered by the plan (8) For Bobby under Amanda's Major Medical plan the Perez family's annual premium payments are (9) So, for Bobby under Amanda's Major Medical plan the Perez family's total costs are You are a consultant for property Insurance Here are two cases Case Jim lost control of his car. He wiped out the car in front of him, hit a pedestrian and then drove into a home Jim has auto liability insurance of 25,000.50,000/10,000. He also has medical Pedestrian's claims 26.000 18.000 Other dever's claim Passengers in other car) claim Dumage to Damage to the 34.000 16.000 Ons How much weit Jim's auto insurance coverage and Im pay for this accident about the bodily mury, the propery damago lability, and for Jin himselfs injury and car? Complete the following table by filling integers in the following blanks with no thousand separators" or "dolaris Actual Pes 526.000 Pedestrian Od 561,000 Actual Tec Iwwe O 521.000 Toperty damage 5 2.400 16000 Questions (1) How much will Jim's auto insurance coverage and Jim pay for this accident about the bodily injury, the property damage liability, and for Jim himself's injury and car? Complete the following table by filling integers in the folowing blanks with no "housand separators" or "dollar signs. Insurance Pes Actual Insured Para Pedestrian Other driver Passenger Total bodily injury 526,000 18.000 24,000 $68,000 Actual tasured Para Pro Other car Total property damage liability $21,000 521.000 J'sures $ 2.400 16,000 Case B. Jorge and Nancy had a $25,000 repair bill on their home afer the tomado went through town. Their policy contained the usual 80% co-Insurance clause. Their home's replacement value was $160,000, their policy coverage was $124,000 with a $500 deductible Answer the following questions by filing numbers into the banks. Round to the second digit after the decimal and do not put thousand separators." "percent signs," or "dollar sigra." (2) How much insurance should they have carried to meet the co-insurance obligation? (3) What percentage of this loss will the insurance company pay? (4) Based on the above exactly percentage you filled in Question (3) after rounding to the second digit, how much of the loss will Jorge and Nancy have to absorb? $ We would like to construct Judy's personal balance sheet from the following information. Fill in the following blanks in the table with A or L. If the item belongs to Assets, fl. ll the item belongs to Liabilities, SL Item Amounts Categories Cash on hand $ 220 Back credit card balance 1.400 Utility bill (overde) 150 Mutual fund investments 17,500 Coin collection 1.800 2017 Honda 12.800 Auto load balance 8.500 Mortgage 115.000 Primary residence 175.000 Jewelry 700 A (Fil numbers in the following blanks. Do not put thousands separators" or "dollar signs in the numbers) Total assets are $ Total abilities are Total net worth is 5 Retirement plans Jullo works for a company with a defined benefits (DB) pension plan, which pays 3.1% of his last year's salary for each year of employment. He plans to retire after 35 years and expects his salary to be 5180,000 in his last year of work. While he will be working during these 35 years, he thinks he can earn 145 every year on his Investments. After his retirement, he annually needs 75% of his income in his last year of work to maintain his standard of living for 30 years during retirement Social Security should pay him 51,500 per month for 30 years after his retirement He thinks he will be able to cam a 4.5% rate of return every year during his retirement In the following Questions, the number by rounding to the second digit atter the decimal. Do not put dollar sig" or "housand separators in the blank) (1) How much annual income will he need from his employer's plan and from his own planning (other than the Social Security only after he retires? (2) From Question (1) discounting all of his required annual incomes after his retirement, how much will he need time? (3) His expected retirement benefit from the DB pension plan at his retirement is (4) From Questions (2) and (3), after taking his retirement benefit from the DB pension plan, how much will he still need at retirement? (5) Given the exact number after rounding that you filled in Question (4) how much should he save annually during these 35 years when he is working? QUESTION 33 Tax Dwyane's caming Information this year is given in Table A below Tatie A Salary Cashmonived as birthday in Interests throm money matt funde Inheritance father's death Cash received from www.ce for de chimie $55.000 120 3.900 330 26.000 3.900 He is single, and the standard deduction for a single taxpayer la $12.000 He has the following expenses that he wants to Indude as temized deductions for the year Table Medical expens Home more interest Condit and interest 1.600 Charitable contributions to a 501) State property taxes 1.600 Tubades Assume the Tax Act allows an embed eduction for medical expenses it more than 10% of adjusted gross income (AGI) andrea scelaneous Includes employee business expenses over 2 of GI are not deductible Other regulations are the same as the sides and the book From the Tax Act the tax rates are 10% on the first $9.525 of taxable income, 12% of the amount over 59.525 up to 530 700 of taxable income 22% of the amount over 700 up to 582.500 of taxable income, and 24% on the remainder Questions in the following Questions, the number by rounding to the second dig aller the decimal. Do not put dolor in percent in or Thousand separators in the blank) (1) Given the information from only Table A his gross income for purposes 2) Assuming that the answer to Question (1) is his adjusted gross income this year, the total temized deduction he can take is Table ) When he fleste tax, he can choose to deduct other standard deduction or med deductions from his gross income for tax purposes, which is werd in Question (1) The amount he will choose to deductis (1) Ater the deduction in Question (3) the taxable income (5) Given the income from Question (4) History Mealexper 2,100 Home mortgage interest 7,700 Credit card interest 1,600 Charitable contributions to a 501(c)(3) organization 2.600 State property taxes Job-related expenses 2,000 Assume the Tax Act allows an itemized deduction for medical expenses if more than 10% of adjusted gross income (AGI) and regulates that miscellaneous includes employee business expenses over 2% of AGI are not deductible Other regulations are the same as the slides and the textbook From the Tax Act, the tax ratos are 10% on the first 59,525 of taxable income, 12% of the amount over 59,525 up to 538,700 of taxable income, 22% of the amount over $38.700 up to 582.500 of taxable income, and 24% on the remainder Questions. In the following Questions, fl the number by rounding to the second digit after the decimal. Do not put "dollar sign." "percent sign, " or "Thousand separators" in the blank) (1) Given the information from only Table A his gross income for tax purposes is (2) Assuming that the answer to Question (1) is his adjusted gross income this year, the total emized deduction he can take is given the information from Table B (3) When he files the tax he can choose to deduct other standard deduction or homized deductions from his grus ncome for tax purposes, which is answered in Question (1) The amount ho will choose to deductis 5 (4) Ater the deduction in Question (3) the taxable income is 5 (5) Given the taxable income from Question (4). his tax liability is $ (5) His marginal tax rate is His average tax rate is This year, he sold stock shares for a long-term capital gain of $8.500. He also sold some financial services stock for a long-term capital loss of $3.000. In addition, he sold the home that he had lived in for the past three years and experienced a 516 500 gain on the house in this year long term gains have shorative reduced tax rates (she tax bracket is 105 or 12% and (b) 15% the tax bracket is 22% or 24% Answer these Questions in the following Questions, the number by rounding to the second dig atter the decimal Do not put dollarsign "percent sign," or "thousand separators in the blank) (8) His net taxable long-term capital gain for this year is 5 (negative it is a long term capital loss) (9) Given the information above and his marginal tax rate in Question (6). He will pays for save in negative si in taxes as a result of these transactions related to long-term capital gains or losses QUESTION 34 Banking and Deposls The Soto Family has some questions about banking and deposits Magret wants to open a checking account that will be the least expensive, given her normal financial transactions. She typically writes 15 checks a month and uses an ATM 10 times a month. Her minimum checking balance falls to about $450 in an average month Account A No monthly fee is charged a minimum balance of at least 5300 is maintained A $3.00 fee is charged in any month the minimum balance falls below 5300 An ATM fee of 50 30 per transaction is charged on all transactions Account B Ne monthly fee is charged it a minimum balance of at least 5500 is maintained A $2.50 for plus $0.10 check is charged in any month the minimum balance fails below 5500 There is no ATM Ice on transactions Questions (1) Based on the whove Wormation, which of the account would be the least expensive for Maggie? Account w Ar Binti Bank) (Fil numbers in the following banks Round to the second diolah the decimal Do not put dollar sign or thousand separators in this blank) The cost of Account Ass per month The cost of Account is per month (2) Samuel has 52.800 to deposit in a money market fund earning 16%. If he adds 5000 to that account annually, how much will be accumulated in 5 years? (Round to the second digitaar the decimal and do not put dolor sign or thousand separators in this blank) (3) Anna's checkbook balance shows $58596. The bank statement shows $636 31. The bank paid her $2.50 in interest She issued Checks 1501 (533). 1507 (569 351 and 1511 (563 50), but they are not shown on the statement A service charge of 53 was levied by the bank. She made a 3120 deposit yesterday that is not on the statement What is the reconciled balance for her? Fill the number in this blank and round to the second digit after the decimal Do not put doller signor thousand separators in this blank) Peter has some questions about buying a car and a house. Fill numbers in all of the following blanks. Round to the second digit after the decimal and do not put dolar sign, percent sign, or thousand separators in the blanks He wants to buy a car now and has $2,500 for a down payment on a vehicle. He can afford monthly payments of $500 for this new car. He wants to finance a vehicle over no more than 4 years. Lenders are currently offering a 8% interest on 5-year loans to him (1) The maximum price he can pay for a vehide las He also wants to buy a house now. He wants to calculate the diference in monthly payments on a 5150,000 home as a result of a $5,000 down payment or a $10,000 down payment Use your financial calculator to figure the monthly payments, assuming they get a 35% 36-year mortgage (2) His monthly payments for the 55,000 down payment plan 5 (3) His monthly payments for the 510.000 down payment plans He decides to purchase this house and is calculating how much money he will need when the closing day rolls around. The purchase price is the home value stated above. He will choose to pay a 510.000 down payment and he must pay points on the loan Closing costs should be 5% of the purchase price (4) What is the total dolar amount he will need at closing Atur buying the home, his monthly mortgage payment is exactly the answer you filled in Question (1) aterrounding of this amount insurance is $10, property taxes are $220.interest in about 100, and the other payments are for principal payments and other fous. Assume that he has other itemized deductions that already exceed is standard deduction and that he is in the 20% marginal tax bracket (5) What is the annual reduction in his taxabilly as a result of owning a home with this mortgage? per month Brad wants to decide to use credits. He has a take home income of $2.000. He total monthly payments on consumer dubtare $230. (In all of the following questions, the number by rounding to the second dit after the decimal. Do not put "dollar sign percent signor Thousand separators in the blank) (1) His debt safety ratio is (2) Using the suggested maximum debt safety ratio (which is 20%), his macimum debt burden in Now, we focus on only his credit card accounts. He has a 5386 balance on his credit card account. The minimum payment on this credit card account is 3% of the latest balance or $20, whichever is greater The APR on a credit card account is 15% (3) His minimum payment for this credit card account this month is (4) Suppose he pays the minimum payment your exact answer in Question () atter rounding in this month How much of the minimum payment will go to interes How much of the minimum payment will pay down the principal? (5) Suppose he pays 5600 interest on credit cards this year, and he is a single taxpayer in the 24% marginal tax bracket, his tax savings from the Interest payments on credit cards are ho to owns a house. The market value of Nis house lo 5135,000, and he has a first mortgage balance of 565,000. A home owly loan lunder requires him un to loan to market value (6) How large could his home qully loan be? You are a consultant about it and health Insurance. You have some cases from you clents as follows (in all of the following questions, fl the number by rounding to the second dig after the decimal Do not put "dolar sign percent signor Thousand separators in the blank) Case Alce is 48 years old and ears 594,000 annually. The multiple earnings approach to determine the amount of the insurance needed shows that she should have 65 times her earnings. An assement shows the total financial resources needed of $2.500.000 and total financial resources walable of 52.110.000 Questions (1) Based on the multiple earnings approach, how much Insurance should she have? (2) Based on the needs analysis method from the ment, how much insurance should she have? Case Nick and Shela Preston are married and have purchased a comprehensive major medical policy that covers them and their two sons, Wally and Brent. The policy has a 3500 calendar year family deductible 12.000 Mop los provision and an 80% consurance cause. The following losses occur on January 1, Sholawas treated for an infection at the cost of $350 on July 1, Wally was treated for an injury suffered while watersking at the cost of $7,000 on December 5, Nick underwenty supoy at the cost of 2.200, and on January 5 of the following you Brent was treated for a broken the cost of $1.050 Questions (3) How much will the inever pay for each of these losses? January 1 loss 5 July 1 loss 5 December 5 loss d January next year los Continued trom the previous Question Set (In all of the following questions, fit the number by rounding to the second digt ater the decimal. Do not put "dolar sign." "percent sign," or thousand separators in the blank) Canec Tommy and Amanda Perez are a dualeaner couple with a young son, Bobby Tommy and Amanda each receive health care coverage for themselves from their respective employers. Their employers pay the premiums for the workers and coverage for dependents is available if the worker pays the premium cost. They are trying to decide under which policy to cover Bobby for the upcoming year. The following is a brief description of the policies and projected medical expenses for Bobby Tommy's HMO Coverage Amanda's Major Medical Coverage Limited 500.000 year person $25 doctor's Pete Copa surat are cline visit $15 prescription S500 yeyeon Soin hospital charges Participation not applicable 1020 with a $1.000 ) Precio dental and Monthly premiums for dependents $120 dependent mouth $90 dependem Bobby is a healthy B-year-old who is accident prone. Based on his past medical records. Tommy and Amanda expect the following covered medical costs for the year. 8 trips to the doctor-average cost of 585 per trip 2 trips to the urgent care clinic-average cost of $400 per trip 1 broken bone-average cost of in hospital surgery 51.100 15 prescriptions-average cost of 550 per prescription Questions (4) For Bobby under Tommy's HMO, the Perez family's total out-of-pocket medical costs (Including all of the copayments) are 5 (5) For Bobby under Tommy's HMO, the Perez family's annual premium payments are (6) So for Bobby under Tommy's HMO, the Perez family's total costs are (7) For Bobby under Amanda's Major Medical plan, the Perez's family's total medical constance payments are they also have to pay 5 deductibles and expenses from prescriptions, dental, and vision, which are not covered by the plan (8) For Bobby under Amanda's Major Medical plan the Perez family's annual premium payments are (9) So, for Bobby under Amanda's Major Medical plan the Perez family's total costs are You are a consultant for property Insurance Here are two cases Case Jim lost control of his car. He wiped out the car in front of him, hit a pedestrian and then drove into a home Jim has auto liability insurance of 25,000.50,000/10,000. He also has medical Pedestrian's claims 26.000 18.000 Other dever's claim Passengers in other car) claim Dumage to Damage to the 34.000 16.000 Ons How much weit Jim's auto insurance coverage and Im pay for this accident about the bodily mury, the propery damago lability, and for Jin himselfs injury and car? Complete the following table by filling integers in the following blanks with no thousand separators" or "dolaris Actual Pes 526.000 Pedestrian Od 561,000 Actual Tec Iwwe O 521.000 Toperty damage 5 2.400 16000 Questions (1) How much will Jim's auto insurance coverage and Jim pay for this accident about the bodily injury, the property damage liability, and for Jim himself's injury and car? Complete the following table by filling integers in the folowing blanks with no "housand separators" or "dollar signs. Insurance Pes Actual Insured Para Pedestrian Other driver Passenger Total bodily injury 526,000 18.000 24,000 $68,000 Actual tasured Para Pro Other car Total property damage liability $21,000 521.000 J'sures $ 2.400 16,000 Case B. Jorge and Nancy had a $25,000 repair bill on their home afer the tomado went through town. Their policy contained the usual 80% co-Insurance clause. Their home's replacement value was $160,000, their policy coverage was $124,000 with a $500 deductible Answer the following questions by filing numbers into the banks. Round to the second digit after the decimal and do not put thousand separators." "percent signs," or "dollar sigra." (2) How much insurance should they have carried to meet the co-insurance obligation? (3) What percentage of this loss will the insurance company pay? (4) Based on the above exactly percentage you filled in Question (3) after rounding to the second digit, how much of the loss will Jorge and Nancy have to absorb? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts