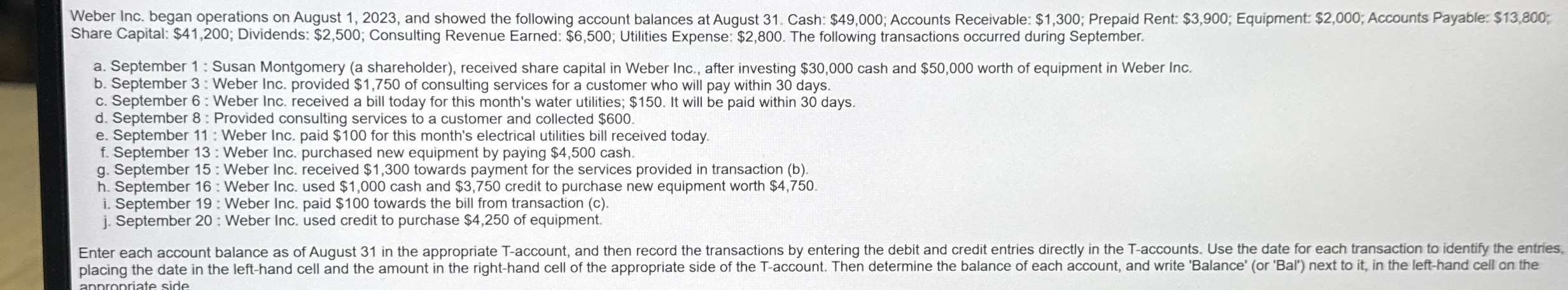

Question: Weber Inc. began operations on August 1 , 2 0 2 3 , and showed the following account balances at August 3 1 . Cash:

Weber Inc. began operations on August and showed the following account balances at August Cash: $; Accounts Receivable: $; Prepaid Rent: $; Equipment: $; Accounts Payable: $; Share Capital: $; Dividends: $; Consulting Revenue Earned: $; Utilities Expense: $ The following transactions occurred during September.

a September : Susan Montgomery a shareholder received share capital in Weber Inc., after investing $ cash and $ worth of equipment in Weber Inc.

b September : Weber Inc. provided $ of consulting services for a customer who will pay within days.

c September : Weber Inc. received a bill today for this month's water utilities; $ It will be paid within days.

d September : Provided consulting services to a customer and collected $

e September : Weber Inc. paid $ for this month's electrical utilities bill received today.

f September : Weber Inc. purchased new equipment by paying $ cash.

g September : Weber Inc. received $ towards payment for the services provided in transaction b

h September : Weber Inc. used $ cash and $ credit to purchase new equipment worth $

i September : Weber Inc. paid $ towards the bill from transaction c

j September : Weber Inc. used credit to purchase $ of equipment.

Enter each account balance as of August in the appropriate account, and then record the transactions by entering the debit and credit entries directly in the Taccounts. Use the date for each transaction to identify the entries, placing the date in the lefthand cell and the amount in the righthand cell of the appropriate side of the account. Then determine the balance of each account, and write 'Balance' or 'Bal' next to it in the lefthand cell on the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock