Question: Webmasters.com has developed a powerful new server that would be used for corporations' internet activities. It would cost 510 million at Year 0 to buy

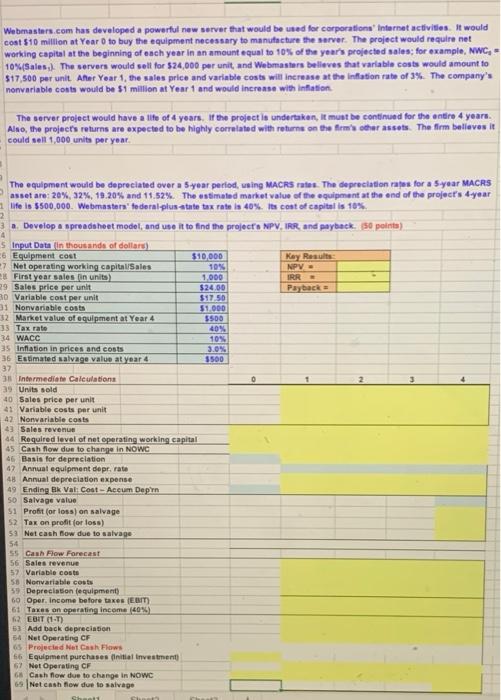

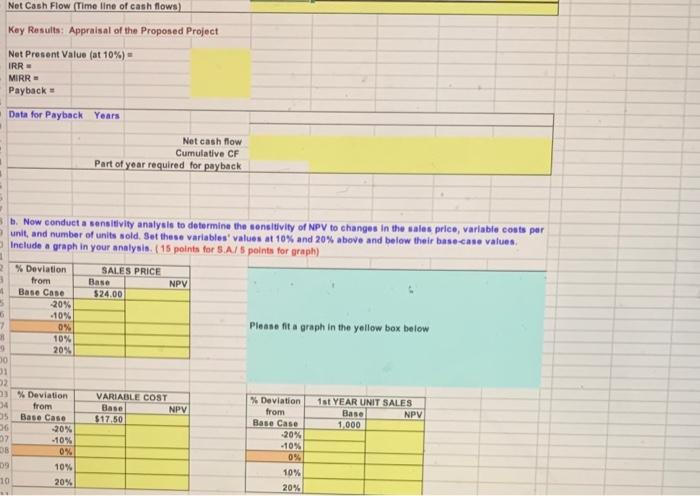

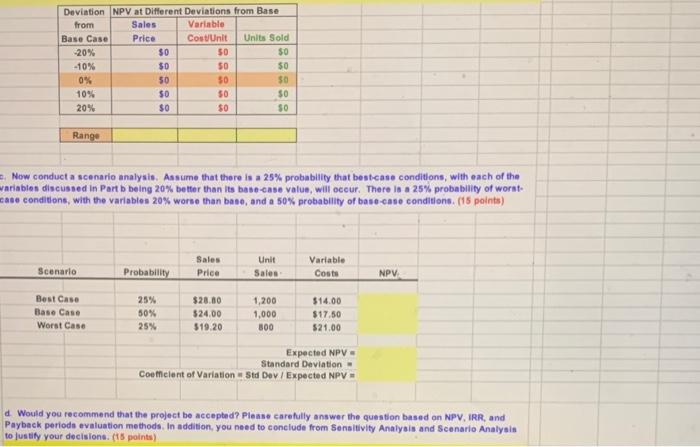

Webmasters.com has developed a powerful new server that would be used for corporations' internet activities. It would cost 510 million at Year 0 to buy the equipment necessary to manutactire the server. The project would require net working capital at the beginning of esch year in an amount equal to 10% of the year's projected sales; for example, MWC. = 10%(5ales, . The servers would sell for $24,000 per unit, and Webmasters belleves that varlable costs would amount to 517,500 per unit. After Year 1 , the sales price and variable costs witi increase at the inflation rate of 3\%h. The company's nonvariable conts would be $1 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the ontire 4 years. Asso, the projects returns are expected to be highly correlated with returne on the firm's other assets. The firm belleves it could sell 1,000 units per year. The equipment would be depreciated over a 5 year period, using MACRS rates. The depreclation rates for a 5 year MACRS asset are: 20%,32%,13.20% and 11.52%. The estimated market value of the equipment at the end of the projecris 4 year life is 5500,000 . Webmastera' federalpius 4 thate tax rate is 40%. its cot of capital is 10%. a. Develop a spreadsheet model, and use it to find the project s NPV, IRe. and paybeck. (50 peinta) Net Cash Flow (Time line of eash flows) Key Results: Appraisal of the Proposed Project Net Present Value ( at 10\%) = IRR = MIRR = Payback = \begin{tabular}{|l|l|} \hline Data for Payback Years \\ Part of year required for payback \\ \hline \end{tabular} b. Now conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, varlable costs per unit, and number of units sold. Set these variables' values at 10% and 20% above and below their base-case values. Include a graph in your analysis. ( 15 points for 5.A/5 points for graph) Please fit a graph in the yellow box below 6. Now conduct a scenario analysis. Assume that there is a 25% probability that bestease conditions, with each of the yariabies discussed in Part b being 20% better than its bese-case value, will occur. There is a 25% probability of woratcase cenditions, with the variables 20% worse than base, and a 50% probability of base-case conditions. (15 points) d. Would you recommend that the project be accepted? Please carefully answer the question based on NPV, iRR, and Paybeck periods evaluation methods. In addition, you need to conclude from Senalitity Anafyais and Scenario Analysin to lustify your decisions. (15 points) Webmasters.com has developed a powerful new server that would be used for corporations' internet activities. It would cost 510 million at Year 0 to buy the equipment necessary to manutactire the server. The project would require net working capital at the beginning of esch year in an amount equal to 10% of the year's projected sales; for example, MWC. = 10%(5ales, . The servers would sell for $24,000 per unit, and Webmasters belleves that varlable costs would amount to 517,500 per unit. After Year 1 , the sales price and variable costs witi increase at the inflation rate of 3\%h. The company's nonvariable conts would be $1 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the ontire 4 years. Asso, the projects returns are expected to be highly correlated with returne on the firm's other assets. The firm belleves it could sell 1,000 units per year. The equipment would be depreciated over a 5 year period, using MACRS rates. The depreclation rates for a 5 year MACRS asset are: 20%,32%,13.20% and 11.52%. The estimated market value of the equipment at the end of the projecris 4 year life is 5500,000 . Webmastera' federalpius 4 thate tax rate is 40%. its cot of capital is 10%. a. Develop a spreadsheet model, and use it to find the project s NPV, IRe. and paybeck. (50 peinta) Net Cash Flow (Time line of eash flows) Key Results: Appraisal of the Proposed Project Net Present Value ( at 10\%) = IRR = MIRR = Payback = \begin{tabular}{|l|l|} \hline Data for Payback Years \\ Part of year required for payback \\ \hline \end{tabular} b. Now conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, varlable costs per unit, and number of units sold. Set these variables' values at 10% and 20% above and below their base-case values. Include a graph in your analysis. ( 15 points for 5.A/5 points for graph) Please fit a graph in the yellow box below 6. Now conduct a scenario analysis. Assume that there is a 25% probability that bestease conditions, with each of the yariabies discussed in Part b being 20% better than its bese-case value, will occur. There is a 25% probability of woratcase cenditions, with the variables 20% worse than base, and a 50% probability of base-case conditions. (15 points) d. Would you recommend that the project be accepted? Please carefully answer the question based on NPV, iRR, and Paybeck periods evaluation methods. In addition, you need to conclude from Senalitity Anafyais and Scenario Analysin to lustify your decisions. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts